No proper processes at Cbus for CFMEU payments

The $94bn construction industry superannuation fund didn’t have proper processes to ensure that its ‘partnership’ payments to the CFMEU were in the best financial interest of members, according to Deloitte.

The $94bn construction industry superannuation fund Cbus did not have proper processes to ensure that its “partnership” payments to construction industry union CFMEU were in the best financial interest of members, an independent review by accounting firm Deloitte has found.

The 91-page report, which was commissioned as a result of a request by the Australia Prudential Regulation Authority in August following media reports about the union, criticised Cbus for a “lack of consistency, appropriate process, appropriate governance and necessary rigour” in how the decisions were made for payments to the union.

The review assessed nine payments to the CFMEU totalling $912,500, including amounts for rent, utilities and a renewable energy research project.

These included $120,000 paid to the NSW division of the union of as part of a partnership agreement for the 2023-24 financial year, and $235,000 to the Victorian and Tasmanian branch of the union for the 2024-24 financial year.

The review says that Cbus’s processes with regard to the payments to the union were “lacking for the determination as to whether decisions (on spending) have been made in the best financial interest of members in mind”.

Superannuation funds are required by law to ensure that their spending is done with the best financial interests of members in mind.

The report said that there were shortcomings in Cbus’s processes for overseeing payments to the CFMEU for a range of services, which meant that Deloitte could not assess whether its spending was being done with the best financial interests of members in mind.

“We were unable to conclude whether the expenditure decisions were made for the sound and prudent management of the trustee’s business operations or if they achieved the intended purpose and stated benefit,” the Deloitte report said.

The report has made a series of recommendations that the fund tighten up the “design and operation” of its spending to ensure that it complied with the requirement that spending be in the best financial interests of members.

A Cbus spokesman said the fund would be accepting in principle all 26 recommendations in the report.

“Cbus will now work with Deloitte, as required by the licence conditions, to develop an action plan to address each of the recommendations in the review to be approved by APRA,” the spokesman said.

The independent review has concluded that all current and nominated directors on the Cbus board met the “fit and proper” test at the date of the report.

“Cbus acknowledges the seriousness and importance of the work required to strengthen the fund’s systems design, frameworks, policies, processes, governance and reporting as identified in the independent review to become a better, stronger fund for our members,” it said in a statement.

It said the fund had already begun the work to develop improvements in the way “the fund documents the value that industry partnership arrangements generate for the fund and our members”.

The review into the board governance and spending arrangements of the $94bn construction industry super fund was ordered by the Australian Prudential Regulation Authority in August as a license condition on Cbus trustee United Super.

APRA called for the review after media allegations about misconduct within the Construction, Forestry and Maritime Employees Union.

APRA said the review was needed to address “prudential concerns regarding Cbus’ assessment of the fitness and propriety of its responsible persons and fund expenditure management.”

Superannuation funds are required by law to make sure that any spending is done in accordance with their duty to act in the best financial interests of their members.

APRA said the review was needed to “provide transparency and reassurance” to the fund’s 923,000 members about the allegations, which it said had raised “matters of significant public interest”.

Cbus announced in November that it had appointed three directors to the board after an interim report by Deloitte found that the three had passed the “fit and proper test” needed for super fund trustees.

They were the CFMEU national president Paddy Crumlin, CFMEU legal and industrial program director Lucy Weber, and Jason O’Mara.

Mr O’Mara was renominated to the board after resigning in August.

APRA followed the announcement with a statement that it was “not yet satisfied that the processes required to be undertaken by Cbus” were complete.

It said it expected Cbus to consider the independent review report and “in the light of the report will consider whether further action is appropriate.”

Cbus has also been under pressure for its handling of insurance claims, and is facing legal action by corporate regulator ASIC.

