NAB boss Ross McEwan upbeat on national economy as Victoria recovers

NAB chief Ross McEwan ‘an optimist’ about the nation’s future after a ‘dramatic’ boost in activity and confidence levels.

National Australia Bank chief Ross McEwan has declared himself an optimist about the nation’s future after a “dramatic” boost in activity and confidence levels in previously locked-down Victoria, although he has lent support to the Reserve Bank’s latest round of cash rate cuts given the “highly uncertain” outlook for business.

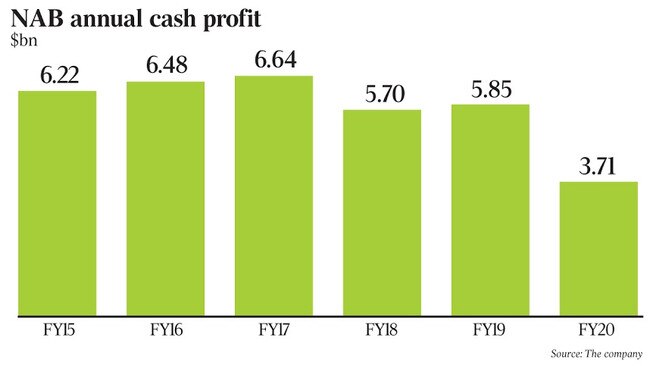

Unveiling a 36.6 per cent slide in 2020 cash earnings to $3.7bn, Mr McEwan said Victoria, which represented about a quarter of the national economy, was “getting going again” following the state’s 112-day lockdown.

Spending in key sectors was up strongly over a five-day period to November 1 compared to the week before. General retail was up 82 per cent, with clothing 1047 per cent higher and furniture up 250 per cent. Other standouts included restaurants (up 62 per cent) and barbers and beauty salons (174 per cent), according to the lending major’s own figures.

While pent-up demand explained part of the spike, overall spending was 1 per cent higher than the same period a year ago, although challenges remained, including the resuscitation of central Melbourne.

“Business activity has picked up dramatically – customers have confidence to borrow, and there was an additional, very positive step [on Wednesday] when NSW and Victoria agreed to reopen the border [from November 23],” Mr McEwan told The Australian.

“I’m optimistic for a business-led recovery with NAB at the centre; we’re seeing hopefully a sustainable rebound.”

In reference to the low number of recurring COVID-19 cases and relatively healthy economy, Mr McEwan said there was “no other place I’d like to live now than Australia or New Zealand”.

Mr McEwan took charge of NAB at the end of last year after a stint overseeing the recovery of UK-lender Royal Bank of Scotland. At NAB, he is planning to steer through a shake-up, including simplifying the business, which was left reeling following the Hayne royal commission.

Mr McEwan’s caution about the longer-term outlook for the economy were in line with Reserve Bank governor Philip Lowe’s announcement on Tuesday of further emergency measures to jump-start growth.

Slashing the cash rate by 15 basis points to 0.1 per cent, Dr Lowe said the near-term outlook was better than three months ago but the recovery was still expected to be bumpy and drawn out. The RBA also outlined a $100bn quantitative-easing bond program and said interest rates were likely to remain at ultra-low levels for years.

Mr McEwan echoed some of Dr Lowe’s sentiments, citing a “highly uncertain” future and uneven recovery across industries.

He said the rapid economic decline had seen a big deterioration in the labour market, with unemployment expected to peak at 8.1 per cent early next year before gradually recovering to 5.9 per cent at the end of 2022.

Credit impairment charges of $2.76bn, up 201 per cent, were a major drag on the NAB result.

Charges in 2020 included $1.86bn of extra forward-looking collective provisions, reflecting the potential impact of COVID-19. This included a $1.47bn top-up to the economic adjustment to protect against lending losses across its portfolio, and $388m specifically for stressed sectors such as aviation, tourism and hospitality, retail and commercial property.

The mortgage market, even so, was undergoing fundamental change as customers sought certainty through fixed-rate loans, with the major banks — apart from ANZ — lowering their four-year product to just under 2 per cent for the first time.

Mr McEwan said the proportion of fixed-rate home loans in the market was likely to surge from its customary level of about 10 per cent to more than 30 per cent.

Like with the other majors, NAB loan deferrals wound down nicely, with $19bn in mortgage and business credit outstanding late last month compared to an initial peak of more than $60bn.

Of the 110,000 home loans originally deferred, 38 per cent had resumed repayments, with a further 54 per cent indicating they would resume once the deferral period expired.

With the remainder, 5 per cent were referred to workout, 2 per cent had their deferral extended and 1 per cent converted to interest-only.

“Given what it looked like six months ago, it’s a great outcome,” Mr McEwan said.

About 76 per cent of customers with deferred business loans said they would resume repayments when their deferred period expired, and a further 18 per cent before expiry.

NAB paid a final dividend of 30c a share, with the 60c annual payment representing a 64 per cent reduction on 2019 and a 49.8 per cent payout ratio on statutory profit.

Credit Suisse analyst Jarrod Martin said the result was in line with expectations at the pre-provision level, and NAB was now the leader of the sector on provision coverage.

The bank, he said, was positioning itself for an absolute reduction in costs, meaning the result was likely to be well-received.

UBS analyst Jon Mott said the profit was “mixed with a number of moving parts”.

However, the bank’s tier one capital ratio of 11.47 per cent was solid, and the net interest margin was flat due to the benefits of home-loan repricing and lower wholesale funding costs, offset by the lower interest rate environment and competitive pressures.

“We think the market is likely to give NAB the benefit of the doubt,” Mr Mott said.

Loan growth in 2021 was expected to be a mixed bag.

Unlike Westpac, which this week warned of a contraction in business lending and solid growth in mortgages, NAB said business lending would expand by 2 per cent.

The bank’s economics team forecast housing credit growth would be less than 0.5 per cent — a prediction that Mr McEwan said was “contentious internally” but was based, among other things, on closed international borders.

Expenses rose 10.7 per cent, or 2 per cent excluding notable items, and were mostly associated with the bank’s updated strategy.

Modest expense growth of up to 2 per cent is expected in 2021, with a subsequent target of absolute cost reductions after that relative to the bank’s $7.7bn cost base. NAB set a double-digit return on equity target, up from 8.3 per cent.

The close of 2020 marked the completion of NAB’s three-year transformation strategy, which lifted investment spending by $1.67bn and focused on reducing complexity.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout