NAB vote puts all banks to the test: AustralianSuper’s Ian Silk

AustralianSuper has blamed the stunning vote against NAB’s remuneration report on the lack of any performance testing.

The nation’s biggest superannuation fund has blamed the stunning vote against National Australia Bank’s remuneration report on the lack of any performance testing for long-term incentives in the bank’s new pay framework.

After Wednesday’s thumping 88.4 per cent “no’ vote against the report — a record for a blue-chip company — AustralianSuper chief executive Ian Silk targeted combined short-term and long-term incentive schemes like the one adopted by NAB last September.

Mr Silk, who oversees the $140 billion fund, said similar structures had a poor record of support from investors.

“It sends a clear message to all boards that such schemes, where they lose any long-term performance testing, are not acceptable to most shareholders,” he said.

All three of the major banks with September balance dates — NAB, ANZ Bank and Westpac — earned first strikes on their remuneration reports.

If they earn a second strike next year, with “no” votes in excess of the 25 per cent threshold, shareholders can vote to spill the board.

NAB streeted the other banks, with last week’s vote against the Westpac remuneration report at 64 per cent and ANZ at 34 per cent.

The three chairmen promised to come back next year with remuneration schemes that would achieve a better balance between shareholders and customers.

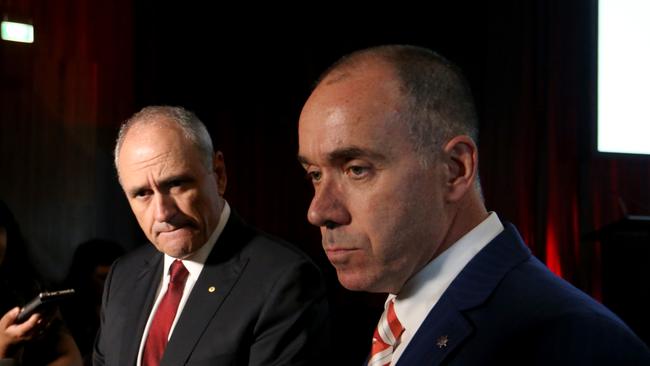

NAB chairman Ken Henry, who spruiked the bank’s new framework in September, told the media after the annual meeting in Melbourne that the board would consider changes capable of delivering a zero-bonus outcome for executives.

“This is one of the things we have to look at, there’s no doubt about it,” Dr Henry said.

“Is it possible to have a single variable reward remuneration scheme that nevertheless delivers zero-bonus outcomes?

“That is a big challenge for us — so that is one of the things that we will look at, absolutely.”

ANZ chairman David Gonski declined yesterday to add to his commentary at the bank’s annual meeting in Perth, where he said the board would continue to work hard in 2019 to “ensure further alignment between compensation and shareholder interests”.

Dean Paatsch, the principal of proxy advisory firm Ownership Matters, which recommended “no” votes against all three remuneration reports, said the major-bank boards should reflect on “how badly they had misjudged the mood of the room”.

“If they’re getting this so wrong, it makes you wonder what else they’re getting wrong,” he said.

“It’s having an effect on the value of their franchises, and the best example of that is the wholesale defection of customers from retail funds to the not-for-profit funds.

“Next year they have to exercise the kind of sound judgment that was sadly lacking this year.”

Dr Henry said on Wednesday the board remained determined to have a pay framework that met the expectations of all shareholders.

NAB decided to change its old framework because it didn’t put enough emphasis on the management of non-financial risks and conduct matters.

“And, there was a risk that our so-called long-term incentive scheme might even be encouraging short-term thinking and value-destroying behaviours,” Dr Henry said.

NAB chief executive Andrew Thorburn said he would be willing to work under a no-bonus system.

“At the end of the day, a bonus is a decision that a board makes after taking into account my overall contribution,” he said.

“I make my case, I step out, the board makes a balanced call.

“I think they are wise and objective people.”