RBA data show $16bn drop in spending

The sharp fall in spending, transactions and payments in April casts doubt on a V-shaped economic recovery.

A $16bn drop in spending, transactions and payments in April has sparked concerns of a prolonged period of consumer caution, casting doubt on a V-shaped economic recovery.

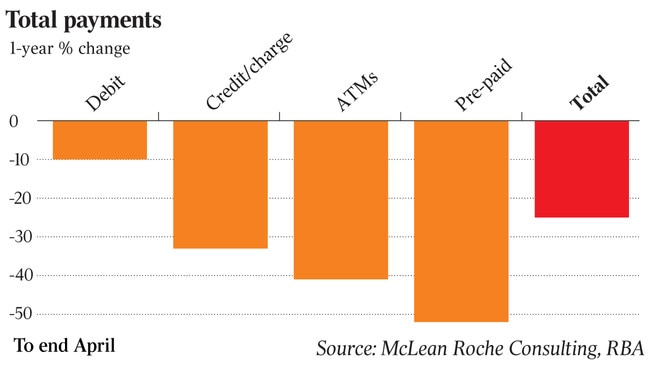

Reserve Bank data for April showed sharp falls across payment methods, including debit and credit cards, as large parts of the economy were in hibernation due to COVID-19.

The data includes domestic and overseas transactions, taking into account a shift by many to online shopping.

Debit card spending dropped 10 per cent in April compared to a year earlier, while the value of consumer credit and charge card transactions tumbled 33 per cent. ATM transactions fell by more than 40 per cent as people avoided cash due to the pandemic.

The dive in the numbers has some analysts saying the slump in consumer buying and consumption will continue for some time.

Analysis by McLean Roche Consulting’s Grant Halverson shows the sharp drop across payment types exceeds the last two Australian recessions, as the RBA data dates back to 1985.

“There has never been a one-month drop like this, ever,” he said. “There is certainly no ‘V’ (shaped economic recovery).”

Retail turnover plunged a record 17.7 per cent in April, seasonally adjusted numbers from the Bureau of Statistics revealed earlier this month.

They provide a monthly and quarterly estimate of turnover and volumes for retail businesses, including store and online sales, while the RBA data reflects actual transactions.

Westpac senior economist Matthew Hassan said COVID-19 had exacerbated a spending slump and further reduced appetite for debt by consumers.

“The scale of this fall in April is unlike anything we have seen and it is directly related to this unprecedented health crisis,” he said.

Mr Hassan said the plunge in transactions was a result of the hit to spending activity during the lockdown, with retail consumption levels on his analysis falling to levels not seen since the implementation of the GST.

CBA senior economist Belinda Allen said while the bank’s June spending data was showing an improvement, many households were still reluctant to open their purse strings.

“The labour market is still deteriorating … we are still yet to reach the peak in unemployment,” she said.

“There is still cautious behaviour by households, which will be there for some time.”

Parts of the economy are reopening, providing some optimism around how it will fare as activity restarts. That was also stoked by the cost of the federal government’s JobKeeper subsidy being revised down to $70bn.

Treasury this week suggested the unemployment rate may hit 8 per cent by September, after previously forecasting a June jobless rate of 10 per cent.

The pandemic has reignited debate about payment trends in light of a huge reduction in the use of cash and marked shifts in consumer behaviour.

RBA assistant governor Michele Bullock last week highlighted changes to payment behaviour linked to the COVID-19 crisis. She said it would prompt a cut to ATM networks and may sound the final death knell for cheques.

Ms Bullock also warned that unless banks stepped up efforts to allow retailers to direct payments to lower-cost EFTPOS networks over those for credit cards, the central bank could force that change or a cut in wholesale fees.

The drop in credit card use also includes a shift by consumers to buy now, pay later platforms, such as Afterpay and Zip.