NAB calls for micro-economic reforms, not lower rates

NAB chief executive Phil Chronican says the RBA’s rate cuts are having ‘perverse’ effects on the economy.

National Australia Bank acting chief executive Phil Chronican has signalled his opposition to further interest rate cuts, instead calling for concerted action by “all arms of government” to help stoke business investment.

Announcing a 14 per cent slide in 2019 net profit to $4.8bn, mainly due to $1.1bn of further customer remediation charges, Mr Chronican said the Reserve Bank’s program of rate cuts to a record low of 0.75 per cent had had some “perverse” effects on the economy.

“I’m not convinced that rate cuts are effective, and indeed they have a perverse impact,” he said.

“One thing we know is that the overwhelming majority of homeowners don’t actually reduce their repayments; they just let the reduced interest rate eat into their principal.

“So it’s not doing much to stimulate household expenditure, yet on the other side depositors, many of whom are retirees, have lower and lower income and are cutting back on their spending.”

READ MORE: Suitors lining up for MLC | NAB executive bonuses slashed | NAB takes profit hit

While bringing forward tax cuts was welcome, it would have a longer-term effect in stimulating the economy, he said. A more immediate impact would be through a program of micro economic reforms and cutting regulation.

One solution, he said, was a reprise of the approach taken in late 2014, when the Council of Financial Regulators co-ordinated a national policy to slow the rampant growth in house prices without the RBA having to lift rates. Now, facing the challenge of stimulating growth without taking rates into negative territory, the Council of Financial Regulators, which includes the RBA, ASIC, the prudential regulator APRA and Treasury, could co-ordinate a range of regulatory and micro-economic reforms to promote confidence and investment.

Mr Chronican said resolving uncertainty about how banks follow responsible lending rules, particularly for small business credit, would be a good start.

“In the conversations we’ve had with the Treasurer and Treasury we’ve tried to make the point that we want to do our bit to support these businesses and it would be helpful if the government could focus on what it could do itself,” Mr Chronican said.

“The Treasurer shares our concern that we need to find a way of giving business the confidence to go out and help kickstart the next growth cycle.”

Profit in line with consensus

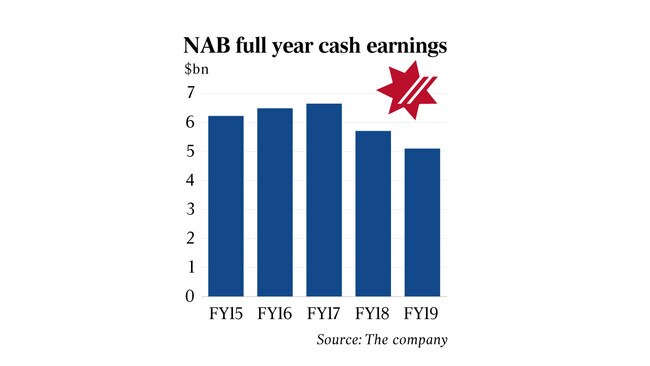

NAB’s cash profit of $5.1bn, down 11 per cent, was in line with the market’s consensus.

Ignoring $1.4bn of notable items, including remediation, cash earnings edged up 0.8 per cent.

Investors responded well to the result, driving the stock up 62c, or 2.2 per cent, to $28.42, as underlying revenue increased by 1.1 per cent.

The result is the last for Mr Chronican, who has been acting chief executive since February after the dramatic exit of former boss Andrew Thorburn, who quit after intense criticism from the Hayne financial services royal commission. New NAB chief executive Ross McEwan — the former boss of Royal Bank of Scotland — begins in the top job on December 2.

NAB’s full-year accounts follow results by Westpac on Monday and ANZ last week, with the trio all warning of a difficult operating climate in their 2020 year. Commonwealth Bank delivers a trading update to investors next week.

NAB’s top-line lifted as a result of growth in business lending, partly offset by a 4 basis-point reduction in the net interest margin excluding volatile treasury and markets income and remediation.

On the downside, housing volume turned negative in the second half, and lending growth to SMEs slowed to 3.5 per cent, year-on-year. While this compared to 5.3 per cent in the first half, the growth rate was still well ahead of NAB’s major-bank peers. Mr Chronican said housing credit growth was likely to remain weak.

The bank maintained the dividend at 83c after the interim payout was lowered from 99c, equating to a 16 per cent reduction from 2018 as NAB shored up its capital base.

Despite this, the common equity tier one ratio finished the year at 10.38 per cent — still shy of APRA’s “unquestionably strong” measure of 10.5 per cent by the beginning of 2020.

NAB announced a partly underwritten dividend reinvestment plan, with a 1.5 per cent discount, to raise about $1.5bn and take the CET1 ratio to 10.75 per cent.

Citi analyst Brendan Sproules said that, in contrast to its peers, NAB had said its costs in 2020 would be “broadly flat”, underpinned by savings from its three-year transformation and reduced investment spending.

A solid result

Mr Sproules said it was a solid result in difficult operating conditions.

Jon Mott from UBS took an alternative position, describing the result as soft, with revenue challenges and asset quality slipping.

Capital remained a concern, with NAB’s low CET1 now “an outlier”.

Asked if the bank could grow its profit in 2020, Mr Chronican was cautious in an environment of record low interest rates and growth challenges in its home-loan portfolio.

“It’s a pretty fine line to be honest,” he said.

“Top line revenue growth will be hard to achieve and therefore profit growth will really be a function of how well we manage our expense base and how well we manage credit costs.

“I wouldn’t want to put a number on it.”

Mr Chronican also signalled further pressure on its interest margin. “Even if (interest) rates were just to stay where they are today, as a number of the structural elements of our balance sheet unwind and get repriced at current rates, that will have further downward pressure on net interest margins,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout