Revealed: traders’ calls leave Westpac red faced

Bank staff talk revealed: lesbian threesomes, RBA interventions and traders “steamrolling” the interest rate market.

These are the transcripts Westpac didn’t want you to see.

Lesbian threesomes, Reserve Bank interventions and traders aggressively “steamrolling” the interest rate market — all are laid out in black and white in newly revealed transcripts of expletive-laden conversations among the bank’s staff.

Media organisations including The Australian last night won access to the transcripts, which reveal the conduct of Westpac traders over a two-year period between 2010 and 2012 during which the corporate regulator accuses the bank of rigging the benchmark bank bill swap rate 16 times.

The 7.7MB cache of documents shows Westpac’s star trader, Col “The Rat” Roden, tried to convince a more junior executive, Sophie “The Perfumed Steamroller” Johnston, it would be a good idea to engage in a lesbian threesome in romantic Prague.

The transcripts also show RBA deputy governor Guy Debelle, who at the time had oversight of financial markets, raised concerns about the bank’s funding position with Mr Roden’s boss, Westpac head of treasury Curt Zuber.

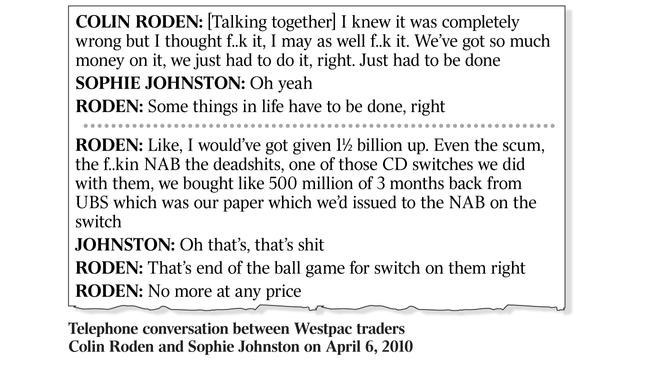

And they go to one of the central issues to be decided by Federal Court judge Jonathan Beach: when Mr Roden said he would “f..k” the BBSW, did he mean he wanted to manipulate it?

Of the three banks ASIC last year hit with legal action for alleged BBSW rate-rigging, only Westpac toughed it out to trial, with ANZ and National Australia Bank last month paying $50 million each to settle. Westpac faced the regulator at a six-week trial, which ended last week.

The transcripts show Westpac’s traders regularly discussed the BBSW and the vast quantities at stake made the desk’s denizens nervous — after one big day of trading, April 6, 2010, Mr Roden was waiting on the RBA’s decision on interest rates to learn whether he’d made the right bet — “we’ll find out very shortly whether or not we win the lottery”, he told Ms Johnston down the line to London.

The RBA didn’t move the cash rate and Mr Roden was elated.

“We made about 12 million bucks today … that’s what you’d call a good day,” he told Ms Johnston.

This was despite a “massive rate set” that saw him buy $2.5 billion worth of bank bills from other banks that he went on to abuse. NAB were “scum” and “deadshits”, and as for Goldman Sachs — “I hate those f..kers as well”, Mr Roden said.

But the daily trading in billions of bank bills was not the only thing on Mr Roden’s mind. The day after that, he rang Ms Johnston in London for their regular catch-up at the beginning of her day and the end of his. Mr Roden was still angry with the NAB — “f..kin’ deadshits”, “f..k they’re dickheads” — and elated with the “bloody awesome” BBSW result, but finance talk was sandwiched between his attempts to encourage Ms Johnston to have a lesbian threesome with a friend.

“I had dinner with my friend and one of her other friends last night,” Ms Johnston said.

“Did the friend give you the kiss on both lips or just the big (one) on both cheeks or the big one on the lips?” Mr Roden asked.

Told “she’s of that persuasion but it’s only a friend”, Mr Roden was disappointed. Ms Johnston should take her friend on holidays to Prague, he said. “It’s pretty romantic so maybe it’s a good idea to go to Prague with your, with your lady friend right,” he said. “Cause anything can happen.” Ms Johnston declined. The transcripts also reveal the intensity of the five-minute trading frenzy just before 10am when the bank bills were traded by a broker at ICAP, setting the BBSW.

“Oh no,” says Ms Johnston as she is hammered by trades in late April, “ I just wanted ... to keep it from going to ridiculous levels.”

“Oh God.”

The episode earned Ms Johnston a “f..kin black eye”, Mr Roden told ICAP broker Jason Howell a few minutes later. “That’s why I just f..kin ripped into her.”

In a May 24, phone call, Ms Johnston explicitly claimed her team “manage BBSW and the rate set”. “And if we’ve got a large rate set and it’s interest, in the bank’s interests to, umm, try and decrease that rate or something, we kind of just oversee how that gets set, as well as a number of other banks,” she told a man identified only as “Greg”.

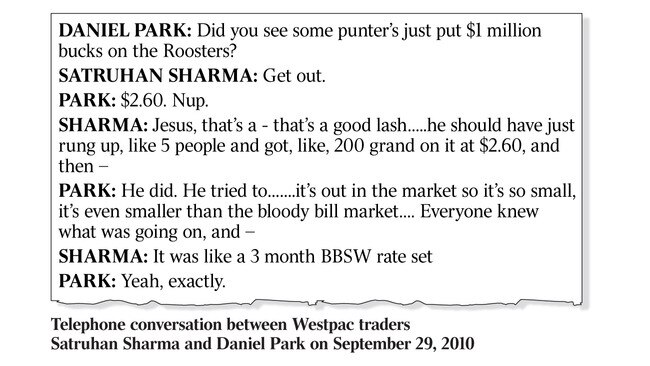

In another instance the next month, Ms Johnston warned Westpac financial markets trader Adam Parker of a “really ugly” trading day where the bank was thin on capital to sell to other banks in the market. “So we’re going to be staying clear … it’s not going to be nice, I’m afraid,” she said during the May 28 phone call. Mr Parker was resolute: “We just do have a bit of blue horse shit and it’s going to be filth.” He may have been referring to ANZ, which has trademarked its colour blue. In a November phone call, trader Dan “Bench” Park said the US SEC was “looking at us under a microscope on the New York branch”.