With mortgage competition and the stubborn outlook for interest rates not going away, it’s only going to get tougher from here.

The same can be said for all Australian banks but for CBA, which ranks among the most expensive of the big banks in the world, any downshift in momentum will be acutely reflected in its shares. After all, CBA has long been priced for perfection.

CBA’s shares have enjoyed a fresh rally, surging nearly 20 per cent over the past three months to touch a record in recent weeks of $117.53. The jump meant that its already eye-watering valuation was pushed higher, coming in at 2.6 times tangible book value.

This is miles ahead of global players like HSBC, Citi or JPMorgan, and it is double the average of CBA’s three key Australian rivals, that combined traded at 1.3 per cent book value.

All this makes it difficult for CBA to keep up to the lofty expectations of the market.

On Wednesday, the weight of expectation became too much as its shares fell more than 3 per cent on the release of its workmanlike set of profits, although they ended the session down a more subdued 1.7 per cent.

At current levels, CBA’s shares are offering a yield of 4.2 per cent, although that’s before franking, which is only just ahead of the annualised rate of inflation. That has added to the pace of investors switching into higher-yielding bank shares.

For his part, Comyn says he doesn’t spend his time worrying about the share price or the valuation.

“It’s not something that we can control,” he tells The Australian. “The way we think about it is making sure that we’ve got the right strategy, that we’re focusing on that over the long term that we execute well, both operationally and strategic. We think about how do we deliver the best customer experience and ultimately create value for both our customers and shareholders.”

He says his management team have a strong understanding of the sorts of things that shareholders value.

“This is around the consistency reliability of our offer, and dividends and franking,” he says.

That’s the reason it has been rewarded with a large share price premium. At its heart, CBA has a powerful and highly-efficient machine that generates low-cost capital that allows it to reinvest more back into its franchise than rivals.

And while its massive footprint means it is geared to the slowing Australian economy, CBA also stands to benefit in a bigger way from the eventual rebound.

Lag effect

CBA’s December half earnings of $5.02bn were down 3 per cent from this time a year ago, as the lag effect of a rapidly cooling economy is now catching up. The slight profit fall means CBA had to work harder to deliver an increase in dividends – up 2 per cent to $2.15 – by dipping more into its capital reserves to fund it.

CBA’s size has long been its competitive advantage, although it also has a downside. As the bank that counts a third of Australians as customers and quarter of all businesses, CBA is the most closely tied to the performance of the economy than smaller rivals.

The big reason for the profit squeeze was an 11 basis point crunch in net interest margins (the difference between deposits and what it lends out). Pressure is moderating, but interest margins are expected to keep falling away.

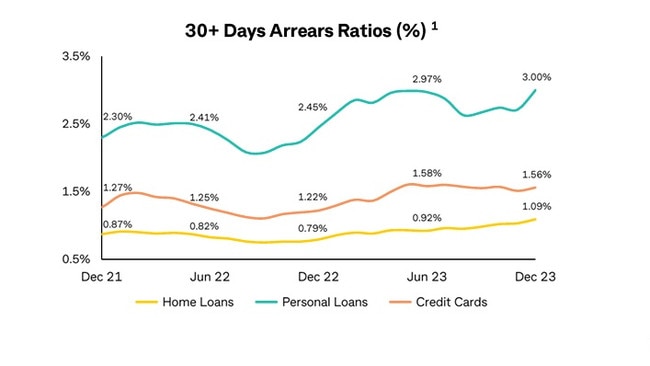

At the same time, CBA is seeing a small lift in late payments on loans, particularly around personal loans. However, actual lending losses realised have fallen by $100m, which is remarkable in this late stage of the cycle.

It will really come down to the two drivers – mortgage competition and the outlook for interest rates, that will make it harder for CBA to outperform for the foreseeable future.

Comyn is determined to hold the line on mortgage pricing, with smaller rivals still undercutting the bigger bank.

Comyn points out while interest rates on mortgages have increased on the Reserve Bank’s rate hikes, pricing on average is substantially less – some 70 basis points – than the cash rate, and this underscores the intensity of competition in the market. He wants to direct more mortgage business through his own branches, while other banks are winning the market by paying up big with mortgage brokers. It’s going to be a fight of attrition, with CBA betting other banks underpricing the market will eventually run out of spare cash to burn.

Meanwhile, the higher-for-longer outlook for interest rates around the world is starting to hurt the pricing for wholesale funding. The cost of cash on global markets is pushing banks to fund more of their lending book with their own deposits, and this has set off a chase for funds.

CBA’s size gives it advantages over rivals when it comes to hoovering up cheap deposits, however, it still needs to price itself into the market and pay up. It has another $20bn of ultra-cheap term funding it borrowed from the Reserve Bank during the pandemic to roll over in coming months, and much of this will be covered by CBA’s existing deposits. However, there will be a step-up in the price it pays that will add to the margin hit. All this means “continuing and ongoing” margin pressures, Comyn cautions. It now remains to be seen whether investors will be prepared to look through this subdued environment and keep backing CBA.

Seven stars

Ryan Stokes isn’t buying into the conglomerate discount. His diversified industrial Seven Group has ridden the mining and infrastructure boom to deliver shareholder returns of more than 80 per cent over the past year, some of the highest returns among the S&P/ASX100.

These returns were extended even further on Wednesday when Seven Group posted another market-beating result.

There is however one area of frustration for chief executive Stokes, with his underperforming oil and gas producer Beach Energy now coming under close attention. The 30 per cent-owned Beach this week posted an unexpected drop in first half underlying profit while heavy writedowns on its Cooper Basin interests saw it plunge into a $345m loss. Stokes, who now chairs Beach, reached for a well worn playbook – shaking-up management.

A key focus for Beach is now bringing long-delayed liquefied natural gas onstream from its onshore Perth basin field. He expects the operations to be producing later this year, putting the pressure on new Beach boss Brett Woods to deliver.

Stokes says the export opportunity as well as supply for the domestic Perth market remains for Beach, although he revealed the geology is proving to be far more complex than initially thought.

“All the operators in the (Perth) basin are building that knowledge base, but there’s still a very strong gas resource that will come to market over the next few years.”

Stokes was talking to The Australian after Seven Group delivered a 31 per cent jump in December half profit to $474m. The investment house raised its full year earnings guidance to low-to-mid-teen per cent growth – a figure that analysts already think is looking conservative. Shares in Seven Group surged more than 7 per cent to hit a record at $38.91.

Stokes has been building the now $14bn Seven Group around the key themes of growing mining production, infrastructure, construction and energy. Apart from Beach’s operational issues and writedowns – each of these areas has proven resilient throughout broader economic swings.

Stokes says WesTrac, a supplier and servicer of Caterpillar heavy mining haulers, has sidestepped the commodities crunch in nickel and lithium given nearly all of its activity has been in iron ore, coal and gold miners where expansion is underway. Lithium by comparison in Australia is just getting off the ground and remains in ramp-up phase.

“We are exposed to how active our customers are. And we have top-tier customers. If they’re producing or mining or operating, there’s going to be an opportunity to support them,” Stokes says.

Boral’s fightback

The multibillionaire Kerry Stokes controls more than 57 per cent of Seven, that in turn includes equipment hire play Coates and building materials producer Boral. Seven also has a 40 per cent stake in television network Seven and The West Australian print media. The media assets might get all the attention, but they barely move the dial against the financial heft of WestTrac, Coates and these days Boral.

Indeed, the long underperforming Boral has become the breakout story for Seven. Stokes installed a new management team led by Vik Basal and an aggressive focus on costs and pushing through price rises saw Boral more than double first half earnings. An extended and bloody takeover battle three years ago saw Seven emerge with control, eventually pushing its stake to 73 per cent. Seven has been eyeing Boral for the substantial cashflow it delivers, but there’s a sense of vindication in the turnaround. Stokes says he always thought Boral was capable of delivering earnings margins of more 10 per cent, which it is now doing.

“There’s more work to be done. Boral has got a lot of potential,” he says.

johnstone@theaustralian.com.au

For Commonwealth Bank’s boss Matt Comyn, the question is whether the two main pressures gnawing at its profits are going to subside.