Pressure increased on poorly performing superannuation funds

The government’s latest shake-up of super policy will increase the pressure on poor-performing funds to merge or lift their game.

The federal government’s latest shake-up of superannuation policy will increase the pressure on poor-performing funds to merge or lift their game, amid increased scrutiny on returns, fees and marketing spend.

Tuesday’s budget outlined a far-reaching package of reforms that will introduce a new comparison tool for consumers, and a test mid next year that will block funds that underperform for two years from receiving new members.

The changes will also prevent the creation of multiple super accounts by stapling an account to an individual, so it moves with them when they change jobs.

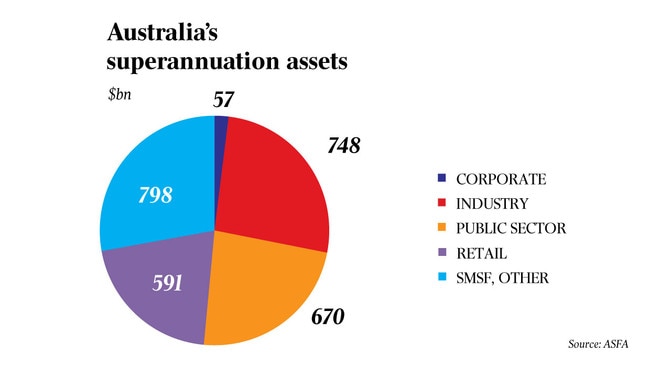

The package received a mixed review from the almost $3 trillion superannuation sector on Wednesday. Some players praised the move on duplicate accounts, but others raised questions about whether the regime would unfairly benefit funds with younger members and potentially tie individuals to poor-performing funds.

Assistant Superannuation Minister Jane Hume said the reforms were aimed at boosting the accountability of funds and improving member outcomes.

“We have a responsibility to them (members) in this compulsory system to make sure that the product they are putting their money into is serving them well,” Senator Hume said. “Having a very demanding benchmark is really important.”

Senator Hume said the new comparison tool and benchmarking would assess a fund’s investment performance after fees and taxes for consumers, given the Australian Prudential Regulation Authority’s heatmap report was more a tool for the funds themselves. She said the latest reform package coupled with tougher compliance measures could hasten mergers among super funds.

Her comments came as two of Queensland’s profit-for-member funds, Energy Super and LGIAsuper, signed a memorandum of understanding to pursue merger discussions. Combined, they would have 123,000 members and manage $20bn.

Other announced transactions in the works include the mooted marriage of Cbus and Media Super and Sunsuper’s merger with QSuper, which would create a fund giant managing more than $160bn.

KPMG’s head of wealth and asset management, Linda Elkins, said the budget’s superannuation reforms were likely to add to merger momentum in the sector.

“These measures are likely to accelerate the trend for funds to consolidate. Funds with poor performance or high fees which cannot rectify their position will need to consider merging or transferring to another fund,” Ms Elkins said.

Corrs Chambers Westgarth partner Michael Chaaya said: “Effectively shutting the doors to new members in underperforming funds could potentially bring some funds to their knees.”

Ms Elkins noted while the industry welcomed no further changes in superannuation tax in the budget, it continued to navigate uncertainty given there was no reference to the super guarantee or the Retirement Income Review.

Senator Hume said it would “be foolish” — given the economic turmoil caused by COVID-19 — for the government not to consider pausing legislated increases in the super guarantee to 12 per cent over the next five years. But she reiterated the government’s view that any such decision would depend on the prevailing economic situation.

The industry is awaiting the government’s response to the Retirement Income Review, which delved into the age pension, compulsory super and savings rates. Senator Hume said the government did not yet have a timetable for the release of its response.

“I don’t think there’s a rush,” she said. “We’ve come out with some reforms that are about making the system more efficient and delivering to members and maximising member’s retirement savings.”

The Australian Taxation Office and APRA will have key roles in administering the budget measures for super.

An APRA spokesman on Wednesday said: “APRA welcomes efforts to support and accelerate its ongoing work to improve superannuation member outcomes by raising industry standards, increasing transparency and weeding out underperformers.”

APRA deputy chair Helen Rowell will deliver a speech next week when she is likely to provide more information on the regulator’s thinking on the proposed reforms.

APRA data puts the annual industrywide MySuper rate of return as at June 30 at negative 1.1 per cent, while over five years the average annual return was 5.2 per cent.

On the new proposed budget measure on boosting fund accountability around expenditure and managing member’s money, Senator Hume said the action was not meant to be prescriptive.

“We don’t want to ban a particular action but we want to make sure that trustees think about every decision that they make with members’ money.”

But Corrs’ Mr Chaaya labelled that reform “unnecessary” given the existing legal duty to act in the best interests of members.

Industry Super Australia hit out at the part of the reform package that staples a member to their super fund.

“The low-cost workplace default system has protected workers from being ripped off by unscrupulous

players, these reforms must build on and improve those foundations – not undermine them,” said chief Bernie Dean.

“While it is pleasing the government is tackling multiple accounts, stapling workers to a single fund could

leave them stuck in a dud fund for life, costing them hundreds of thousands of dollars at retirement.”

Retail employee-focused fund Rest said the measure to stem duplicate super accounts was positive, given the those with multiple accounts were levied more fees and insurance premiums.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout