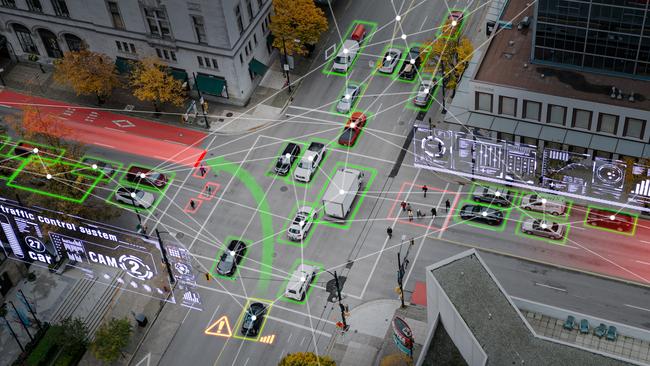

For business and the economy, AI is one obvious solution to Australia’s sagging productivity rates, although with any new and untested technology it does present a raft of unknown risks.

AI is being taken seriously inside boardrooms given the likely boost to efficiency. The technology has already shown the potential to disrupt nearly every industry. But, it also promises serious consumer harm if not managed correctly.

Industry Minister Ed Husic outlined an approach which will be grounded in existing legislation rather than new rules for AI alone. It follows the release of the government’s interim response to six months of consultation into AI overseen by Husic’s department of Industry and Science.

Rather than legislate the risks of AI away in its early phase, the intention is to develop rules surrounding the design and development of AI based on risk.

Higher-risk AI settings are likely to include applications such as autonomous driving, defence, financial advice, healthcare or recruitment. In theory at least this will mean low-risk innovation of AI and the uptake of tools for things which speed-up business processes, improve customer experience or analytics can continue unimpeded.

As one bank CEO tells The Australian: “We have lots of data and lots of processes — that makes what we do a perfect match for AI”.

Husic describes planned rules as “mandatory guardrails” which could apply to the testing of the products as they’re being designed and developed. It leans more to the Canadian and European Union approach, rather than the voluntary US regime.

The rules, when developed, will also outline expectations around transparency on how the models have been designed, what models are intended to do as well as expectations around performance.

The bulk of the guardrails will involve updating existing laws, from financial services to healthcare, while strengthening privacy and copyright laws.

New laws are being considered around disinformation linked to AI, while there is consideration whether existing competition and consumer laws around deceptive conduct are broad enough to protect against harm from AI deepfakes.

Importantly, the approach by Husic is technology-neutral, but acknowledges there are both risks in the rapid rise of AI as well as massive untapped economic benefits to come — estimates sit at a $600bn benefit to the Australian economy by the end of the decade, although this is a number almost impossible to calculate.

The risks of a heavy regulatory response to AI would see Australia miss out on the economic benefits of the technology while stand-alone legislation risked being too rigid or inflexible. New AI specific laws would quickly become out of date and keep Australian business behind where the world was moving.

Gilbert + Tobin partner Simon Burns, who specialises in technology law and IP, points out many of the harms or risks experienced with AI today are the result of the lag between the incredible speed of AI evolution and the much slower development of organisational skills, understanding and capability surrounding AI. “In other words, good intentioned organisations getting it wrong,” he says.

A principle-based regulatory response would help businesses stay on the right side of the benefits of AI, Burns says.

Commonwealth Bank — one of the biggest users of AI in Australia — had argued for a risk-based approach to AI to enable companies and regulators to keep up with the pace of innovation.

During the consultation, Telstra had pushed for a risk-based approach, adding any rules should be developed with an eye to pinning liability and accountability for automated decision-making. Rules should also be supported by a range of other safeguards including industry standards, guidelines and principles that encourage industry to manage their own risks and set standards.

This would minimise harm while not stifling investment or innovation, Telstra says.

Wall Street view

Two of Wall Street’s most powerful names have called out a better year for mergers and deal making on improving economic conditions, including early interest rate cuts in the US.

The comments by Goldman Sachs boss David Solomon and Morgan Stanley’s new boss Ted Pick draw a line under what has been a tough year for bankers, with a dearth of deals and stock market listings. Although, Australia was one of the first markets to stir back to life in the December quarter with a flurry of deal.

Goldman’s Solomon, who heads up the leading M&A advisory franchise in the US, says the past year wasn’t an “A environment” for Goldman’s core investment banking business. “In fact, I don’t even think it was a B environment,” adding that it was clear activity levels around the world have been “depressed”.

Goldman’s full year profit of $US8.5bn ($13bn) was down 24 per cent on the previous year. Investment banking income was off 16 per cent on the year and down 12 per cent in the December quarter.

However, he called out the potential for US interest rate cuts as early as the first half of this year for renewing optimism of a soft landing and was stirring corporates into action.

“We are already seeing signs of a potential resurgence in strategic activity,” Solomon told investors on Wednesday.

Goldman’s generates two-thirds of its revenue from the US. Last year, it named former treasurer Josh Frydenberg to chair its Australian business, putting on hold his aspirations for a political return for now. Around 11 per cent of revenue comes from Asia, which includes the Australian franchise.

Rapidly rising interest rates around the world has hurt markets and slowed growth. This hammered corporate confidence and put the brakes M&A activity, which hurts lucrative fee income.

‘Preparing the groundwork’

For Solomon, there were signs that Goldman’s big clients were again asking the bank to prepare the groundwork for M&A and potential stock market listings.

More broadly, Australia has led the way in deal making activity over recent months. On numbers compiled by Bell Potter’s Richard Coppleson, there are currently 15 “live” takeovers in play with a combined value of $42bn. Eight of them lobbed in December alone. The split is cash takeovers worth $25.2bn, with scrip based offers at $16.8bn.

The numbers are distorted by Origin Energy, with Brookfield and its partners vowing to revisit the blockbuster $19bn bid that fell short of shareholder support late in November. Others getting takeover offer in recent months include lithium play Allkem, agribusiness Costa, media play Southern Cross, a privatisation of Pact Group, Link Group and funds house Perpetual.

Solomon cautioned there were risks to the improved outlook. “There’s a lot going on in the world. And so I think one of our jobs is to always be a risk manager and worry 98 per cent of the time about the 2 per cent of things that can go wrong”.

Across town, new Morgan Stanley CEO Ted Pick delivered his first set of annual accounts following last year’s retirement of long-serving boss, the Melbourne raised James Gorman.

Pick noted when Gorman took charge shortly after the global financial crisis, Morgan Stanley was a “classic self-help story”. But by through a series of strategic acquisitions, a reduction of risk and a major push into wealth management, the bank now generates a higher rate of profits that are far more stable.

Pick believes that corporate finance and refinancing will drive the next cycle of investment banking growth, and this was an area that Morgan Stanley wants to double down on globally.

Morgan delivered full year profit of $US9.1bn, down from $US11bn a year earlier. Investment banking revenue rose 5 per cent in the fourth quarter from a year ago.

Pick says he too is entering 2024 with confidence. “Our base case for the coming year is constructive”. However, he called out two major downside risks. The first is geopolitical, that global conflicts in the Middle East and Ukraine intensify. The second is the state of the US economy over the course of 2024.

“The base case is benign, namely that of a soft landing. But if the economy weakens dramatically in the quarters to come and the Fed has to move rapidly to avoid a hard landing, that would likely result in lower asset prices and activity levels,” Morgan’s Pick told investors on a separate call.

He also warned if inflation has not been brought under control and continues to challenge consumers and businesses, that could result in a higher for longer interest rate outlook.

Even so, the backdrop was one of improving boardroom confidence and an increasingly positive tone from retail and institutional clients. This was translating to a better M&A and IPO pipeline.

johnstone@theaustralian.com.au

Business got a rare regulatory win with the Albanese government signalling its intention to approach new artificial intelligence tools with a lighter touch, using a risk-based approach and existing laws, rather than cut off the potential of the technology just as it is getting off the ground for commercial use.