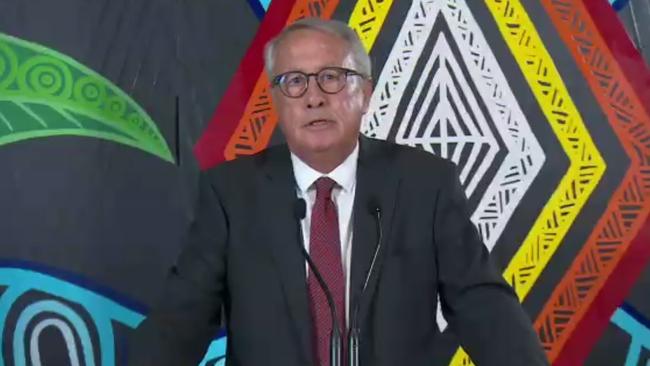

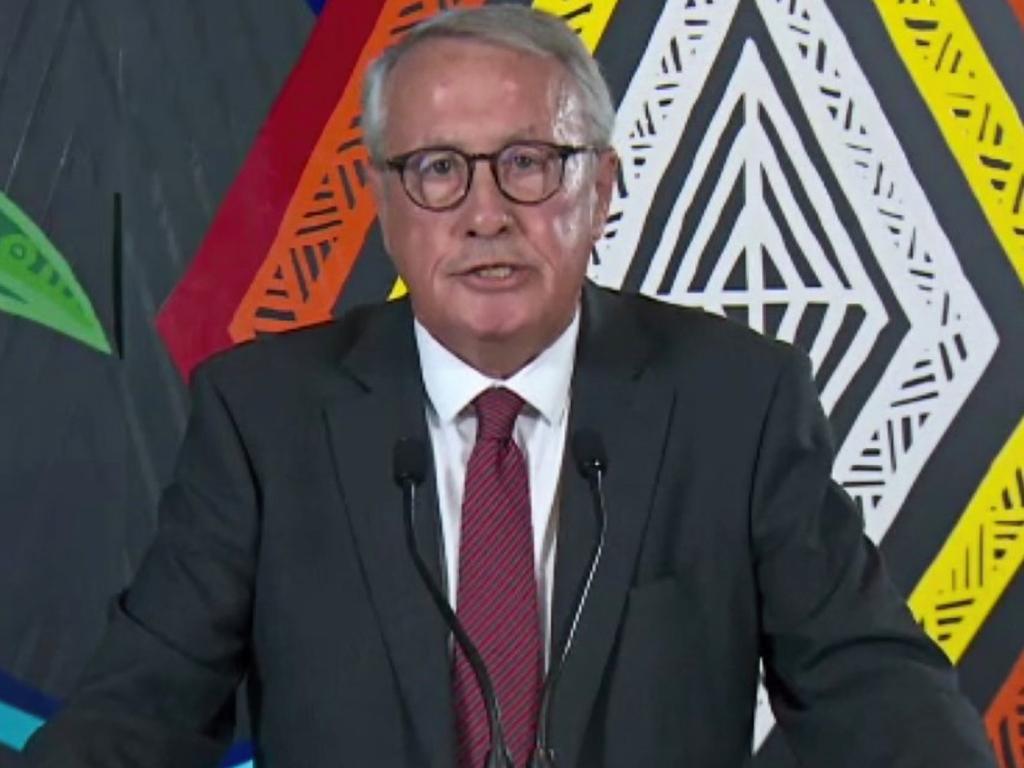

Cbus chair Wayne Swan, who is also federal president of the Labor Party, defended the fund’s governance arrangements when he appeared before the Senate economics reference committee on Friday.

Cbus chief executive Kristian Fok has said the fund supports the review, which would build on work that the fund already had begun.

He said the fund would continue “to work constructively” with the regulator and would fully co-operate with the independent reviewer.

“We note the allegations of criminal activity in the building and construction sector, and we condemn such activity,” Mr Fok said.

“We support efforts by governments, regulators, and union organisations to eradicate such criminal behaviour.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout