These are the so-called Scope 3 emissions, produced outside a company’s direct industrial processes. They are the “everything else” after a company’s own emissions or energy footprint are measured. It’s essentially emissions created by customers using a company’s products or released when products are disposed of at the end of their life. It also covers emissions produced by suppliers.

For business, getting on top of Scope 3 is important, with pressure for change coming from consumers and regulators. Business also sees a competitive edge in addressing the issue.

Scope 3 emissions are material – they make up as much as 65-95 per cent of most companies’ total. But as Ampol CEO Matt Halliday tells The Australian, by definition “someone else’s Scope 1 or 2 emissions are someone’s Scope 3”.

“Everyone looks at the problem from their own perspective. These are complex issues that need a system-wide solution,” he says.

However, Scope 3 emissions are tough to define and by their nature are even harder to control. This is what the Climate Leaders Coalition is seeking to do through the release on Tuesday of a road map to address the emissions. That will set the stage for a major meeting between the CEOs on Wednesday.

The corporate leaders acknowledge they can’t do it by themselves, with strong policy support needed from both federal and state governments to help get them there.

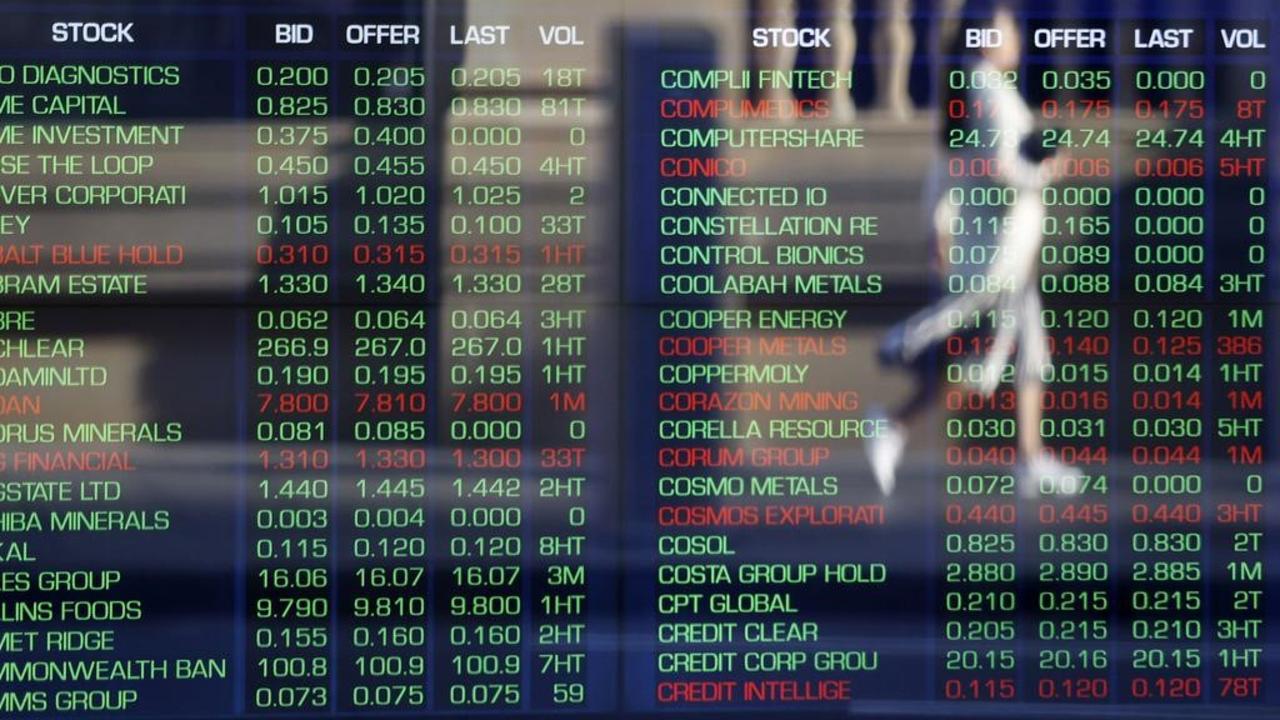

The Climate Leaders Coalition is co-chaired by former Telstra boss David Thodey and includes 48 CEOs across all industries. They include Halliday, Matt Comyn from Commonwealth Bank, Qantas’s Alan Joyce, Woodside’s Meg O’Neil, Brad Banducci from Woolworths and NAB boss Ross McEwan. The CEOs have worked on different streams from food to aviation, gas and property, attempting to define a common reference point for what needs to be done in measuring and cutting Scope 3 emissions.

“This is the opportunity to have an aligned corporate view of what the equation needs to look like and that would have a lot more credibility in explaining to state and federal governments in what is required from a solutions view to build out,” Halliday says.

For his part Ampol’s Halliday has been working with the Climate Leaders Coalition to examine what is needed for the transition to producing green hydrogen as the gas energy feedstock for its refinery. This project has involved Woodside’s O’Neil and APA chief Adam Watson.

Halliday says this initiative involved looking at whether Ampol’s giant refinery outside Brisbane can use green hydrogen instead of gas. This would be a step up from the grey hydrogen it produces currently, which is captured and fed back into the refinery to support operations.

Going green, or using green energy to produce hydrogen, is technically possible but the commercial feasibility is where the project “gets very challenging”. It is significantly more expensive to produce and transport the green hydrogen, which is where more work needs to be done in reducing the pricing gap.

“Policy settings are going to be really important, but it gives us an important reference point to what policy solution is going to help it become even more economic,” Halliday says.

He points to the US, which offers support of up to $US3 a kilogram to fast-track efforts to use green hydrogen as an energy source. The same applies to green fuel for aviation, where biofuels will be important, given the lack of green alternatives to power jets.

Here Halliday says Australia has a ready supply of biofuel feedstock to produce green aviation fuels, but green capital is heading offshore, particularly to the US, where subsidiaries are driving the development of the industry.

It is clear that businesses believe they won’t be able to get there alone. Once they define the scale of the Scope 3 challenge they feel they can work better with all levels of governments to help what they say will be a monumental transition. As Thodey said: “While the challenge of reducing Scope 3 emissions is complex and wide ranging, it is far from insurmountable.”

–

Perpetual motion

Every now and then Perpetual’s management gets a stinging reminder of what happens when they take their eye off their core business. Perpetual’s head of equities Paul Skamvougeras is calling it quits as the bluer than blue chip fund manager is within reach of clinching a deal to secure long-time rival Pendal. His exit is likely to be the start of more disruption on both sides as the two headstrong fund management cultures are stitched together.

While Skamvougeras – who has held the role under a rolling contract for more than a decade – is not planning to move to another investment manager, he is expected to continue in the long tradition of former Perpetual heads of equities and start his own boutique fund when his non-compete finishes in 12 months.

Change doesn’t come often for Perpetual, which has an outsized influence on the Australian equity market with $21.3bn under management. As a value-based manager, performance has been poor during the share boom but returns have improved sharply over the past two years, seeing the funds outperform their benchmarks.

The longevity of the Australian share fund – more than 50 years – puts Perpetual right at the top of the tree in terms of market reputation. At the same time the fund managers – Skamvougeras and before him John Sevior and Peter Morgan — have been prepared to publicly call out bad deals or poor corporate performers.

“They’ve always been prepared to say publicly what they believe is happening with companies. They’re strong managers prepared to speak their mind,” says Geoff Wilson, who heads Wilson Asset Management.

For now the pressure will be on deputy head of equities Vince Pezzullo, who has been promoted to the top funds job to keep the tradition as well as grow Perpetual’s funds under management. He takes charge as big super funds are increasingly taking active management in-house, putting pressure on the broader market.

Pezzullo has been with Perpetual since 2007, doing his apprenticeship under Sevior. After being promoted to deputy head of equities 2016, Pezzullo is expected to keep changes in his new team to a minimum to show the ratings houses there is consistency in the funds management style.

Skamvougeras will stay with Perpetual during the transition period to help smooth over any disruption. “Our team has never been stronger, delivering great investment performance with fund flows building. I have great confidence the team will continue to deliver for our clients,” he said.

The shake-up comes just as Perpetual’s management is trying to convince its own shareholders of the merits of the $2.4bn merger with Pendal. Perpetual itself was thrown off guard by a late takeover approach led by Regal Funds Management, which had an eye to carving up the lucrative corporate trust business.

This emergence of the Regal offer prompted a legal ruling last week that cleared the way for Pendal to pursue not only a $23m break fee but also further payment from Perpetual if the agreed deal does not proceed.

The Pendal acquisition is deeply unpopular among Perpetual’s fund managers, mostly as the combination threatens to dilute their clout within the merged entity and potentially the remuneration pool. The combination of the two will create a $240bn funds major, with Pendal tipping in the majority of the funds.

It also is set to bring about disruption and cost cutting, with Perpetual’s management looking for ways to make the high cost of the Pendal deal work harder.

johnstone@theaustralian.com.au

On Wednesday, nearly 50 of the nation’s top chief executives will meet to tackle the hardest part of their efforts to slash carbon output: to measure and then start taking control of the emissions they don’t produce.