Payments market set for shake-up as BPAY, eftpos, NPP merger looms

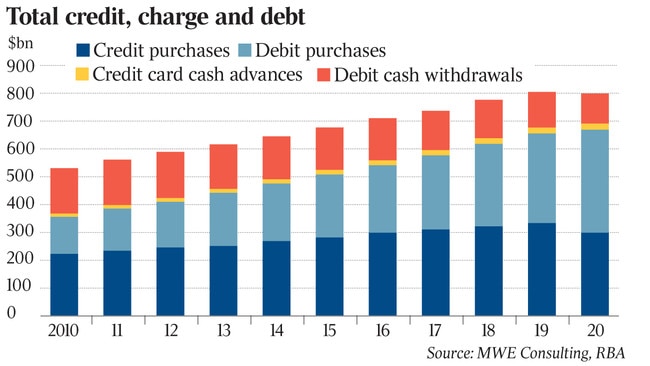

The $800bn retail payments market is set for a watershed 2021 as three key bodies mull a merger, and reviews are conducted by Treasury and the RBA.

The $800bn retail payments market is set for a watershed 2021 as three key bodies mull a merger, and separate reviews are conducted by Treasury and the central bank across infrastructure, policy and technology.

This year has laid the groundwork for 2021 developments to be even more important, given COVID-19 has accelerated the uptake of digital technologies, including in payments.

The Treasury and Reserve Bank’s concurrent payments reviews come against the backdrop of controversial merger talks — which started in June — between BPAY, eftpos and the real-time New Payments Platform.

The three-way consolidation, which some believe will dent competition and investment across the payment platforms, is being discussed by the 22 shareholders of the three organisations — in a process that could take nine months.

An industry committee, including representatives from the big banks, is assessing issues of ownership, structure and corporate governance, and representatives from the NPP have met with the competition regulator on the proposal.

It is thought several banks are supportive of the tie-up between BPAY, eftpos and the NPP as it allows them to pool their investments, while retail stakeholders have concerns the marriage will reduce competition.

Payments expert and MWE Consulting director Mike Ebstein said it was “not immediately clear” what the benefits of the three-way merger would be.

“Given Australia is a relatively small market, there may be scale economies and reductions in fixed operating costs,” he added. “However, it would be necessary for the public interests to be safeguarded by ensuring access to the retail payments markets is not hindered.”

The eftpos Australia annual report showed it had grown transaction volumes by 13.3 per cent in the 12 months to June 30, and more than doubled net profit to $10.7m.

Take-up of buy now, pay later debit services and reforms that allow retailers to route payments to the lowest-cost processing method have helped.

But BPAY lost money last financial year. It reported a narrower loss, though, of $2.5m for the 12 months ended June 30, on flat revenue and inclusive of an impairment loss on intangible assets.

Hugh Frames, BPAY’s chief operating officer, highlighted the group’s core business which he said was financially sound.

“The company recorded a strong profit on its core business despite a one-off impairment of an Osko product enhancement due to non-delivery by others for $4.7m during the financial year,” he said. “BPAY Group’s strong operational profits have enabled the company to make investments in the past three years.”

The NPP — which allows instant transfers via phone numbers, emails and internet banking — is growing strongly and processing an average of 1.7 million transactions a day.

Mr Ebstein said the value of transactions on the NPP overtook cheques in the 12 months to August, and on current growth trends the platform would overtake cards in February or March.

He wanted Treasury’s review to focus on a balanced regulatory structure that did not weigh on entrepreneurial flair.

“It has to be done in a balanced way, recognising we don’t throw the baby out with the bath water,” he said. “Regulation does need to be simplified rather than strengthened.”

The Treasury review will be led by King & Wood Mallesons partner Scott Farrell and report by April, before the federal budget.

An issues paper was issued this month and submissions are being received until December 31.

The issues paper noted “minimal overlap” between the Treasury and RBA reviews.

Following a COVID-related delay, the RBA’s retail payments regulation review is now expected to be complete in 2021. The RBA’s Payments System Board is led by governor Philip Lowe.

Among other topics, the Treasury issues paper asks for feedback on different regulatory models in Britain, Singapore and New Zealand, suggesting the RBA may lose oversight of the payments market.

“Interesting that Treasury only sees fit to consider New Zealand, Singapore and UK as models — astonishing not considering the leaders in this area (are in) mainland Europe,” McLean Roche Consulting’s Grant Halverson said.

“The need for real competition is the single biggest issue, yet barely rates a mention.”

Early this year, TransferWise’s global technology boss Harsh Sinha highlighted the difficulties the firm and other non-banks encountered in getting direct access to the NPP, which made them reliant on incumbents.

The issues paper said payments infrastructure had to be responsive to technological advances.

“Developments in the payments system continue to gather pace and in some cases evolve in an unpredictable manner,” the document noted.

The issues paper also touches on cross-border payments, open banking, digital wallets, stored-value facilities, cryptocurrencies and the BNPL sector.

It notes that open banking — which gives consumers more control over their data — could attract new entrants into the local payments sector.

On instalment payments, the paper highlighted differences in the regulatory framework in the UK and the US, with the latter having little to no regulation of BNPL operators.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout