QBE Insurance hit hard by natural events but no major shake-up in store

QBE will not pay a final dividend in a bid to conserve capital after its bottom line was hit hard by a string of natural disasters.

Natural catastrophes have hit QBE hard, after the declared it would not pay a final dividend in a bid to conserve capital, but the company’s chair has stressed nothing is “intrinsically broken” at the insurer.

However, the insurance giant has committed to returning to paying dividends in 2021, setting a potential payout ceiling of 65 per cent of adjusted cash profits.

QBE has been battling crises both internally and externally in the recent year, but efforts by the insurer have seen it maintain its prudential capital adequacy in the top half of the company’s range.

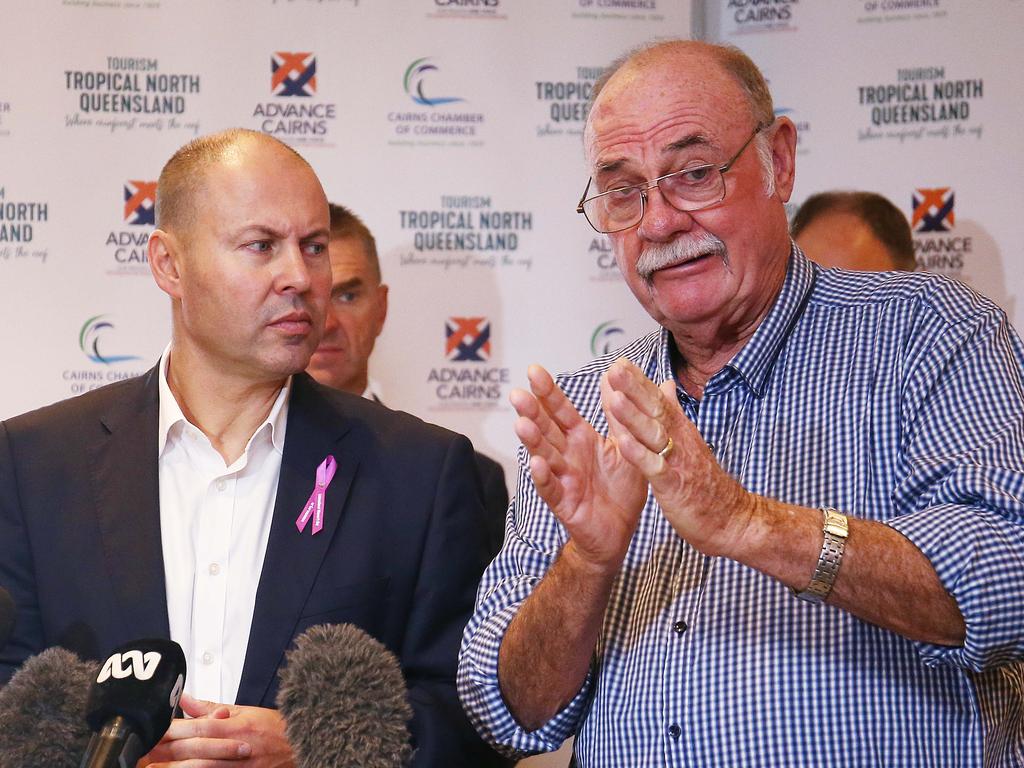

QBE chair Michael Wilkins said the improvements in the company’s balance sheet reflected its cautious approach and recent improvements in the global economy.

“This reflects premium rate increases and continued growth in select areas of the global portfolio coupled with a very substantial uplift in Crop premiums due to significantly higher commodity prices and underlying growth,” he said.

Improvements in gross written premiums across the group are up 28 per cent on the first quarter in 2020.

Underlying gross written premium is up 10 per cent from 2019.

The Australian insurer recently announced London-based Andrew Horton as the new CEO of the group. Mr Horton is set to move to Australia and will base himself in Sydney before his official start date on September 1.

However, Mr Wilkins said QBE was working hard to get Mr Horton into the country, with attempts currently frustrated by Australia’s border restrictions that have left tens of thousands stranded overseas.

“If we can’t get him into the country at that time, for whatever reason, we have our operation in the UK and he will start there September 1,” Mr Wilkins said. Mr Horton will walk into a company grappling with losses due to catastrophic weather and stung by the shock removal of its previous CEO.

But Mr Wilkins stressed there was no major shake-up of the company in store.

“He and I have had a few chats about QBE and about the organisation and he’s excited about the prospect of joining us,” Mr Wilkins said.

“He will come and look at the operations, there’s nothing intrinsically broken at QBE.”

The new CEO is in line to receive a $14m package when he takes up his role, bolstered by $4.5m in cash and share rights to compensate his leaving London-listed insurer Beazley.

The board moved swiftly in September last year to remove the past CEO after allegations emerged of inappropriate behaviour by Patrick Regan towards a junior staffer.

Mr Wilkins told The Australian said the board acted once it became aware of his breach “of our code of ethics”.

The insurer, which has a footprint in several countries around the world, has been dealing with costly weather events – with floods, fires, and polar storms hitting markets in the United States and Australia.

These and other events saw QBE slugged around $260m in costs, well above the group’s first quarter allowance of around $180m.

The payouts come on top of the $230m in catastrophe claims that hit the insurer earlier in 2020.

Mr Wilkins welcomed the move by the federal government, announced earlier this week, to create a $10bn reinsurance pool to back policies covering almost 500,000 properties in the north of Australia.

“We welcome the federal government’s announcement of a reinsurance pool and look forward to working with government on the design and implementation,” he said.

“We also believe it is important to continue to invest in mitigation, improve planning laws and strengthen building codes to support more resilient communities.”

On top of the pandemic claims, QBE is also facing the proposition its Australian business may be forced to start making pandemic-related business interruption claims.

This comes after QBE lost in the attempt by the British insurance industry to block pandemic-related business interruption insurance claims in the United Kingdom.

QBE had provisioned $240m to cover pandemic-related claims arising from the UK.

The insurer has provisioned $US785m overall to cover pandemic-related claims.

Mr Wilkins said QBE had so far paid $100m in COVID-related claims.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout