Banking royal commission threat grows

Scott Morrison will resist a renewed push for a royal commission into the banking sector despite political turmoil.

Scott Morrison will resist a renewed push for a royal commission into the banking sector after the High Court decision to disqualify former deputy prime minister Barnaby Joyce shaved down the government’s wafer-thin parliamentary majority.

In the wake of last week’s ousting of Mr Joyce, a Nationals MP, concern is building among investors that the government may be forced to hold a royal commission into the sector, with Commonwealth Bank regarded as the most vulnerable.

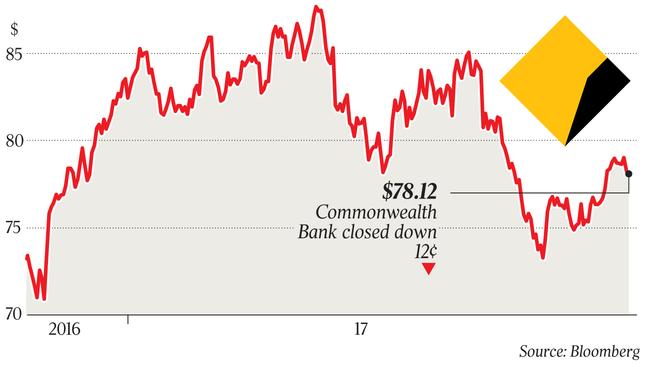

Shares in CBA have fallen 1.1 per cent since Friday, and rivals ANZ, National Australia Bank and Westpac also lost ground despite a rising market.

Queensland independent Bob Katter and Nick Xenophon Team MP Rebekha Sharkie have indicated they may work with Queensland Nationals MP George Christensen to trigger a royal commission into the banks.

Mr Christensen in June backed down from his threat to cross the floor to support a Greens bill for a commission of inquiry into the banking sector, which was co-sponsored by the Senate crossbench and passed the upper house.

The Turnbull government is now fighting fires on several fronts in the wake of the High Court citizenship ruling, as Mr Joyce looks to win back his seat at a December 2 by-election.

The Treasurer yesterday said the government would not bow to pressure and establish a banking royal commission, arguing proponents for a wide-ranging inquiry would have to “explain the disruption” to retail shareholders.

“It’s the Labor Party’s job to create chaos and havoc and mayhem and to convey that. That’s at least what they think their job is,” Mr Morrison told the Ticky program on Sky News Business.

“It’s our job to provide stability, which is what we’re doing.

“The Labor Party will threaten this and that, but they should understand they’re threatening the Australian people.

“They’re threatening to cause chaos in their own political interest, to create instability which hurts ordinary mums and dads — ordinary investors.”

On Friday, the Australian sharemarket plunged about 1 per cent on the news of the High Court decision. While most of the market recovered towards the end of the trading day, banking stocks did not.

Yesterday, Commonwealth Bank was the only stock not to finish in positive territory.

Jason Beddow, chief executive of Australia’s second-largest listed investment company, Argo Investments, said banking stocks had fared pretty well over the preceding two weeks. But he said the threat of a royal commission would persist regardless of the size of the government’s majority in the House of Representatives.

Argo Investments has more than $900 million invested in the four major banks.

“The banks are going to be under a political spotlight for some time,” Mr Beddow said.

“You’re going to have Labor sitting there with the threat of a commission if they get into power.

“I don’t think the High Court decision materially changes anything for the banks. It might just change the timing, if anything,” Mr Beddow added.

Opposition Treasury spokesman Chris Bowen said Labor would continue to work towards a royal commission.

“Federal Labor will continue to pursue every avenue to debate and pressure for a royal commission into the financial services sector,” Mr Bowen said.

“In fact, if Scott Morrison had listened to Labor when we first announced there should be one in early 2016, a royal commission would be in its concluding stages now.”

Opposition Assistant Treasury spokesman Andrew Leigh said the opposition would pursue a royal commission “as strongly as ever” as most Australians believed the sector should be held to account.

Mr Christensen’s colleague, Nationals senator John Williams, a long-time critic of the financial services industry who voted for the Greens’ commission of inquiry bill, said he had been calling for a royal commission for years longer than the ALP.

“We recommended (a royal commission) after an ASIC inquiry when Labor was in government and they didn’t proceed with it. It’s a pity we didn’t have this royal commission about six years ago; we might have cleaned out a lot of this mess that is now showing up,” Senator Williams said.

Speaking at a Financial Services Council function earlier yesterday, Mr Morrison defended harsh measures the government had already taken, including the executive accountability regime that gives the regulator the power to withhold bonuses and sack badly behaving bankers.

Mr Morrison also singled out the new financial complaints authority and the government’s $6.2 billion major bank levy.

“Australians are fair-minded and practical. They know that businesses need to make a dollar,” Mr Morrison said. “But profit should not come at the expense of the Australian people or the integrity of the financial system.”

He said the accountability regime was “legislation with teeth” and was “necessary to restore the public’s faith in the leadership of our banks and the way they go about their business”.

Mr Morrison said chairmen of the big four banks had been consulted on the legislation.

“We will not measure success in enforcement actions alone — the ultimate goal is to end inappropriate behaviour,” he said. “The onus is on the banks to ensure the regime drives improvements in culture and behaviour.”