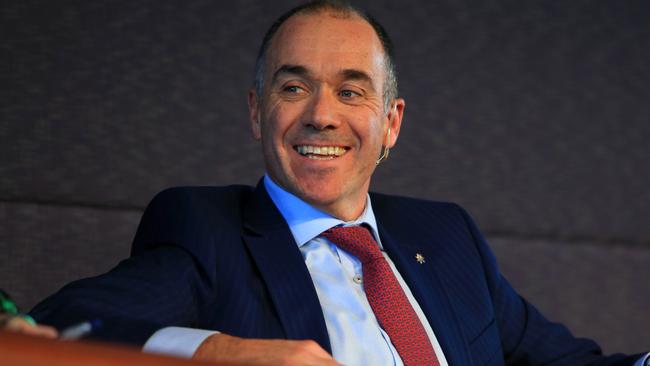

NAB chief Andrew Thorburn to take extended leave

NAB chief Andrew Thorburn has surprised investors and stoked debate over his tenure by opting for extended leave.

National Australia Bank chief executive Andrew Thorburn has surprised investors and stoked debate over his tenure by opting for extended leave as the bank reels from scandals and the sector awaits and responds to the Hayne royal commission’s final report.

Mr Thorburn told his group executives and senior managers on Friday that he was taking most of January as leave and then another month off after returning for several days to help formulate the bank’s response to the royal commission, sources told The Australian.

A NAB spokesman later confirmed the decision yesterday and Mr Thorburn told staff on internal social media that he needed time off after the “biggest, most relentless year of my career”.

Royal commissioner Kenneth Hayne is due to hand down his final report and recommendations on how the financial services sector can move to stamp out misconduct by February 1.

That makes Mr Thorburn’s move highly unusual for an executive at the top of one of the nation’s largest companies, and contrasts with the bosses of the three other major banks, who are all understood to be taking two to three weeks off.

“It is remarkable that the CEO of a major bank would be on leave after the final report from the royal commission is published,” Shaw and Partners analyst Brett Le Mesurier said. “Notwithstanding that he has had a tough year, so has every other major bank CEO.”

A fund manager, who is underweight the banking sector and declined to be named, said he was “amazed” by the decision. “This does not happen in this market. CEOs of major banks don’t take extended leave,” he said.

The bank is yet to disclose the terms of Mr Thorburn’s extended leave to investors through a statement to the ASX.

The royal commission’s final report will be a historic blueprint for industry reform that will land during a federal election year. It follows a string of scandals in the sector, including rampant sales cultures, charging fees for no service and fees to dead people.

NAB was embroiled in another scandal that hit the CEO’s office through Mr Thorburn’s former chief of staff earlier this year.

Police raided the home of Mr Thorburn’s former chief of staff Rosemary Rogers earlier in the month in connection with $113 million worth of corporate travel organised for the bank by corporate services company The Human Group. The Australian is not suggesting any wrongdoing on behalf of Ms Rogers or Mr Thorburn, only that police are investigating the matter.

NAB has asked chief financial officer Gary Lennon to act as CEO in Mr Thorburn’s absence.

Mr Thorburn’s words to staff did point to his return after a period of long service leave.

“After that I’ll be taking four weeks of long service leave — a further chance to reflect and recharge, and come back ready for what 2019 brings,” he said.

One source suggested Mr Thorburn discussed taking extended leave with NAB chairman Ken Henry earlier this year, but it is unclear when that was.

Mr Thorburn took the reins as NAB chief in August 2014 after joining the bank in 2005.

Mr Thorburn took the reins as NAB CEO in August 2014 after joining the bank in 2005.

Speculation about his future began in earnest when former NSW premier Mike Baird joined the bank three months after quitting politics in 2017 to become NAB’s chief customer officer. Head of business and private banking Anthony Healy and CTO Patrick Wright have also been talked about as potential successors to Mr Thorburn.

Mr Thorburn told The Australian’s annual CEO survey on the weekend that the company was one year into a three year transformation program that would simplify the bank. “Of course, we are facing significant questions as a sector around reputation and trust — and there’s a clear case for change, which we are committed to,” he said.

It has been a tough year for the CEOs of the major banks, who have all had to front intense questioning during the final round of the royal commission and, prior to that, parliamentary hearings in Canberra.

NAB rules off its first half on March 31.

First though, Mr Thorburn and the NAB board will have to face shareholders this week.

NAB holds its annual meeting in Melbourne tomorrow and investors are expected to deliver a massive strike against the bank’s remuneration report.

That would follow a historic first strike against Westpac’s pay report last week that was the highest vote against a blue-chip company’s remuneration report since the two-strike rule was introduced.

Mr Thorburn would be the second senior Australian banking executive to take extended leave of absence within the last week.

ANZ group executive for Australia Fred Ohlsson announced last week he would to take a career break in order to return to his native Sweden for an unspecified time.

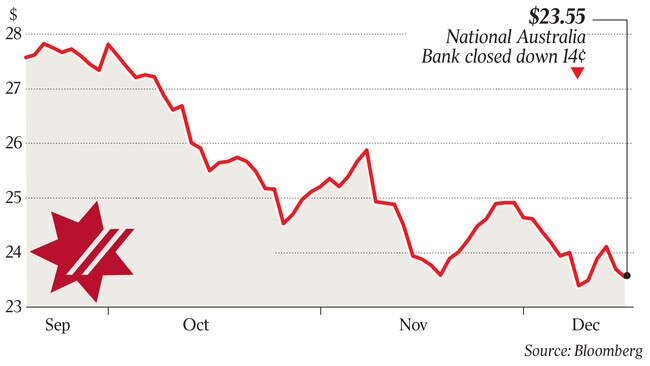

December has already been a taxing month for NAB.

Separately, NAB told the ASX yesterday the impact to the parent entity from proposed higher capital requirements in New Zealand would be “materially lower” than the $NZ4 billion-$NZ5bn ($3.8bn-$4.7bn) increase it expects in tier-one capital across the Tasman.

NAB said it would “collectively engage” with the Reserve Bank of New Zealand and Australian Prudential Regulation Authority on the mooted changes.

Bank of New Zealand is a subsidiary of NAB, and the moves are being closely watched as Australian banks account for 88 per cent of the New Zealand banking system’s assets.

Last week, the Reserve Bank of New Zealand announced substantive capital changes for banks following a consultation period and a five-year phased implementation. The RBNZ suggested capital increases would range from 20 per cent to 60 per cent, although analysts have said Australian banks may shift capital across to their NZ entities.

The proposals may change risk weightings applied to assets and drive a jump in the tier-one capital requirement to 16 per cent.

Credit Suisse analysts yesterday said that while the requirement for more capital in a NZ subsidiary did not necessarily mean more capital at Australian bank group level, changes to risk-weighted assets would flow through to parent entities.

“The largest impost is on NAB given not only the largest additional tier one but a relatively lower starting point group common-equity tier one,” they said. “ANZ and CBA have pro-forma excess capital positions while Westpac is at target but with the lowest estimated increase.”

ANZ last week said the changes implied a potential capital increase of $NZ6bn-$NZ8bn.

An APRA spokesman said the regulator would continue to engage with the RBNZ.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout