Proxy firms take aim at CBA CEO Matt Comyn’s pay packet ahead of AGM

Commonwealth Bank chief executive Matt Comyn’s mammoth pay packet has come in for attention from influential proxy groups ahead of the lender’s annual general meeting.

Commonwealth Bank chief executive Matt Comyn’s mammoth pay packet has come in for attention from influential proxy groups ahead of the lender’s annual general meeting, with warnings shareholders should carefully consider his rewards.

In a note to investors, proxy group Institutional Shareholder Services said investors “may be concerned” over CBA’s incentives to its executives, saying the bank had tilted them “towards an unduly high percentage of non-financial measures and board discretion”.

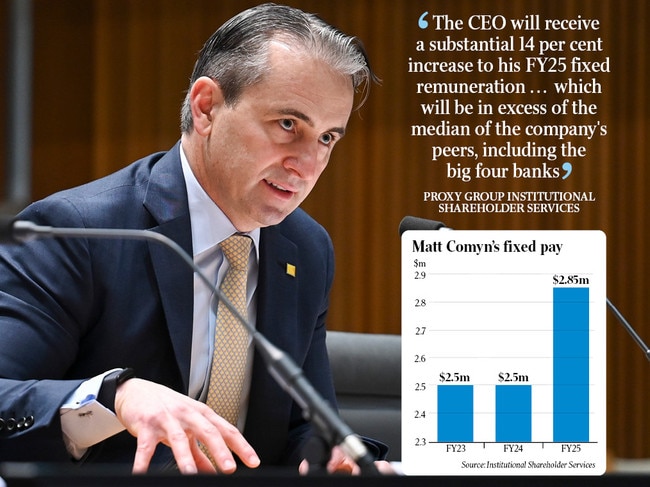

ISS said Mr Comyn was set to bank a 14 per cent pay rise to $2.85m in the coming financial year, “in excess of the median of the company’s peers” at rival big four banks.

CBA handed staff earning up to $100,000 a 5.25 per cent pay rise last year, followed by a 4.25 per cent lift in 2024 and 3.5 per cent in 2025. However, Mr Comyn has not had a pay rise since 2021.

“In exacerbating concerns somewhat, the company has increased the quantum of the CEO’s FY25 fixed remuneration, which has subsequently increased the CEO’s total long-term incentive opportunity to $3,990,000, and is now at a level above the median of the company’s market capitalisation and ISS-selected peer groups,” ISS said.

Rival proxy house CGI Glass Lewis also queried Mr Comyn’s payments in a report to investors.

CGI Glass Lewis told investors “we are prepared to accept the proposed increase in his remuneration” but called for CBA to give a “more detailed explanation, including relevant benchmarking, in next year’s remuneration report”. The proxy firm said Mr Comyn’s wage was a “key consideration” for shareholders to consider when voting on the remuneration report.

ISS also said shareholders should consider a “qualified vote” for a bonus for Mr Comyn, highlighting long-term incentives to the bank executive, in a move signalling concerns from the proxy player. The proxy group said the primary measure for the granting was based on service over four or five years, and the grant lacked “substantive, specific or fully disclosed performance measures”.

However, ISS backed all measures at CBA’s AGM, including CBA’s remuneration report.

ISS warned the grant of CBA shares to Mr Comyn was “inconsistent with shareholder interests and Australian market practice”, despite assurances from the bank that standards had been introduced in response to calls from the Australian Prudential Regulation Authority. The proxy group said the grant of restricted share units “has a very high probability of vesting and essentially represents deferred fixed remuneration”.

The intervention from ISS comes as shareholders prepare to decide whether to support several motions at CBA’s AGM on October 16, with many institutional investors following the advice of the proxy groups.

If more than 25 per cent of shareholders vote against a remuneration report, this produces a “strike”, and the board can be spilled in the event of two back-to-back strikes.

A CBA spokesman said the bank had “one of the most transparent and detailed remuneration reports”.

“Our remuneration structure has been consistent since 2021 and seeks to balance attracting and retaining talent, complying with APRA’s CPS511, and meeting shareholders’ expectations,” he said. “As part of our approach to transparently reporting, we have disclosed the increase in the CEO’s fixed remuneration for FY25 in this year’s AGM notice of meeting.”

CBA previously faced shareholder strife over bonuses handed to executives in the wake of a $700m Austrac penalty for failing to police suspicious cash deposits made at its intelligent ATMs.

In 2017 then chair Catherine Livingstone cut $20m in short-term bonuses on the back of the Austrac penalty, as CBA attempted to avoid a second strike.

CBA former chief risk officer Alden Toevs, who presided over the bank’s risk program during the period covered by the Austrac scandal, escaped with his bonuses intact.

However, the recently introduced Financial Accountability Regime, an evolution of the earlier Banking Executive Accountability Regime, could see future banker bonuses slashed under new rules.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout