OneVue takes ‘necessary steps’ on Sargon debt

Superannuation platform manager OneVue has assured shareholders it won’t be left hurt by Sargon Capital’s collapse.

The Alex Waislitz-backed superannuation platform manager, OneVue, has moved to assure its shareholders it won’t be left financially damaged by the collapse of Sargon Capital.

OneVue said it would preserve its legal rights over an outstanding $31m owed to it by Sargon from last year’s purchase of its Diversa Trustee business.

However, OneVue’s ability to pay a dividend could greatly rely on Sargon paying the rest of the acquisition price.

Sargon agreed in June last year to buy the Diversa arm for $43m as part of its grand plans to supercharge its growth and become a significant player in the superannuation technology and administration industry.

However, those lofty plans soon came undone when Sargon was placed into receivership on January 29 and its shares in OneVue were placed in a trading halt a day later as it assessed the impact to its operations, with the bulk of the purchase price for Diversa still owed by Sargon.

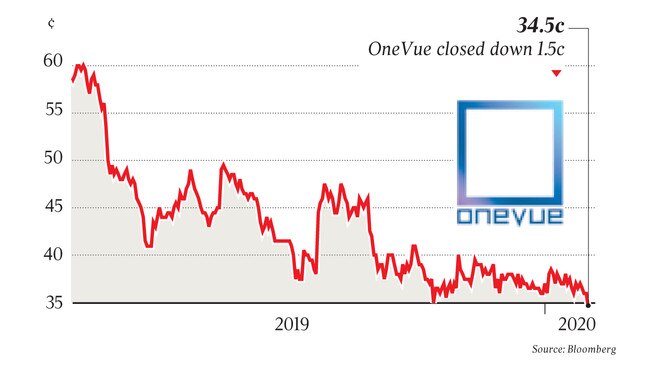

Shares in OneVue came back on the market on Monday and ended down 1.5c at 34.5c.

In a statement to the ASX on Monday, OneVue, whose major shareholder includes a range of investment funds owned by billionaire stockpicker Mr Waislitz, said its board and management have had sufficient time to plan for all possible scenarios in relation to the Sargon receivable and would act to protect its legal rights.

“We are therefore taking all necessary steps to ensure we preserve our legal rights and we place ourselves in the strongest position possible to recover the full value of the deferred consideration,” the statement to the ASX read.

“We continue to work closely with our external legal and other advisers to achieve the best outcome for our shareholders.’’

This event has had no impact on OneVue staff and their ability to perform and deliver to clients on a day-to-day basis, the statement said.

OneVue managing director Connie Mckeage said: “It is important to emphasise that the OneVue business and its commitments to clients and growth is in no way dependent on the outcome of the Sargon receivable.

“The business is appropriately funded and has the balance sheet strength, cash-generating capabilities, cash on hand and debt facilities to support the growth and operating requirements of the business.

“All outstanding amounts for acquisitions were fully extinguished in January 2020, including the final payment to KPMG for the acquisition of their superannuation administration business.”

But OneVue said in respect to shareholders, the share buyback program would be initiated as recently announced, with the foreshadowed dividend remaining subject to the final principal repayment of the outstanding amount of $31m.

The Australian revealed last week that the collapse of Sargon, which claims to administer $55bn in super savings across its trustee business and counts former Labor senator Stephen Conroy as a director, had come to the attention of financial regulator APRA, which is understood to be monitoring the receivership.

Before its failure, Sargon was considering a float on the sharemarket. Its former chair was ex-Crown Resorts chair Rob Rankin.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout