Reserve Bank chief slaps down banks over rate cuts

The RBA Governer has urged customers of ANZ and Westpac to seek a better deal elsewhere.

Reserve Bank governor Philip Lowe last night demanded that banks pass on the full cut in the official interest rate to help drive economic growth, after two of the nation’s biggest lenders ignited customer anger by pocketing part of the savings.

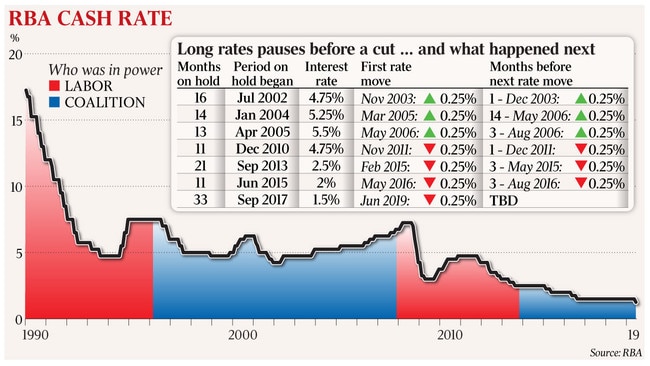

The RBA board cut the cash rate for the first time in almost three years yesterday, taking the official rate to a record low of 1.25 per cent, down 25 basis points.

Josh Frydenberg lashed the ANZ after it said it would cut variable mortgage rates by just 18 basis points. Westpac later announced it would cut its standard rate by only 20 basis points.

National Australia Bank and Commonwealth passed on the RBA’s cut in full — saving the average borrower $62 a month, or $744 a year, on the average $400,000 mortgage.

“ANZ has a lot of explaining to do to their customers,” the Treasurer said.

The bank’s action, he said, was “deeply disappointing”, given royal commissioner Ken Hayne had accused the banks only a few months ago of “putting profits before people”.

“Actions like this don’t give the Australian people any comfort that the banks have changed their behaviour,” Mr Frydenberg said.

Financial markets were largely unmoved by the move after the RBA last month signalled its willingness to cut the cash rate for the first time since August 2016. The Australian dollar was at US69.79c, the ASX 200 index rose 12 points to 6332 while the yield on 10-year government bonds dipped to 1.5 per cent.

Dr Lowe said he was disappointed some banks had not passed the RBA’s rate cut on to consumers in full, saying their funding costs had slipped back to 2017 levels. Banks last year raised mortgage rates by an average 15 basis points.

Breaking with the RBA’s practice of leaving markets to respond to official rate movements, Dr Lowe said: “This reduction in the cash rate should be fully passed through to variable mortgage rates. Full pass-through would also mean that the economy receives the full benefit of today’s policy decision.”

He called on customers to shop around, saying: “If your bank has not passed it through, I encourage you to go and look for a better deal somewhere else.”

Dr Lowe signalled there was room for more rate cuts.

“It is possible that the current policy settings will be enough — that we just need to be patient,’’ he said. “But it is also possible that the current policy settings will leave us short. Given this, the possibility of lower interest rates remains on the table.”

Dr Lowe said the outlook for household consumption, which has been hit by flat wages and falling house prices, was “the main domestic uncertainty”, but the bank stuck with expectations for 2.75 per cent growth in the economy this year and next.

“Some pick-up in growth in household disposable income is expected and this should support consumption,” Dr Lowe said.

He said the rate cut did not mean Australia’s economic outlook was worsening.

“Rather it reflects the fact that, even with the expected pick-up in growth, the Australian economy is likely to have spare capacity for a while yet,’’ he said.

“The economic outlook remains reasonable, with the main downside risk being the international trade disputes, which have intensified recently.”

He said the bank was hoping unemployment would be further reduced and wages continued to grow. He called on the federal government to implement “structural policies that support firms expanding, investing, innovating and employing people”.

Business groups said the rate cut would bolster the economy in the short term as it dealt with a fall in housing construction and should be complemented by longer-term strategies to boost growth. Business Council of Australia chief economist Adam Boynton said: “Today’s decision shows that Australia’s challenges haven’t gone away.

“We need faster economic growth to create new jobs, sustain higher wages growth and fund the services Australians need. That means focusing on policies to lift investment, make Australia’s economy more innovative and thereby drive productivity growth.”

Australian Industry Group chief executive Innes Willox said the cut highlighted a clear slowing in momentum in the broader economy and the labour market.

“As our data for the manufacturing, construction and services sectors have shown for some time, there are clear pockets of slowing demand as a result of drought, decline in housing construction, falls in house prices, tightening business credit, rising energy prices and concerns about global trade tensions,” Mr Willox said.

“Industry hopes today’s decision will provide the basis for renewed economic momentum.”

National accounts figures due today are expected to show a fall in economic growth to the weakest level since the global financial crisis.

ANZ, the country’s third-biggest lender, was the first to announce cuts to its mortgage rates, but held back more than a quarter of its cut “to balance the increased cost in managing our business.”

Mr Frydenberg had questioned how ANZ could fail to pass on the interest rate cut in full after the Hayne royal commission found banks were putting profits before people and demanded the bank explain its decision to customers. He said yesterday’s rate cut, combined with income tax cuts the government wanted to legislate when parliament returned next month would deliver a working couple earning a combined $120,000 a year a saving of about $3000.

Opposition Treasury spokesman Jim Chalmers said the RBA cut interest rates to levels less than half of those of the GFC a decade ago because the government had no plan to fix the economy.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout