Nippon Life aims to be to be our largest life insurance operator

Japan’s Nippon Life plans to become Australia’s largest life insurance operator.

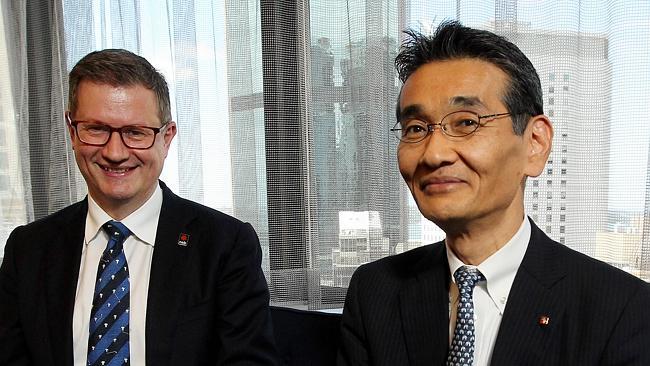

Japan’s Nippon Life plans to become Australia’s largest life insurance operator after its $2.4 billion deal to buy 80 per cent of National Australia Bank’s MLC life insurance business, the managing director of its international business, Hiroyuki Nishi, said yesterday.

Mr Nishi told The Australian that Nippon, Japan’s largest life insurance company with $700bn in assets, would spend more than $50 million to upgrade the information technology and management systems of MLC.

“We see Australia as a country of great potential and enormous opportunity,” he said. “We aim to be No 1 in Australia sooner or later. I have a very competitive spirit. We plan to invest for the long term and provide some attractive products.”

Coming alongside the $300m capital expenditure announced by NAB yesterday to upgrade the systems in MLC’s superannuation and investment business, the deal will see MLC step up its role in the Australian wealth management market.

The deal puts the Tokyo-based life office in direct competition with its smaller rival Dai-ichi Life, which bought Tower Australia in 2010 for $1.2bn.

Now known as TAL, the Australian company is one of the largest life insurance companies in the local market.

Under yesterday’s deal, Nippon Life will retain the MLC brand for at least 10 years and remain in a long-term distribution partnership with NAB for at least 20 years as it moves to step up its share of the wealth market. MLC has about 12 per cent of the Australian life insurance market, compared with TAL’s 15 per cent.

Andrew Hagger, the chief executive of NAB Wealth and MLC chief executive, said the combination of the deal with Nippon Life and MLC’s proposed capital investment would mean the group was now “on the front foot in the market place”.

He said the sale of 80 per cent of the MLC life business followed tighter capital requirements on all banks.

“Given the current capital regulations it is very important to run the business in a capital wise way,” Mr Hagger said.

“But we want to grow our business as we know our customers want these products.

“To set ourselves up for growth, we will be partnering in our life insurance business and investing in our superannuation business. We are seeing a strongly reinvigorated MLC today with stronger market positions.

“This growth agenda means we will be on the front foot in the market place in the coming years, which will be really good for our customers, good for shareholders and good for the capital management of the bank.”

The Nippon Life deal came after Japan Post paid $6.8bn earlier this year to buy the Toll Holdings logistics group.

Mr Nishi said Nippon Life was planning to expand its international business given the slow growth in the Japanese market and the country’s falling population.

He said the company had had informal relations with MLC dating back to the 1990s but had only been studying a possible entry into the Australian market in the past few years.

“We have been researching the Australian market for three years,” Mr Nishi said.

“We have found the macroeconomic growth has been around 3 per cent for the past 10 years and the population is increasing — not like Japan.

“Australia is an advanced country with an increasing population. On top of that the superannuation market is very attractive and can help drive the insurance business in the future.”

Mr Nishi said Nippon Life was watching for possible changes in federal government policy that could make products, such as annuities, more attractive here.

He said there was significant potential to expand the penetration of life insurance in Australia. Only 3.5 per cent of the Australian population has life insurance compared with almost 9 per cent in Japan.

Mr Nishi said Nippon Life planned to take a long-term approach to developing the Australian market.

The company has already expanded into India, Thailand, Indonesia, mainland China and the US, although its offshore premiums only represent 3 per cent of its total business to date.

Nippon Life has 50,000 salaried sales representatives in Japan, of which 95 per cent are women. But the company will retain NAB’s distribution system through financial advisers.