Sell-side analysts unleash earnings downgrades following CBA’s record earnings

The nation’s biggest bank will be unlikely to grow earnings this year, and not only because of bad debt charges, analysts say.

Commonwealth Bank isn’t expected to lift earnings this year, due to mounting wage increases, technology costs, a further squeeze in margins and bad debt charges, analysts warn after the nation’s biggest lender booked record cash profit.

However, the view is not widely shared by investors after CBA shares jumped 2.8 per cent following its $10.2bn cash profit result on Wednesday.

“A lot of the sell-side analysts have quite negative views on CBA,” said Atlas Funds Management chief investment officer Hugh Dive.

“Many of them have target prices in the $80s, but a lot will depend on the bad-debt cycle,” he said on Thursday.

Most investment analysts covering CBA are lowering the margin and earnings forecasts for this financial year and next, citing a range of factors including an incoming fight for deposit funding, higher costs and increases in bad debt provisions.

The downgrades so far mean analysts expect CBA cash earnings to fall 8 per cent to $9.37bn in 2024, be flat in 2025, and not print above $10bn again until 2027, according to consensus estimates by Visible Alpha. Net interest margins, a key measure of bank profitability, is tipped to fall to 1.97 per cent, from 2.07 for the 2023 financial year and fall further to 1.93 per cent in 2025.

On Wednesday, CBA said inflationary pressures and technology investments including the cost of initiatives to fight scams had led to operating costs increasing 5.5 per cent over the year.

CBA has offered a 17 per cent wage increase to workers over four years. That offer is below pay proposals of National Australia Bank, but higher than those at ANZ, and represent an annual cost increase of about 4.25 per cent.

“It is difficult for CBA to avoid higher operating expenses,” said Barrenjoey head of bank research Jonathan Mott. “Technology costs continue to rise, while the cost of risk and regulation continue to increase, especially in areas of cyber and scams.”

“While cost pressures are significant, we expect CBA to rein in investment spend to help manage earnings,” he said.

Barrenjoey’s 12-month target price for CBA shares is $85 each.

E&P Capital banking analyst Azib Khan said the bank’s “negative jaws” in the second half of the year, where cost growth (1.8 per cent) exceeded growth in pre-provision profit (down 0.6 per cent), was an ominous sign.

The broker downgraded its earnings forecasts for the current financial year by 2.7 per cent, and by 3.7 per cent in the 2025 financial year. JPM, with a target price of $87.4 and an underweight rating, also downgraded cash earnings for this financial year by 3 per cent, reflecting lower revenue expectations and a higher operating costs forecasts.

CLSA banking analyst Ed Henning, who lowered its target price for CBA shares after the result to $100.8, from $101.5, said the outlook for CBA and the banking sector was not all “doom and gloom”. The banks have strong balance sheets and are well provisioned to handle an expected increase in bad debts as some homeowners struggle to cope with the 4 percentage point increase in interest rates since May last year.

But Mr Henning did highlight “some earnings risk for CBA and the sector as a whole”.

“We see the deposit and wholesale funding headwinds increasing and while mortgage pricing has improved, we still believe it will be a headwind into financial year 2024 albeit slightly reducing,” he said.

After CBA posted higher expenses than expected, “we see headwinds continuing into financial year 2024 around inflationary pressures, costs for scams and Unloan,” he said, referring to CBA’s digital only banking product.

Citi, which has a $82.50 target price, told investors CBA management had presented a narrative focused on balance sheet strength, with which the broker agreed, but said there had been a “lack of focus on the challenges facing core earnings” ahead.

“Earnings are expected to moderate as the net interest margin trajectory continues downward and cost inflation becomes more entrenched,” Citi banking analyst Brendan Sproules said in a note to clients.

Trading at over 18 times expected earnings, CBA shares are of the most expensive stocks in the world, and “at some juncture, the market will have to contemplate the falling core earnings profile and rising bad debts,” he added.

Overall, analysts and investors agree that CBA has the best business franchise out of the big four, but that the risks are skewed to the downside for all banks.

The crucial issue for them will be Australia’s economic outlook.

“If your base case is flattish earnings with some economic risks, and the bank is already relatively expensive, you can probably justify the share price,” says Argo managing director Jason Beddow.

“However, it’s difficult to see why the share price would increase much more.”

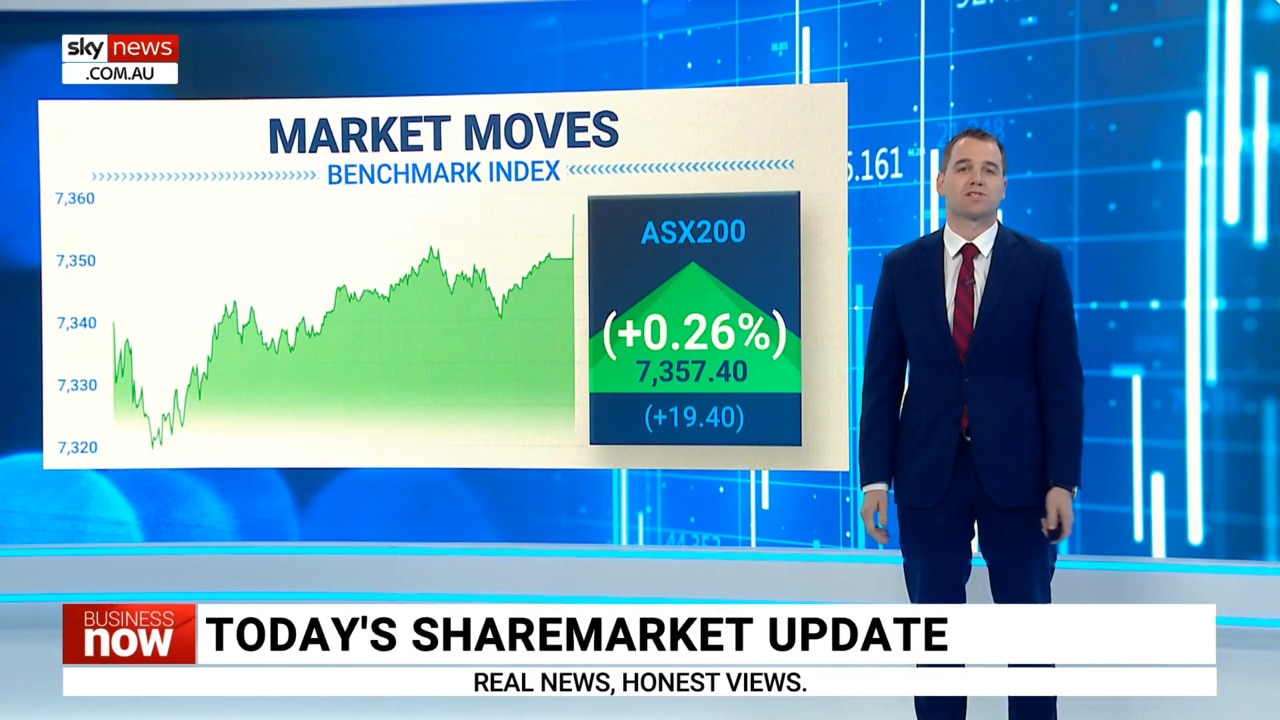

CBS shares slipped 0.4 per cent to $104.47 in a slightly higher market on Thursday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout