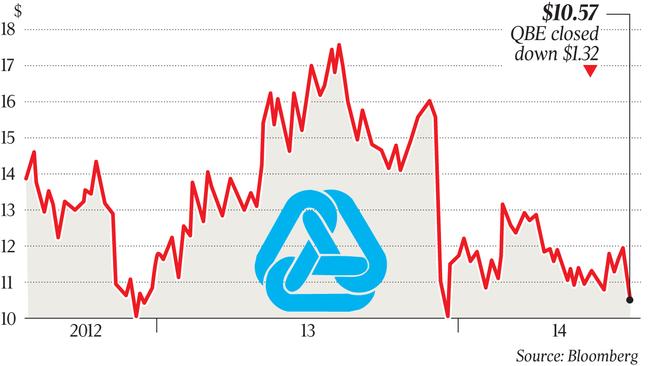

QBE swings to first half loss after spike in claims

QBE shares surged as the insurer said it had had little choice but to increase premiums, after it posted a $US712m interim loss.

QBE shares surged 7 per cent on Thursday after chief executive Pat Regan said the insurer was seeing the best pricing environment since the aftermath of the 9/11 terror attacks and would likely continue to do so for the rest of the year and into 2021.

The underlying trends behind the strengthening pricing environment, namely low rates, rising climate-related weather events and COVID-19 losses, had left insurers with little alternative but to materially increase premium prices, Mr Regan told The Australian.

“None of those trends are going away quickly, so that would tell you that pricing should continue for some time. It’s difficult to predict anything in the future but through the remainder of 2020 and into 2021 would be my best guess,” he said.

“At the moment a lot of insurance companies are not covering their cost of capital on a lot of the lines they’re writing so they don’t really have any choice but to try and do something about that (by increasing premiums).”

Mr Regan’s comments came after QBE posted a $US712m ($994m) net loss for the six months through June, following a spike in claims and a $US90m investment hit it suffered due to the market meltdown in the first quarter of the year.

QBE saw its average rate increase climb more than 10 per cent in the second quarter.

“This is the highest group-wide rate increase QBE has seen since the aftermath of 9/11,” Mr Regan said.

The surge in the second quarter lifted the group’s average rate increase for the half to close to 9 per cent.

“Alongside that positive premium rate environment, we’re also seeing significant growth opportunities, with organic gross written premium growth of 10 per cent in the first half, probably the highest level of organic growth QBE has seen in 20 years,” he said.

The market cheered QBE’s improving outlook, pushing the share price up more than 7 per cent shortly after the market open. It closed up 6.8 per cent at $10.74.

Pricing momentum in the local market was impacted by its decision to freeze premium rates in some of its business lines in response to COVID-19, Mr Regan said, as he admitted that customers in Australia “can’t afford to pay more for their insurance right now”.

He declined to say when QBE would lift the freeze in the local market, but revealed the insurer was taking a “wait-and-see” approach and factoring in the greater uncertainty in the economic outlook.

“Clearly all insurers here are seeing higher reinsurance costs because there’s been a higher amount of climate related weather events, so there are factors that would (indicate) prices have to go up. But there’s only so much money in the system, business activity will be subdued,” he warned.

On a constant currency basis and adjusting for disposals completed in 2019, gross written premium grew by 10 per cent to $US8bn, from $US7.6bn in the prior period.

Its combined operating ratio — a key measure of underwriting profitability that compares claims, costs and expenses to premiums — climbed to 103.4 per cent, reflecting a $US335m hit from COVID-19, as well as adverse catastrophe claims of $US60m and prior accident year claims of $US120m. A ratio of above 100 per cent indicates it is paying out more in claims than it is receiving in premiums.

Excluding COVID-19 impacts, its combined operating ratio was at 97.4 per cent, still higher than last year’s 95.2 per cent. Stripping out COVID-19, the excess catastrophe claims, and factoring in risk margin adjustments, its underlying combined operating ratio was 93.7 per cent.

The underlying ratio suggested solid momentum in the business, Goldman Sachs analysts led by Ashley Dalziell said.

The analysts saw a number of positive elements in the underlying trends for the business, including improved attritional loss ratio and clearer disclosure around future COVID-19 risks and cost assumptions, which suggested a conservative bias in QBE’s current $US600mn estimate.

Mr Regan said the insurer needed to be more efficient to drive down the combined operating ratio, citing a greater focus on digital and automated processes as well as improving all aspects of its claims business.

“With a bit of growth in the system now we can improve our expense ratio without having to resort to significant lay-off programs,” he said.

Catastrophe claims increased to $US308m, up from $US180m in the prior corresponding half. This exceeded its $US252m allowance by $US56m and was due to the widespread bushfires in Australia coupled with hail and storm activity on the east coast.

Despite swinging to a loss in the half, QBE declared a 4c per share dividend, down from 89c last year, which Mr Regan said was an important signal on the improving outlook for the business.

Commenting on the business interruption risk caused by the COVID-19 crisis, Mr Regan said the insurer’s exposure to UK business interruption claims was limited to $US70m, which it had already provisioned for.

Business interruption clauses in policies in the US and local market clearly excluded pandemics such as COVID-19, he said.

“In Australia it’s worth noting that as a result of the APRA stress tests done following the SARS pandemic back in the 2000s, all domestic insurers included specific pandemic virus exclusions in all of their policies.

“These virus exclusions specifically name and exclude SARS, worth noting that the medical name for COVID-19 is SARS-COV2 … we remain highly confident our policies were never intended to, nor do, cover pandemics.”

Any business interruption claims arising from COVID-19, both in Australia and globally, were covered by QBE’s reinsurance protection program, he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout