Netwealth confident of filling financial advice void

The Hayne royal commission has created an empty space in wealth management — a void Netwealth intends to fill.

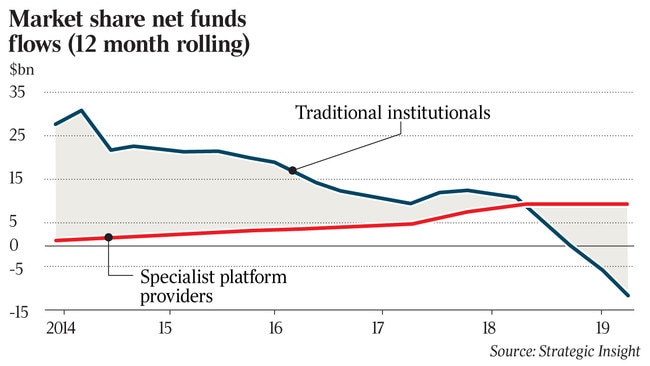

Superannuation and wealth management firm Netwealth is forecasting a big lift in money flowing its way from rich clients and financial advisers leaving the big four banks in the wake of the banking royal commission.

Headed by billionaire Michael Heine and his son Matt, Netwealth yesterday announced a $36 million net profit for the 2019 financial year, as the firm grew funds under advice by 29.9 per cent to a record $23.3 billion.

Mr Heine said Netwealth expected funds under advice to top $30bn by the end of June 2020 as banks and institutions exit the wealth advice market and his firm wins more mandates from wealthy individuals and families.

He told analysts moves by banks such as Westpac, which announced in March it was quitting its loss-making financial advice business and stopping the licencing of advisers, presented an opportunity for Netwealth to pursue new funds. He said the company would invest more in its technology systems to handle its forecast increase in clients.

“The movement from Westpac and others has generated plenty of new business inquiries in recent months. (There are) a lot more people we can talk to who we have previously been unable to. We see some great opportunities and now is the time to invest to take advantage of that,” he said.

“We have got a lot of business which we have already won, and a lot of inquiry out there that we are confident we can win.

“This is going to be driven by existing advisers, a strong pipeline of business we have won and the opportunities we are currently working on.”

Netwealth’s direct funds under management for 2019 was up 38.7 per cent to $3.9bn and total revenue hit $98.8m, compared with $83m a year earlier.

The company declared a final dividend of 6.6c a share, payable on September 26. Its shares rose 3.6 per cent yesterday to finish at $7.20.

Netwealth is not aligned with banks or other financial services groups, something that has helped it grow its business as the banking royal commission has kept competitors in the headlines for negative reasons.

Mr Heine said the business was “focused on expanding our whole of wealth solution to the affluent and high-net-wealth clients”, but warned profit margins may tighten as a result of the investments in technology and staff Netwealth planned to make as the business expanded.

A member of The List — Australia’s Richest 250with an estimated fortune of $1.3bn, Mr Heine said he had no plans to sell down any of his family’s shareholdings, despite some stock coming out of escrow following Netwealth’s November 2017 ASX float: “We have not sold down any shares and we committed to the long term.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout