NAB chief Phil Chronican: Our financial controls broke down

Phil Chronican admits the bank needed a ‘much tighter’ approach to risk and internal audit.

National Australia Bank acting chief executive Phil Chronican admits the bank needed a “much tighter” approach to risk and internal audit, saying he was unhappy its lines of defence had failed to pick up an alleged multi-million-dollar fraud within the chief executive’s office.

During intense questioning by a parliamentary economics committee on Wednesday over how the alleged fraud went undetected for many years, Mr Chronican was candid in his admission that controls had fallen down.

“It was a breakdown in the financial controls,” he said of the incident which was reported to police in 2017 and this month led to charges against Rosemary Rogers, the former NAB chief of staff to prior chief executives Andrew Thorburn and Cameron Clyne.

“That should have been picked up … I was distinctly unhappy that the issue had arisen at all,” said Mr Chronican, who served as a non-executive director until the exit of Mr Thorburn late last month, and was chair of the risk committee when a whistleblower brought the matter of excessive spending to the attention of the board.

Human Group director Helen Rosamond, who was providing NAB with training and executive services, was also charged by police, in the $40m fraud case. It is alleged Ms Rogers received bribes of more than $5.4m to maintain the contract and approve overstated invoices.

Mr Chronican also fielded a question in Canberra about his time at ANZ Bank as head of its Australian operations, when he would have presided over some of the issues that were aired at the Hayne royal commission.

“I believed at the time I dealt with those issues,” he said.

Yesterday NAB outlined that it had set aside a total of $800m over the past five years for customer remediation and related costs, some of which are provisions for future payments.

Mr Chronican branded the royal commission a “wake-up call” for NAB, and said he was adding 150 people to the ranks of those overseeing repayments to aggrieved customers.

NAB’s paid remediation tally since June is $110m.

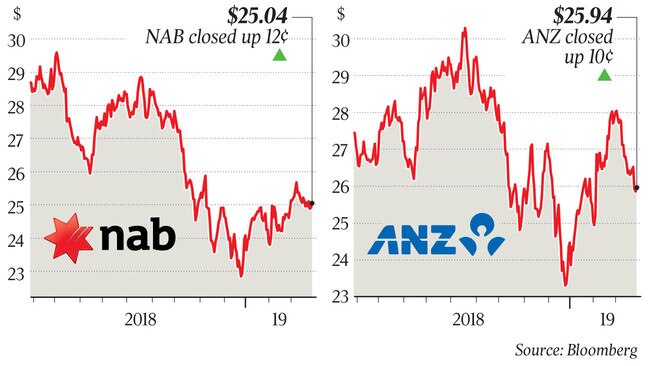

Mr Chronican and his ANZ counterpart Shayne Elliott were separately grilled yesterday by federal politicians about how they were responding to the damning findings of the royal commission, which uncovered ripoffs and other scandals perpetrated by the banks.

Commonwealth Bank boss Matt Comyn and Westpac chief executive Brian Hartzer were questioned by the same parliamentary economics committee earlier this month.

While acknowledging a swift response was needed to the royal commission, Mr Chronican said the bank had to implement sustainable measures.

“We often put in temporary solutions that unravel over time,” he added. “We end up paying twice as much to put the customer back to where they would have been.”

NAB has taken several steps already in response to it facing the biggest fallout from the royal commission, including the loss of Mr Thorburn and later this year chairman Ken Henry.

They include ending its controversial loan introducer program and pledging to act as a model litigant in court action.

ANZ’s Mr Elliott used his parliamentary responses to argue that regulators should prioritise a “fully-functioning financial system” ahead of putting bankers in jail.

Still, Mr Elliott said people should pay the consequences for breaking the law. He told parliamentarians the royal commission had been a “profoundly humbling experience” that had been completely justified by the changes under way across the sector.

When asked about any unintended consequences from putting bankers in jail, Mr Elliott said: “I would have thought the right outcome here is not how many people are in jail but do we have a fully functioning financial system that is responsible and generating good outcomes for our customers.”

Mr Elliott also said that structural issues and internal processes should cop the brunt of the blame for misconduct across the banking sector, and not “a few people with bad intentions”. Deputy ANZ chief Alexis George confirmed ANZ had 650 outstanding complaints with the Australian Financial Complaints Authority.

Over at NAB, it has 559 outstanding matters after receiving a flood of more than 1100 new complaints after AFCA came into force last year.

Another issue occupying the minds of policymakers and bankers is a slowdown in credit growth and whether the post royal commission environment is encouraging too much risk aversion.

ANZ’s Mr Elliott reaffirmed that the bank is “ready to lend”, but conceded that some people might find it harder to borrow because of tough lending standards based in the law. The challenge, he said, was to find the right balance of prudence and availability within the regulatory framework.

“After a period of perhaps being too cautious, ANZ is easing back towards a sensible equilibrium,” he said.

On the topic of lending, Mr Chronican attributed much of the decline to demand and admitted approvals were taking longer due to a more checking and a granular interpretation of responsible lending requirements. “It is slowing down the process,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout