QBE eyes Commonwealth Bank insurance unit

QBE chief executive Pat Regan has signalled he may run a rule over Commonwealth Bank’s general insurance unit.

QBE Insurance chief executive Pat Regan has signalled he may run a rule over Commonwealth Bank’s general insurance unit, although his main focus is maintaining the group’s earnings momentum after it returned to profit in 2018.

Mr Regan told The Australian that, while there was plenty to do to improve QBE’s performance organically, he could not rule out a tilt at the CBA business.

“There is a scarcity of good assets out there,” he said. “So if or when it comes to the market, perhaps we’ll have a look at it.

“There is a tonne of stuff to work on; that is our first priority,” Mr Regan said, highlighting customer retention and QBE’s drive to become more efficient.

Last year, CBA started a strategic review of its general insurance business, which includes motor and home insurance customers, and investment banking sources expect a sale process will be ramped up this year.

Investors want QBE to tread cautiously, however, given it has just unwound a string of troubled offshore acquisitions over the past two years.

“If you can buy things very cheaply it could be a good time to buy,” Allan Gray investment chief Simon Mawhinney said.

He said acquisitions “can often destroy value” and QBE did not have a good track record.

Mr Mawhinney, whose fund owns QBE shares, was positive on the insurer’s return to the black in 2018 and said its improvement program was gaining traction.

“It was an excellent result for what has been a trying time in the insurance sector,” Mr Mawhinney added.

QBE yesterday reported a slightly lower-than-expected cash net profit of $US715 million ($1 billion) for the 12 months to December 31, compared to a loss of $US262m in 2017. Cash profit excludes amortisation of intangibles and non-cash items.

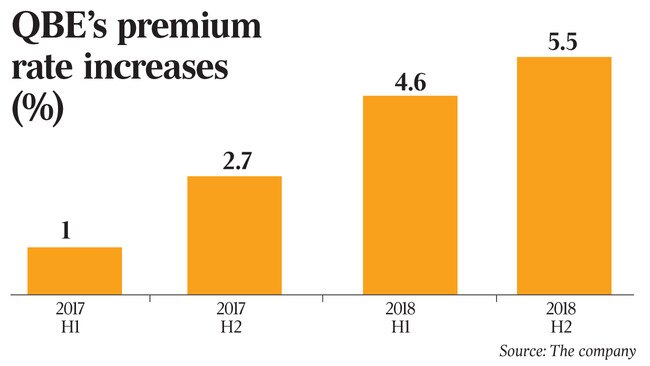

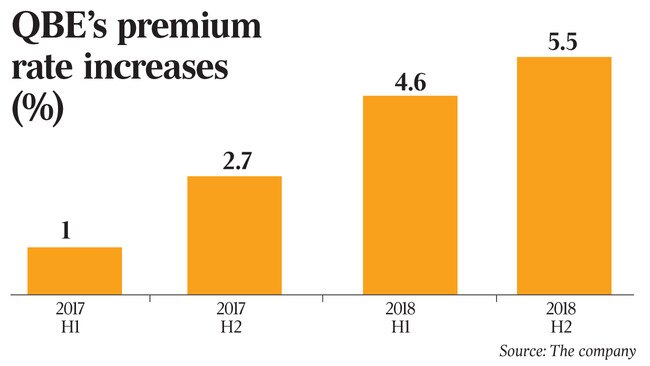

The full-year result was buoyed by lower rates of customer attrition and average group-wide premium rate increases of 5 per cent.

Gross written premium — the total premium written by an insurer before deductions — was higher at $US13.7bn for 2018, from $US13.3n a year earlier.

Investors focused on improved earnings guidance by QBE, which has slimmed down its operations that span the Asia-Pacific, North America and Europe.

The stock rallied 4.2 per cent yesterday to $11.96, hitting its highest close in 18 months.

Mr Regan said while QBE had “laid the foundations” for further earnings growth, he would keep a close watch on US and China trade negotiations given the impact they could have on its crop insurance business and broader macroeconomic conditions.

He also noted QBE had set up a separate entity in Brussels to ensure it remained “fully operational” regardless of the outcome of Brexit deliberations. “We’ve just tried to prepare for the worst eventuality,” Mr Regan said.

The Hayne royal commission included a number of recommendations on the general insurance sector, including that they implement the banking executive accountability regime and unfair contract provisions are applied to insurance contracts.

“Probably in the long term, it will be quite a profound impact,” Mr Regan said, adding that QBE had an active program of work relating to the royal commission’s findings.

The insurer was among companies caught up in the corporate regulator’s clampdown in junk add-on insurance sold at car dealerships.

QBE’s statutory net profit printed at $US390m for 2018, compared to a $US1.2bn loss a year earlier when the global industry was battered by record levels of natural disasters. Revenue fell 8 per cent to $US15.4bn.

Volatile financial markets in the latter half of 2018 weighed on QBE’s net investment yield, which slid to 2.2 per cent, from 3.1 per cent in 2017.

The company declared a final dividend of 28c a share, up from 4c a year earlier. That took total dividends for 2018 to 50c a share.

QBE bought back $333m in shares from investors in 2018 and said it would buy back a similar amount this year.

The prescribed capital printed at 1.78 times.

For 2019, the group expects the combined operating ratio — a measure of profitability expressed as a ratio of total costs divided by total revenue — to come in at 94.5-96.5 per cent.

The combined ratio for 2018 came in at 95.7 per cent for 2018, at the bottom end of a targeted range of 95 per cent to 97 per cent.

A lower combined ratio implies higher levels of profitability.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout