Risk-averse Mirrabooka buffers portfolio with industrial stocks

Small and mid-cap fund manager Mirrabooka Investments sees heightened investment risks in the market.

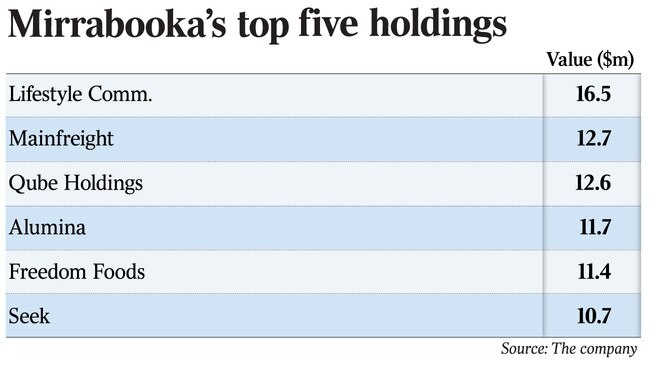

Small and mid-cap fund manager Mirrabooka Investments sees heightened investment risks in the market and has buffered its portfolio with solid industrial stocks, as it waits for volatility to increase so it can go bargain-hunting.

The listed investment company booted a greater-than-usual 19 stocks from its portfolio over the year to the end of June, including Treasury Wine Estates, which is now a top 50 company, Healthscope, Incitec Pivot and Japara Healthcare. It also reduced its position in lab services company ALS.

New additions to the portfolio included Boral, Webjet, Breville, Reliance Worldwide, Dulux and Adelaide Brighton. In total, Mirrabooka added 20 stocks to its portfolio over the year.

“Some of the stocks hadn’t been performing and we just wanted to make sure we held more consistent companies. We wanted to beef up our weighting in solid industrials,” Mirrabooka managing director Mark Freeman told The Australian.

As large-cap companies face subdued growth prospects, investors have increasingly turned to small and mid-cap stocks to boost their returns, sending valuations rocketing.

“Valuations are certainly high but small and mid-caps can get retracements very quickly if they disappoint on earnings results. That’s something that we’re looking for going into this reporting season,” Mr Freeman said.

Wisetech Global is one company Mr Freeman is keeping a close eye on: “It’s on a multiple of 70-80 times. I think it’s a very well-run company and it’s got good growth prospects — but can they satisfy the market on their earnings and their outlook to keep holding on to that multiple?”

The LIC delivered a 14.7 per cent return over the year, below its benchmark, the S&P/ASX mid 50s & Small Ordinaries Accumulation Index, which returned 19.3 per cent. It also lagged on a five-year basis, but has outperformed the benchmark with its 10-year returns.

Mirrabooka’s returns have been reduced in the short term by its lack of exposure to the small and mid-cap resources sectors, which have surged 49 per cent and 42.3 per cent respectively over the past 12 months, boosting the benchmark’s returns.

Mr Freeman said he was comfortable missing out on the resources sector’s large gains.

“We’re happy to stick with what we know and we feel we can do a better job looking for solid industrial companies. They might not go up 40 per cent when the resources sector does but over a 10-year period they can give us a good, solid return. That’s our place in the market,” he said.

The LIC is holding 7 per cent of its portfolio in cash, which has been another drag on performance.

“In a strong market, holding cash works against us. We just think the type of stocks we want to be in, good-quality growth stocks, the multiples are very elevated so we’re a little bit wary,’’ Mr Freeman said.

“The market’s had a very good run so we’re going to stick with our view of being patient.”

Commenting on the escalating trade war between the US and China, he said he did not understand the logic of it and that it was hard to get clarity on exactly how it would play out.

“If it escalates, it’s going to create some uncertainty in markets around global growth and it’ll put some volatility back into the market … if you’re a buyer of stocks you actually want the market to go down in the short term,” he said.

Mirrabooka yesterday reported a net profit of $10.4 million for the year to the end of June, up 36.9 per cent on the 12 months prior.

It will pay a final dividend of 6.5c a share, fully franked, bringing the full-year dividend to 12c a share, fully franked.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout