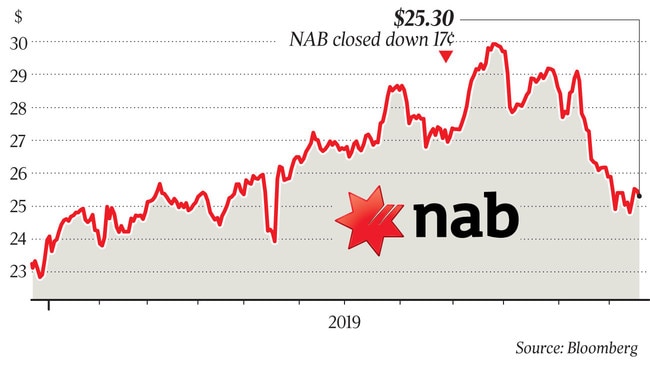

NAB calls for calm over fees scandal

Phil Chronican says the penalty in new action brought against NAB may be less than suggested.

National Australia Bank chairman Phil Chronican believes the penalty in the latest damning legal action brought against it may be “materially less” than documents suggest, as the bank embarks on a three- to five-year plan to fix its battered culture.

NAB was stung on Tuesday with new court action by the corporate regulator alleging several thousand breaches of the law and unconscionable conduct in a longstanding scandal for charging fees where services were not provided.

The court documents point to a maximum penalty in the billions of dollars, but Mr Chronican poured cold water on those amounts at the bank’s annual general meeting yesterday.

“It’s difficult to know where that will land,” he said of the court adjudication.

“Just to give you an example of those 10000 (potential breaches), which relate to about 1300 customers affected, 8706 … relate to just around 450 customers and the total fees involved in those 450 customers is about $1.3m.”

“So while it’s possible to extrapolate and get a very large penalty based on the law, the substance of what’s being alleged is materially less.”

Mr Chronican noted NAB had allocated funds to repay customers for the fee-for-no-service saga, but it was too difficult to reliably estimate a provision for a penalty.

New NAB chief executive Ross McEwan, who started in the role this month, said he had known about the potential action by the Australian Securities and Investments Commission, and was keen to change the bank’s culture and fix its failings.

“We will go on and remediate as these things come up, but we also have to get this bank just doing some of the most basic things well so we don’t get the recurrence of the ASIC activity,” he said.

NAB also has outstanding issues pending with financial crimes regulator Austrac.

The bank did receive some respite, though, at its AGM as the remuneration report garnered investor votes against it of just 3 per cent, well below the 25 per cent threshold required for a second strike.

Work to do

Mr McEwan — the former chief executive of UK bank RBS — said it would take three to five years to implement cultural change at NAB but has drawn a line in the sand with his top team on compliance.

He told them after starting: “If you’ve done your best, you’ve thought about the activity and made a decision, it won’t be me that will come after you.

“But if you’ve gone out and taken money out of a customer’s pocket, by way of bonuses or any other thing and put it in your pocket, yes, you should fear me.”

Mr McEwan also confirmed The Australian’s report that he had tapped consultants at Bain to assist with a NAB-led strategic review which is underway.

“We’ve got lots of work to do, but we’ve also got to think about what will this market look like in the five to 10 year point,” he said, admitting the bank had lost trust and respect.

“We haven’t always done what we said we would and this is unacceptable. I’m under no illusion about the challenges.”

Mr McEwan will provide further detail on his strategy around the middle of next year.

The AGM spanned six hours as shareholders questioned scandals over two decades at the bank, including more recent alleged fraud by the former CEO’s chief of staff and case studies fleshed out at the Hayne royal commission.

Mr Chronican said NAB would have to work hard to reverse 20 years of underperformance.

Many investors are taking a cautious approach to the bank given it has already set aside almost $2.4bn to deal with customer compensation and past regulatory issues.

“Corporate governance (at banks) is terrible, there is a lot of uncertainty,” said David Sokulsky, chief of the Concentrated Leaders Fund. “This is not going to end (NAB regulatory action and remediation), it is going to be ongoing for a number of years … the potential ramifications in terms of the costs are huge.”

The Australian Shareholders’ Association labelled the ASIC action as “a bit of a Pandora’s box” and questioned when the ramifications for investors would end.

NAB reiterated it had outstanding matters with Austrac after the bank identified issues including “certain weaknesses” with the implementation of the Know Your Customer requirements.

Mr Chronican said NAB had “significantly upgraded” its processes and continued to work with Austrac. “I’m not aware of any impending action on their part, but Austrac has sent a very clear message that where there are shortfalls in industry practice they will actively pursue those,” he said.

Westpac was last month hit with explosive legal action by Austrac, alleging it breached the law 23 million times including facilitating payments linked to child exploitation.

Bell Potter analyst TS Lim warned of the magnitude of potential penalties to be imposed on NAB and said coupled with changes to capital requirements in New Zealand the bank’s core capital ratio would “come under some strain”.

On pay, some 97 per cent of shareholders voted in favour of the remuneration report after NAB overhauled pay and scrapped 2019 short-term bonuses for executives. That was in stark contrast to last year when NAB was whacked by a 88.4 per cent vote against remuneration.

ANZ also avoided a second strike against its pay report, while Westpac last week was hit by a second strike despite investors not voting in favour of a motion to spill the board.

Mr McEwan told the AGM he was targeting long-term growth as he focused on five key areas and separating wealth division MLC. The areas include getting the basics right, ensuring a “safe and secure” bank, doing the right thing and simplifying the business.