Resurgent home lending boosts Resimac prospects

Resimac has signalled a strong finish to the financial year, as the non-bank lender benefits from resurgent home lending and a buoyant property market.

Resimac has signalled a strong finish to the financial year, as the non-bank lender benefits from resurgent home lending and a more buoyant property market.

The company said if the domestic economy continued its recovery path and funding markets remained open and stable, it expected 2021 fiscal year net profit of $100m-$105m. That would reflect a jump of as much as 90 per cent on the prior year.

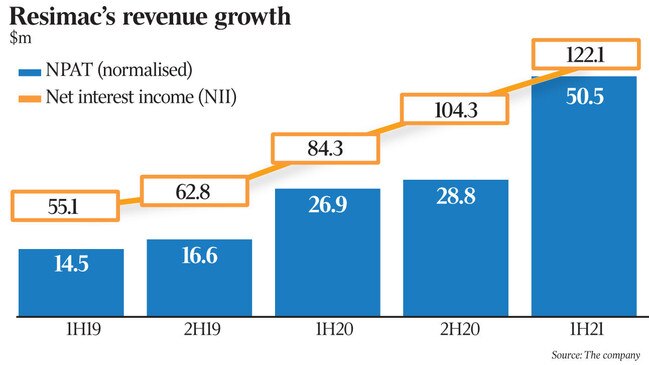

Resimac on Thursday reported that net profit soared 86 per cent to $50.5m in the six months to December 31, compared to the period a year earlier. Normalised profit, excluding lumpy one-off items, surged 88 per cent.

“The momentum and the performance, we believe, is sustainable and that’s because the drivers behind it are real drivers,” chief executive Scott McWilliam said, referring to loan growth, the management of margins and the credit performance of the portfolio.

“The pipeline looks healthy, the outlook looks healthy, and we’re aiming to push out a strong fourth quarter.”

On the outlook for house prices, Mr McWilliam noted regulators would closely assess any emerging risks over the medium term, although demand this time round was being dominated by owner-occupiers rather than investors. “The regulators will look at the heat in the market if there is any,” he said.

Resimac’s interim dividend doubled to 2.4c, compared with the previous corresponding period.

Net interest income climbed 45 per cent, even though loan settlements during the period dropped to $2.1bn, from $2.4bn. Total assets under managements rose 7 per cent to $15.1bn.

The group’s net interest margin — what it earns on loans minus funding and other costs — increased to 2.11 per cent in the first half, from 1.98 per cent in the prior six months.

Resimac chief financial officer Jason Azzopardi said the group had pulled back slightly in the prime lending market in the first half, where fierce competition for customers was occurring predominantly in fixed-rate home loans.

“Margin management is a huge focus for us and there were very aggressive pricing strategies put in place by competitors, banks among them, and sometimes you don’t want to give away such huge margin just to write some more settlements,” Mr Azzopardi said.

The results showed settlements of prime home loans fell 16 per cent in the first half, while settlements of specialist loans — with a higher risk profile — rose 9 per cent.

Banks have been boosted by ultra-cheap funding provided by the Reserve Bank through its COVID-19 Term Funding Facility.

COVID-19 repayment pauses accounted for about 1.55 per cent of Resimac’s loan book, down markedly from 10 per cent at the end of June. Of the remaining 500 customers on loan repayment pauses, a proportion had only requested assistance during Melbourne’s second pandemic lockdown.

“We are heartened by the fact that there is good equity in that portfolio,” Mr McWilliam said of the portfolio’s loan-to-valuation ratio, but he also noted he was closely monitoring the situation as JobKeeper support payments ended next month.

Resimac’s home loan collective provision edged up to $33.5m in its first half.

The lender’s cost-to-income ratio fell sharply to 31.1 per cent as at December 31, from 42.1 per cent a year earlier.

The group is also boosting its technology and credentials as a digital non-bank.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout