Savers losers in CBA’s term deposit switch

ASIC killed a probe into CBA over short-changing customers on term deposit interest rates.

The Australian Securities & Investments Commission killed a major investigation into Commonwealth Bank over short-changing customers on term deposit interest rates, with the practice, which was later followed by other players in the industry, estimated to have cost savers as much as $1 billion.

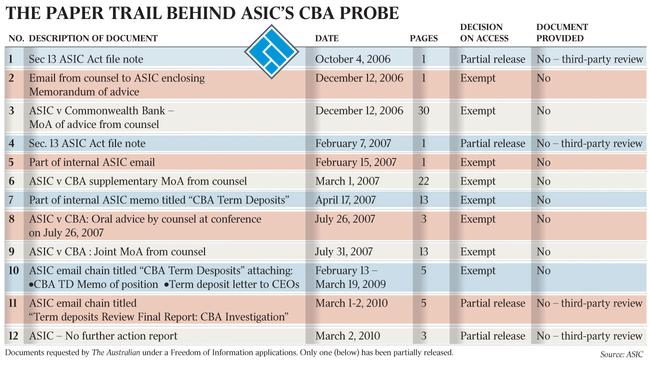

A “no further action” report detailing the decision to stop the investigation in 2010, when the regulator was led by Tony D’Aloisio, has been kept secret because an unnamed “former staff member” objected to its release to The Australian under Freedom of Information laws.

The Australian has been involved in a battle for almost six months for the release of the paper trail behind the decision.

Mr D’Aloisio, who is now chairman of fund manager Perpetual, declined to comment on the investigation and refused to confirm or deny he was the “former staff member” in question.

The Australian is not suggesting that Mr D’Aloisio was involved in the decision or acted inappropriately, only that it occurred while he was chairman.

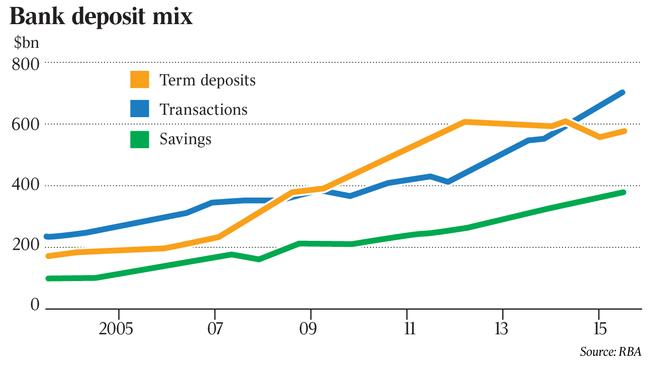

At the heart of ASIC’s potential case against CBA was the bank’s alleged mistreatment of investors in term deposits, which pay higher interest rates to savers than transaction accounts and are important for banks’ long-term funding.

CBA allegedly rolled over term deposits that had expired into a new term deposit at a lower rate, without properly informing investors of the rate cut.

CBA denies the allegation and it is not clear exactly how ASIC felt disclosure was deficient.

“Any suggestion that customers were not informed of their options or rates at the maturity of their term deposits is incorrect,” a CBA spokeswoman said.

ASIC declined to give The Australian an estimate of the loss to consumers, but it is believed investigators put the loss from the term deposit trick, which was also used by other banks, at as much as $200 million a year across the industry.

The regulator is believed to have received first complaints about CBA’s term deposit practices in 2005 but did not begin taking any action to rein them in until 2009, indicating total losses across the industry in the high hundreds of millions, or as much as $1bn.

However, CBA’s spokeswoman denied this figure was reasonable.

The Australian understands ASIC’s decision to take no action against CBA was made despite legal advice given to the regulator in 2006 and 2007 that there was a strong case the bank’s conduct was misleading and deceptive.

News of the aborted investigation into CBA comes amid increasing pressure in Canberra for a royal commission into the banks following a series of scandals, many of them implicating CBA, that have smashed community confidence in the banking sector.

Today’s revelations also raise questions as to what other historical bad behaviour by banks may yet remain to be publicly revealed.

An ASIC spokesman declined to answer detailed questions posed by The Australian or comment on the investigation.

“On the topic of term deposits, over the past eight years ASIC has undertaken significant work to improve consumer outcomes,” he said.

ASIC’s deputy chairman between July 2004 and July 2009, Jeremy Cooper, told The Australian he did not remember the details of the legal advice.

“Maybe the advice was that it was a strong case,” he said.

Mr Cooper pointed towards the limitations of the ASIC Act — the legal instrument that allows the regulator to take action for misleading and deceptive conduct.

“You need to remember the provisions of the ASIC Act are only civil, not criminal,” he said.

He said ASIC followed up the issue, which affected the whole banking industry, with a series of reports.

“It’s not as if this was just shoved under the carpet,” he said.

Mr Cooper said the estimate of $200m a year in consumer loss was plausible. “The sheer scale of term deposits — it wouldn’t surprise me,” he said.

NSW independent Pricing and Regulatory Tribunal chairman Peter Boxall, who was an ASIC commissioner between 2008 and 2011, said the CBA investigation “had all started before I arrived — I didn’t get into it”.

As far as he was aware, the CBA investigation was turned into a wider investigation of term deposit practices across the banking industry, Mr Boxall said.

And he said he was not aware of who made the decision to kill the investigation and issue the “no further action” report in March 2010.

ASIC’s failure to take on CBA appears to have encouraged other banks to follow its lead, causing losses to term deposit customers across the sector.

Much of the alleged misconduct occurred during the 2007-08 global financial crisis, when investors sought safety for their money as they fled a stockmarket in meltdown.

“The GFC was in full mode here — perhaps it was decided that rather than take on the country’s biggest banks we should go down a different route,” Mr Cooper said.

“Their behaviour was annoying, but was it illegal? That’s harder to prove.”

A schedule of documents produced by ASIC during the Freedom of Information stoush show it launched a full-scale investigation into CBA’s term deposit practices in October 2006, when Jeffrey Lucy was chairman.

Mr Lucy told The Australian it was one of a number of matters involving CBA during his time at ASIC, but he “might not have had much day-to-day involvement” in the investigation.

The regulator obtained a 30-page legal opinion from a QC in December 2006 and additional written and oral advice in March and July the following year.

By July 2007, the regulator was considering launching legal action against CBA. Mr D’Aloisio was ASIC chairman at the time, having been promoted from commissioner on May 13, 2007.

ASIC’s investigation dragged on for four years, with a final report produced on March 1, 2010.

On the following day, the “no further action” report was issued.

Because CBA was not pursued by ASIC, other banks began to copy the practice.

ASIC’s investigation into CBA was watered down into a general review of term deposit rates, which itself was beset by delay.

The regulator issued an “investor and consumer guide” to term deposits in April 2009 and announced it would review disclosure practices.

“Investors and consumers should continue to have confidence in term deposits with ADIs (authorised deposit-taking institutions),” Mr D’Aloisio said at the time.

ASIC’s review, conducted between January 2008 and February 2009, but not released until February 2010, found none of the term deposits it looked at disclosed the risk of being rolled into a lower-rate product.

The practice appears to have duped consumers, with nearly half of rollovers at just four banks — some $7.88bn — moving from high-interest accounts to lower interest accounts during the period covered by ASIC’s review.

The regulator looked at the same products again between January 1, 2011 and July 31, 2011, but did not publish the results until July 2013.

In the second survey, five of the eight banks surveyed had begun warning about rate drops in letters sent to customers before their term deposit expired.

Mr Cooper said the review was a good result.

“This was effectively flushed out through its (ASIC’s) own media, and I’d imagine this was written up more broadly,” Mr Cooper said.