Overhaul for besieged Freedom Insurance

Embattled life insurer Freedom Insurance yesterday flagged a dramatic overhaul of its business model.

Embattled life insurer Freedom Insurance, which is yet to take the stand at Kenneth Hayne’s royal commission, yesterday flagged a dramatic overhaul of its business model that had been censured by financial regulators.

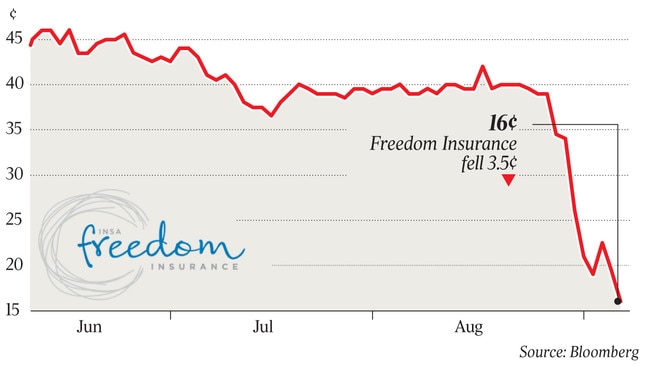

Freedom Insurance shares have more than halved since early last week, when it was named as one of the case studies for the royal commission’s imminent round of hearings into the insurance sector, wiping out about $50 million in shareholder value.

The stock tumbled a further 18 per cent yesterday after the insurer told investors it was looking into how to stay afloat.

A damning report from the Australia Securities & Investments Commission last week put the group’s business model in serious doubt after it told life insurance companies to shut outbound sales centres or face legal action.

Freedom Insurance is mainly an outbound “direct” insurer that sells life insurance and funeral insurance, and derives the majority of its revenue from trailing commissions and upfront commissions, all of which is in the sights of the royal commission and regulators.

To compound problems, a separate ASIC investigation into Freedom Insurance is also putting pressure on the Australian Prudential Regulation Authority to block the group’s $65 million takeover of Bank of Queensland’s life insurance division St Andrew’s. The deal is Freedom’s ticket to an APRA insurance licence.

In a brief statement released to the market yesterday, Freedom said its board of directors were launching a “review of strategic options” for the company after the publishing of ASIC’s report and “initial discussions with ASIC regarding that review”.

“Specifically, the board notes that a significant proportion of Freedom’s upfront commission revenue is derived from the sale of funeral insurance by the company’s direct sales team and that changes to a number of lead sources would be required to continue to meet the expectations of the regulator,” Freedom said.

“Consequently, in order to protect and maximise shareholder value, the board has commenced a broadbased review that will consider matters, including strategy, business structure, operating model and internal practices and procedures.”

Freedom Insurance is being investigated by ASIC over its high-pressure sales tactics.

Sources familiar with ASIC’s investigation into Freedom told The Australian the company had been unwilling to give ground to the regulator’s demands.

Freedom last month posted a 6 per cent fall in annual profit to $13.2m, but the company is bracing for further damage as the royal commission targets conflicted remuneration and bonuses.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout