‘Multiple pressures’ building on financial system

Covid-19 is just one of an array of pressure points for the financial system, according to APRA chair Wayne Byres.

The financial system is under sustained pressure not only from the latest lockdown in Melbourne but also from a powerful array of disruptive forces, including near-zero interest rates, an ever-growing threat of cyber attacks and technology-driven seismic shifts.

Australian Prudential Regulation Authority chair Wayne Byres told Senate estimates that the system remained “fundamentally sound and stable”, even as the Victorian Government extended its lockdown for a second week amid growing concern about highly infectious variants of Covid.

The longer lockdown represents a $2 billion hit to the economy, as the state seeks time to get the latest Covid outbreak under control.

Melbourne-based National Australia Bank late Wednesday said was reaching out to its worst-hit Victorian business customers, offering waivers of payment-terminal fees and a shift to interest-only loans to boost liquidity.

Despite the tougher environment, NAB business banking Australia metro executive Michael Saadie said many businesses were facing the fourth lockdown in a better position than earlier rounds.

“A lot of these customers have been through it a lot longer than this time around and they’ve set themselves up much differently,” Mr Saadie said.

“In hospitality a lot of pubs aren’t dealing with a great deal of stock; they’re just ordering things a few days out so if anything happens their wastage isn’t so great.”

NAB’s economics team expects the Victorian lockdown to hit gross state output by one per cent, with the impact likely to flow through to other states due to loss of revenue from border closures.

APRA’s Mr Byres told the committee that technology-driven shifts were fundamentally changing business models and consumer preferences.

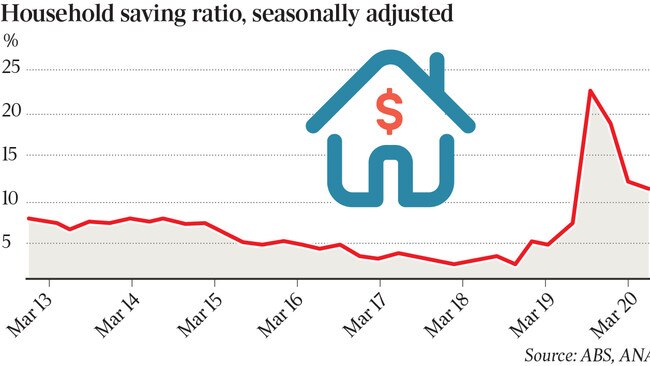

The threat of cyber attacks was escalating, and ultra-low interest rates were leading to asset inflation and a heightened level of monitoring of the booming housing market.

“And all of that is occurring against the ongoing uncertainty and disruption that Covid-19 is creating,” the APRA chief said.

“All of this means that APRA will need to continue to be vigilant, responsive and forward-looking.”

GDP figures for the March quarter defied the sombre outlook, as the economy bounced back from the Covid-induced recession to report growth of 1.8 per cent – higher than economists’ expectation of 1.6 per cent.

The economy is now 0.8 per cent bigger than its previous record, which was attained pre-Covid and before the 2020 bushfires.

Deloitte Access Economics said only five other countries had grown their economies from pre-pandemic peaks.

Reserve Bank of Australia deputy governor Guy Debelle, also appearing at Senate estimates late Wednesday, said the central banks own forecasts for the path to an economic recovery presumed there might be “further short, sharp lockdowns like we’ve seen in a number of states over the last while”.

“The Victorian one is a bit longer than that,” Dr Debelle said, adding “what we’ve seen with those short, sharp lockdowns is that things came back pretty quick, but admittedly these cases were only three days or so”.

Amid widespread concern in the business community about the slow rollout of the vaccination program, and its importance to open state and international borders, one of the nation’s biggest employers, Wesfarmers, said it would offer workers paid leave to get vaccinated.

Wesfarmers chief executive Rob Scott, who oversees retail chains Bunnings and K-mart, said permanent full-time and part-time staff would be eligible for three hours of paid leave per vaccination.

If casuals were only able to schedule a vaccination time when they were rostered for work, their shifts could be changed.

Mr Byres, meanwhile, again played down the need for measures to curb the continuing housing boom, despite figures on Tuesday showing national house prices had jumped by 2.2 per cent in May.

Average house prices in Sydney have spiked 14.3 per cent in just four months – the fastest increase since 1988.

The prudential regulator has repeatedly said it has no mandate to control house prices or enhance affordability, but will intervene if there’s a structural deterioration in bank lending policies.

The APRA boss acknowledged that three categories of higher-risk lending – interest-only, loan-to-valuation ratios in excess of 95 per cent, and debt-to-income ratios of more than six times – had ticked up in recent months.

However, they had come off a relatively low base. “We are watching it very closely,” Mr Byres said.

The last time APRA had intervened 4 to 5 years ago, he said, interest-only loans accounted for about 40 per cent of total lending; a figure which had since halved.

Higher loan to value ratios were the result of activity in the first homebuyer market, and it was likely that investors would start “coming back to the market”.

Mr Byres said there was no threshold for APRA to impose speed limits on loan growth.

“I’ve always resisted a simple rule because it sets you up for bad decisions,” he said.

The factors actively monitored by the regulator included the terms of credit, underlying bank balance sheets which were much stronger than they were five years ago, and who was actually borrowing – first home buyers or investors.

On superannuation, Mr Byres said the pressure on the industry to lift its game was working, with fund mergers and product closures now more commonplace.

Fees were also continuing to decline, as greater transparency forced trustees to look harder at them, particularly on a relative basis.

“But there is still more to do,” he said.

“We still have too many funds, too many underperforming funds, and more room for reductions in fees and costs.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout