Short order: pessimistic fund profited as sharemarket sank

In January, as China began to lock down its cities, Ben McGarry made a move that has reaped big rewards.

In late January, as China began to lock down its cities and restrict the free movement of its citizens to limit the spread of the coronavirus, Ben McGarry thought Australia seemed “pretty relaxed” by comparison.

While China went to work shutting down the world’s second-largest economy, and as Australia progressively ratcheted up restrictions on Chinese immigration, Mr McGarry, who founded the Sydney-based hedge fund Totus Capital in 2012, was concerned by the lack of response from financial markets.

“Given how strong the Chinese response was, and seeing the planes continue to come into Australia, where we just had an honour system with passengers after handing out leaflets — it didn’t seem proportionate,” Mr McGarry said.

That complacency went on for almost two months — during which time the Australian sharemarket inched its way to a new record high, peaking at 7199 on February 20 — despite growing reports of virus-related deaths as far away from China as Iran and Italy.

From that peak, it took just three weeks for the benchmark S&P/ASX 200 to fall into bear market territory, as more than 20 per cent was obliterated from share prices in the steepest sharemarket plunge on record.

While equities were hammered, there was also a dramatic dislocation across bond and credit markets as money managers around the globe liquidated trillions of dollars, sending markets reeling and forcing the world’s central banks to pledge hundreds of billions towards a rescue of the financial system.

The 21 per cent fall in the ASX over the month of March made it the worst month for the market since the October 1987 Black Monday sharemarket crash. But for Mr McGarry, it was a really good month.

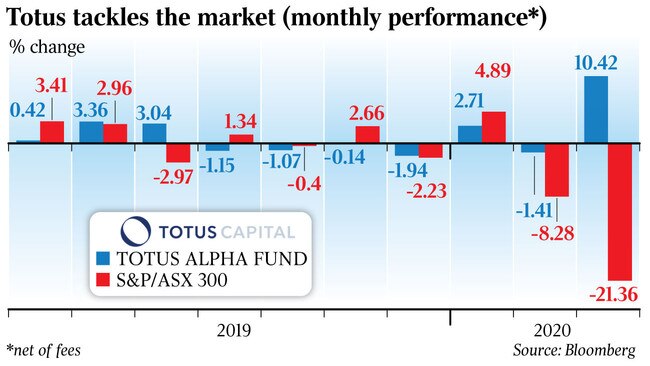

His fund, which manages almost $400m, served up a stonking 10.4 per cent return over the month. This compares to a 21.3 per cent fall in the broader ASX 300 index, which Mr McGarry’s flagship Totus Alpha Fund benchmarks itself against.

A mix of long bets on the performance of 50 stocks including big tech companies, online retailers and groups that benefit from quantitative easing, paired with almost 100 short-selling targets, including annuities provider and junk bond investor Challenger Financial, buy-now, pay-later firm Afterpay, and the, until recently, heavily indebted childcare operator G8 Education, helped Totus Capital add close to $40m to the funds’ assets under management in a month.

And in what could be bad news for most other investors, McGarry is expecting the good performance of Totus to continue.

With a 20 per cent rally in the sharemarket over the last two weeks on the back of Scott Morrison’s historic $200bn stimulus package, Mr McGarry believes markets aren’t pricing in the real damage wrought on the economy by the shutdowns, or the diminished earnings power of businesses caused by the virus, and how future shareholder returns will be quashed by dilutive “emergency” capital raisings.

“If you throw a big rock in a pool, you’ll get ripples,” Mr McGarry said.

“There will be opportunities, of course, but that period of ultra-low volatility is over. We should expect things to be a bit more interesting for a year or two yet — it’d be really unusual if we all just went back to business as usual.”

Speaking to The Weekend Australian from his home in Bondi, Mr McGarry, who manages money on behalf of wholesale clients, family offices and big funds – and is soon to open his fund to retail investors, said he found it unusual that shares were rallying so hard throughout February.

In his view, the outlook for the Australian sharemarket had been weak even before the government was forced to shut down the economy to prevent the spread of COVID-19.

The February reporting season was “one of the weakest” in the last 10 years, and that was before businesses would have felt the impact from the bushfires and the first stages of the Chinese lockdown due to the virus.

“People need to think about this sell-off in the context of that starting point,” Mr McGarry said. “We’ve been sceptical of how enthusiastic the market has been in the last 12 months,” he said.

“We started to see the news come out of China in late January. The market dismissed it as a one-off, unlikely to impact us. But we took a different view. You could see things were really bad in China.”

“China is the world’s second-biggest economy and Australia’s largest trading partner, so we started to reduce peripheral positions and actively looked for companies with exposure to China to short.”

Mr McGarry said while the Morrison government was probably working quickly behind the scenes to contain the virus, Australia still looked vulnerable to the virus and would probably have to follow with a similar shutdown of its own.

“I was certainly pretty worried, especially in the early days, about how the government, at least publicly, seemed quite relaxed about the situation.”

But then, Mr McGarry said, sentiment “changed on a dime”. The facts on the ground changed equally quickly, and markets around the world collapsed.

While central banks and governments had come to the rescue, the sharp reversal in the last few weeks — with many markets entering a bull market as quickly as they plunged into a bear market — was unlikely to mark the end of the larger bear market environment, said Mr McGarry.

“Bear markets and recessions are very rarely a sprint — they’re more of a marathon,” he said.

“An event like this with major western economies in the US and Europe, everywhere you look, completely shut down and an unemployment spike the likes of which our parents have never seen — the idea that this will be over in a month … I think that’s a bit optimistic,” Mr McGarry said.

“It’s the sort of price action you see in bear markets. It’s not just a start and arrive, it’s a journey, and we will see ups and downs,” he said.

Totus Capital, which has returned 18.6 per cent a year since inception, has about 35 per cent of its funds invested in big US tech giants. The current crisis was likely to reflect well on these companies, Mr McGarry said.

He even points to how he and his staff had to race out to buy laptops and PCs because now the entire business is working remotely.

“This business interruption has accelerated that move into the cloud,” Mr McGarry said.

There are clear beneficiaries: Amazon and Microsoft, for instance. But even Visa and MasterCard, while suffering a short-term hit, will be boosted as customers increasingly avoid cash. More people are getting used to shopping online rather than venturing out to the shopping centre, too.

While the fund has a number of long bets, it’s also looking to pick off the companies that will come unstuck during the crisis.

“Shorting is a big part of our book and we do it through bull and bear markets,” Mr McGarry said. “We’re focused on looking at winners and losers out of this virus.”

Star performer before the crisis, fintech group Afterpay, suffered a 75 per cent collapse in its share price in early March. While the stock has since bounced almost 150 per cent, it’s still only half its pre-crisis value — $22 compared to a prior price of $40 a share.

Mr McGarry said Afterpay had a short track record in operation. “It’s just really unproven in this kind of environment. If you go to Westfield Bondi Junction or into the city, a lot of the places where people would use Afterpay are now shut down,” he said. “The business also wasn’t profitable prior to the virus hitting, and it’s one that one is very capital-hungry.”

Childcare provider G8 Education lost 50 per cent of its market capitalisation over the last month and a half, and this week completed an emergency capital raising.

“If you’ve got an unemployment spike, that means there’s less people that need childcare,” Mr McGarry said. “The balance sheet also had a fair bit of debt, and they had really concentrated on the bigger cities and the wealthier suburbs where they could charge a higher day rate for childcare spots. Now there’s an oversupply of places. They’re also a listed company competing against not-for-profit and mum and dad companies.”

Challenger, which sells longevity insurance to retirees and invests in a wide degree of assets to pay for its liabilities, including high-yield corporate debt, was hammered by the bond market routs in March. Its shares sank 70 per cent until it revealed it had sold down some of its riskier assets and shored up its investment portfolio.

Mr McGarry said Challenger still had rough seas to sail through.

“It’s still got a way to play out. We’ve seen the corporate bond market and credit market being supported by central banks but we are yet to see the sorts of defaults that take place in these sorts of crises.” Challenger shares have jumped 65 per cent since bottoming last month, a rally Mr McGarry said “isn’t justified”.

Mr McGarry said there was no easy way out of this crisis.

“This is a health issue at its core and it’s very difficult to solve with central bank policy or government handouts,” he said.

“It’s going to take time for business owners who have been forced to lay off workers to come back to full capacity. It doesn’t look like a V-shaped recovery to me, so it’s interesting the stockmarket is looking at it in that way.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout