BNPL customers miss essentials to repay loan, ASIC review finds

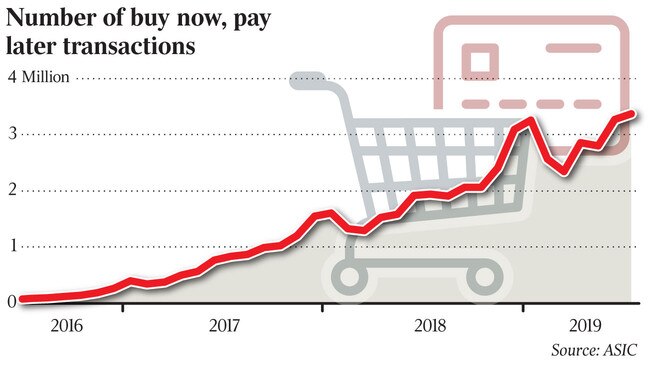

The number of buy now, pay later transactions is skyrocketing, but a significant number of users are copping fees for missed payments, ASIC has found.

A landmark ASIC report on the fast-growing buy now, pay later industry has found that one-in-five users have missed payments, and a similar proportion have cut back on essentials like meals to make their payments on time.

Of the consumers who cut back or went without essentials in the 2019 financial year, the Australian Securities & Investments Commission research found that almost half were between 18-29 years old.

Despite this, ASIC made no recommendations for tighter consumer protections, instead pointing to work on an industry code of conduct, and the introduction of design and distribution obligations from October 2021 to force companies to issue products in line with consumer needs.

The review of the sector comes amid breakneck growth of buy now pay later providers such as Afterpay and Zip Co. Global take-up among young consumers has seen Afterpay emerge as a $30bn company while Zip Co has delivered fast-paced share price growth.

The regulator said its review showed extra costs were borne by some consumers who were having difficulty meeting other financial commitments.

“While most buy now, pay later arrangements are marketed as a budgeting tool or a way to make purchases more affordable, some consumers are missing payments and incurring fees as a result,” the report,” released on Monday, said.

“From our research we also found that some consumers who use buy now, pay later arrangements are experiencing financial hardship, such as cutting back on or going without essentials (for example meals) or taking out additional loans, in order to make their buy now, pay later payments on time.”

In addition, there was a risk of some consumers paying inflated prices for goods and services when using a buy now, pay later arrangement.

Industry behemoth Afterpay signalled its support for ASIC persisting with its light regulatory touch and focus on “consumer outcomes and harms rather than imposing prescriptive compliance obligations”.

Speaking at a UBS Australasia conference, Afterpay’s executive vice president Damian Kassabgi said that ASIC’s own research found that Afterpay has over 70 per cent of the marketshare, but less than 30 per cent of the consumer debt.

“When we are thinking about late payments and consumer outcomes, we don‘t think that the focus is on our particular service, and we checked that,” he said.

“We looked at 144,000 Afterpay users and found that there was no kind of correlation in relation to the use of Afterpay and either an increase or decrease in their spending on essentials. If anything, where we do see potentially problematic behaviour is a fact that we know that credit card debt now and credit cards that involve an interest payment, around 40 per cent of that debt is for essential purchasing in the economy.”

Afterpay also said that key measures of consumer outcomes had continued to improve since the ASIC review period.

As well, the company’s own research of 144,000 customers had shown there was no causal link between spending on Afterpay and changes in spending on essentials.

Peter Gray, co-founder of the industry’s number two player Zip Co, said the sector had held up “extremely well” after undergoing the biggest economic shock in decades, with a flight to online spend and very low levels of customer hardship.

Mr Gray said the review had confirmed there were different business models in the sector, with Zip differentiated from some others which relied on late fees to make the economics work.

Zip also conducted credit and identity checks on all applicants.

This meant that only one in 100 were late each month, compared to one-in-five in the sector missing a payment.

The Zip co-founder said the code of practice would lift industry standards.

“However, while we believe the code is a very good start, Zip will continue to implement its own higher standards, particularly around customer suitability,” he said.

A note by RBC Capital Markets said ASIC had continued to focus on consumer outcomes, following its initial report in November 2018.

“We note that most of the metrics have not deteriorated compared to the initial report,” RBC said.

“We do not see adverse changes for Afterpay and Zip, given the criteria around late payments on the Afterpay platform and credit decisioning processes on the Zip platform.”

In a shortened trading session, Afterpay shares shed 45c to $101.40, and Zip eased 5c to $6.

The buy now, pay later providers reviewed by ASIC included industry giant Afterpay, BrightePay, Humm, Openpay, Payright and Zip Pay.

While the demand for other consumer credit products was showing signs of plateauing, the buy now pay later industry continues to grow rapidly, with the number of transactions increasing from 16.8m in 2017-18 to 32m in the financial year 2018-19, up 90 per cent.

Total missed payment fee revenue for the six providers came to $43m, up 38 per cent compared to the previous financial year.

There were more than 6.1 million open accounts as at June 2019, representing up to 30 per cent of the Australian adult population.

Total revenue across the six providers grew by 50 per cent, from $266m to $398 million, and the industry continued to grow in 2020, with the number of transactions made, number of users and total value of transactions growing by more than 20 per cent in the year to June.

However, in a further example of poor customer outcomes, 15 per cent of consumers surveyed said they had taken out an additional loan to meet their buy now, pay later obligations on time.

Of those consumers, 50 per cent were aged between 18 and 29.

-with David Swan

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout