Platinum Asset Management outflows top $3bn for year

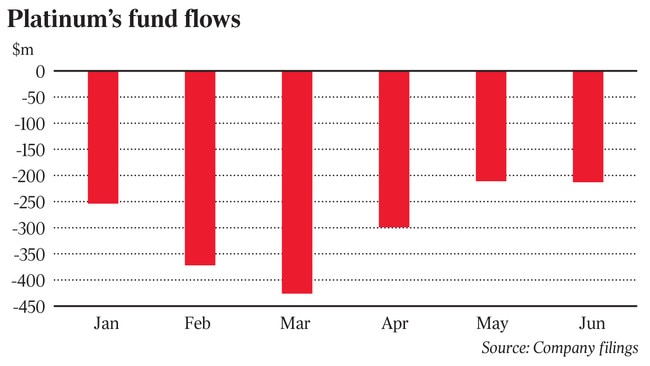

Platinum Asset Management’s run of outflows worsened through June, taking its outflows for the year to more than $3bn.

Platinum Asset Management’s run of outflows worsened through June, with a further $213m flowing out of the value manager’s funds in the month, taking its outflows for the year to more than $3bn.

Platinum’s funds under management sat at $21.9bn at June 30, before an annual distribution to unitholders of $532m.

In an update to investors, the value manager said the past two years had been challenging due to bets in short positions and energy and materials holdings that had not paid off.

“It is important to remember when looking at compound performance, the last two years have dragged down longer-term numbers; we kept up with the first nine years of the bull market, despite our cautious approach and this bull market being US-centric.

“This followed on from the portfolio sidestepping the global financial crisis, so through-cycle returns were well ahead of the market from the May 2007 peak to what looks like for now a cycle peak at February 2020,” Platinum said.

Platinum’s flagship $8.35bn international fund has underperformed against the benchmark MSCI index over both the short and long term.

It gained 0.4 per cent over the month of June, compared to a 0.5 per cent rise in the MSCI and returned 1.1 per cent versus the MSCI’s 6 per cent gain in the three months to June 30.

On a six-month time frame, it returned -10 per cent against the MSCI’s -4.3 per cent.

Over a three-year period, the MSCI’s 10 per cent return dwarfs its own 3.3 per cent, while over 10 years the MSCI delivered an 11.4 per cent gain versus Platinum’s 7.7 per cent.

“Looking forward, the portfolio is more fully invested than we are optimistic as we tread a fine line between shorting in the face of stimulus and momentum, and acknowledging that to some extent, shorting expensive stocks while owning cheap stocks is compounding a view that requires rotation away from current historic extremes,” Platinum told investors.

“One might describe us as having a finger on the trigger (to add protection) as we constantly assess the complex impacts of lockdowns, second waves, stimulus removal, and underemployment, coupled with insatiable demand for certain types of stocks.”

Platinum sees more promise in hard-hit travel stocks than energy plays in the current market, which led it to top up its position in recent weeks.

“With changes in the dynamics of the oil market, accelerated by COVID-19, we have not topped the energy positions back up, preferring to add several new exposures in higher-quality travel-related companies, which we expect to bounce back strongly on a three- to five-year view, as restrictions inevitably relax over time,” it said.

Rival fund manager Magellan posted its own update last week, revealing it had seen net inflows of $249m in the month, bringing its total funds under management at June 30 to $97bn.

While Platinum is estimating performance fees of $9m for the year, Magellan picked up performance fees of about $81m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout