Monday morning shock for new bank boss Matt Comyn

Matt Comyn only found out yesterday morning he was to be the new chief executive of Commonwealth Bank.

Matt Comyn only found out yesterday morning he was to be the new chief executive of the $140 billion Commonwealth Bank.

Comyn, who was only 36 when he was handed responsibility in 2012 for CBA’s largest division, retail banking services (RBS), will become CEO in April aged 42 — two years younger than a youthful Ian Narev when he took over from predecessor Ralph Norris.

Comyn is widely regarded as a talented executive.

“If you’re looking for shock and awe, you won’t find it with Matt,” one source said yesterday.

“But he’s highly numerate, a solid performer and generally well-liked.”

In hindsight, Comyn has been given every opportunity to stake his claim for the top job at the nation’s biggest company.

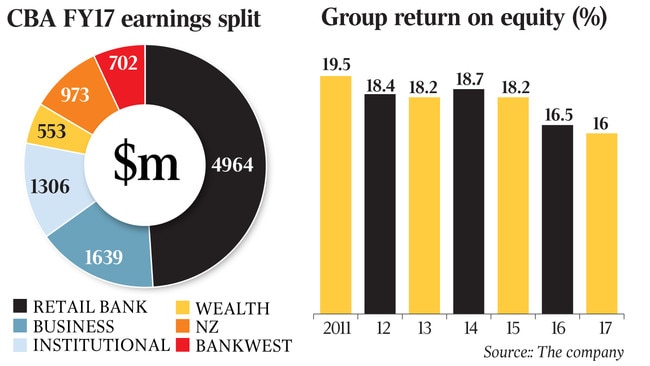

Retail is the bank’s dominant division, boasting the industry’s biggest home lending book, 14,000 employees, and almost one in two Australians as customers through a home loan, credit card or deposit account. Last year it was one of the standout performers, lifting profit by 9 per cent to $4.96 billion.

The retail business accounts for half the group’s profit and leads the development of CBA’s digital products and services.

“I think it is very important that we remain at the forefront in technology and innovation as we have for more than a decade, and I will be absolutely committed to leading the team to make sure that remains the case,” Comyn said yesterday.

Comyn’s opportunity to run the retail division came as a result of the usual fallout from a CEO appointment.

Ross McEwan, who finished second to Narev in a 2011 internal succession race, was lured from his position as retail banking head to become chief executive of the Royal Bank of Scotland in Britain.

Then in charge of local business banking, Comyn was handed the job by Narev, setting him up as a leader among equals in the CBA management board.

In 2010, after running CBA’s biggest digital business CommSec from 2006, Comyn briefly jumped ship to head up the Wall Street-backed stockbroker Morgan Stanley Smith Barney.

The diversion was short-lived, with Comyn returning to CBA after seven months.

Comyn has become a well-rounded executive who is no stranger to a crisis. Well before Austrac, Norris tasked him to lead CBA’s response to the Storm Financial debacle and identify where bank failures had occurred.

Austrac is unlikely to be his last crisis, as the industry prepares for a year’s intensive scrutiny from the Hayne royal commission and other regulatory challenges.

Narev strongly endorsed Comyn’s elevation yesterday, saying he had observed him closely for a decade. “He is going to be an exceptional chief executive,” Narev said. “He has the values, the skills, the experience and the caring to strike the balance ... to maintain very strong operating momentum, to do the hard work that needs to be done to build a better bank, and to regain trust and prepare Commonwealth Bank for a very different competitive future.

“As a customer and a shareholder of the Commonwealth Bank, I could not be more confident about the Commonwealth Bank’s future.”

Leaving aside CBA’s well-chronicled scandals, which could yet cost the bank dearly, Comyn has repaid Narev’s faith with strong financial results.

Cash profit for retail banking expanded 9 per cent in 2017 from $4.54 billion to $4.96bn, and has lifted 60 per cent from $2.93bn in 2012.

CBA said yesterday Comyn had transformed traditional retail banking services, growing the number of active digital users to more than six million customers, including four million who log into the CommBank mobile app every day.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout