Westpac mulling NZ future after RBNZ rebuke over risk management failures

Westpac is considering a demerger of its NZ business after the country’s central bank slapped it with compliance notices for ‘material failures’ in reporting.

Westpac’s divestment spree is far from over as it weighs a New Zealand spin-off or sale, ahead of changes to capital requirements in that market and after being hit with compliance notices for liquidity reporting failures across the Tasman.

Westpac on Wednesday said it was considering the “appropriate structure” for its New Zealand operations, including a demerger, as it assessed what was in shareholders’ best interests. The bank is thought to have Macquarie Capital helping to assess strategic options for its NZ business.

“Westpac is in the very early stage of this assessment and no decisions have been made. This will also consider the impact of the Reserve Bank of New Zealand’s reviews which were announced,” the bank said.

The RBNZ on Wednesday slapped Westpac NZ with formal compliance notices for “material failures” in reporting its liquidity over eight years, forcing the bank to undertake independent reviews and hold more liquid assets.

The regulatory action is yet another blow to Westpac, which is still reeling from agreeing last year to pay a record $1.3bn penalty to Austrac given the bank’s millions of breaches of financial crimes laws.

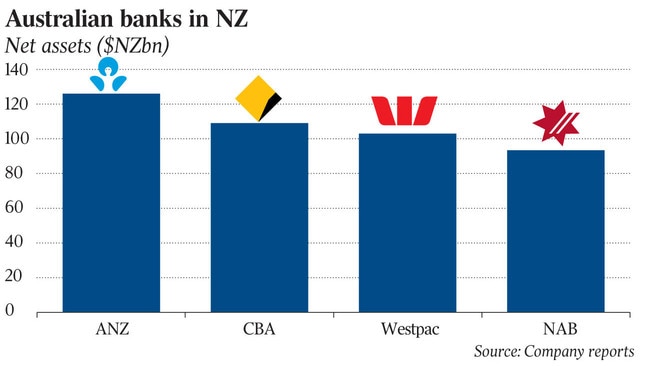

Australia’s banks, which dominate New Zealand’s banking market, are separately preparing for more stringent capital requirements across the Tasman that were delayed due to COVID-19. The package of changes has a phased implementation. Increased requirements for bank capital ratios start next year.

The RBNZ’s proposed capital requirements had prompted ANZ chief executive Shayne Elliott to warn in 2019 that he may look to pare back some activities in that market in response.

Westpac’s shares fell almost 1 per cent to close at $24.19 on Wednesday, bucking a 0.5 per cent rise in the S&P/ASX 200.

Ethical Partners’ investment director Nathan Parkin said the bank’s deliberations on a spin-off of its New Zealand operations fit with a strategy to focus on core operations.

“From a Westpac shareholder point of view it’s a relative positive,” Mr Parkin said. “I can’t imagine the Reserve Bank of New Zealand would want then to separate it out though.”

Velocity Trade analyst Brett Le Mesurier said that on his numbers Westpac had the smallest exposure to New Zealand among the major banks, on a total loans basis, at $82bn.

“It is very worthwhile investigating [an NZ demerger] for Westpac, but I suspect the costs of separating it and giving it financial support will be prohibitive,” he said.

Westpac’s New Zealand operations posted a 38 per cent decline in cash earnings to $649m in the year to September 30, compared to the prior 12 months.

Westpac has in the past 18 months sold its Pacific arm and general insurance unit, and is also looking to offload its investment platform, life insurance and auto loan divisions as part of a retreat to focus on core businesses.

The bank’s statement labelled New Zealand a “valuable part” of the group and noted it had been so for more than 160 years. “The business continues to perform well with a strong position in retail and commercial banking,” Westpac said.

“However, given the changing capital requirements in New Zealand and the RBNZ requirement to structurally separate Westpac’s NZ business operations from its operations in Australia, it is now appropriate to assess the best structure for these businesses going forward.”

RBNZ deputy governor Geoff Bascand on Wednesday said the central bank had instructed Westpac to commission two independent reports to address failings in how it reported liquidity position. Banks must keep regulators informed of their liquid assets, which reflect cash or assets that can be easily converted into cash.

The independent reviews fall under Section 95 of the Reserve Bank of New Zealand Act 1989.

Westpac “has continued to operate outside of its own risk settings for technology for a number of years,” said Mr Bascand, also the RBNZ’s general manager of financial stability.

“Westpac NZ needs to take a close look at its risk governance practices.”

A second independent report must be undertaken for Westpac to provide assurance that the actions it has taken to improve the management of liquidity risks, and the culture surrounding it, are effective.

The RBNZ said until it was satisfied that Westpac NZ’s remediation work was complete and effective, it would demand an increase in the bank’s required liquid assets holdings.

Westpac said breaches of the RBNZ’s policy were previously reported to the central bank and the Australian Prudential Regulation Authority, with the latter taking action against the bank in December.

Westpac entered into an enforceable undertaking with APRA in December to address a string of risk governance deficiencies, and had also admitted to breaching the regulator’s liquidity standard. Given the Austrac legal action (which was settled), Westpac was required by APRA to hold an additional $1bn in capital in late 2019.

On Wednesday the bank said its NZ unit acknowledged the importance of liquidity and risk governance obligations and it supported the RBNZ’s position.

“WNZL will also act promptly on any recommendations from the reviews. WNZL has taken a number of steps to improve risk governance but recognises more work is required,” it said.

The RBNZ said it would work with Westpac NZ to implement the findings.

“It is important to note that the Reserve Bank is confident that Westpac NZ’s current liquidity and funding positions are sound,” it said.

Westpac had noncompliance issues in New Zealand in 2016 and was ordered to conduct reviews under Section 95. Those breaches related to the bank using unapproved capital models and errors in Westpac’s capital modelling, including how it classified some exposures.

ANZ also ran into trouble across the Tasman regarding capital, and was told in 2019 to provide the RBNZ with two independent reports linked to Section 95 notices. Deloitte was engaged by ANZ to prepare the independent reports, the first of which was published in December 2019 and sparked a further Section 95 notice.

Wednesday’s RBNZ statement said Westpac NZ was found to be in breach of the requirements of the Reserve Bank’s Liquidity Policy (BS13), which includes compliance with so-called minimum mismatch ratios. The ratio is a measure of a bank’s liquid assets, adjusted for expected cash inflows and outflows to mitigate risk during a period of stress.

The RBNZ said Westpac was not reporting the ratios correctly, with noncompliance from 2012 to 2020.

“The calculations have since been corrected and Westpac NZ has progressed a program of remediation,” it said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout