ME Bank ‘very sorry’ for redraw debacle

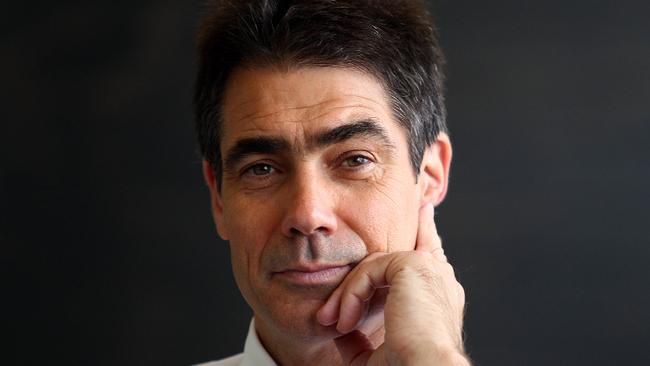

ME Bank CEO Jamie McPhee has apologised profusely to parliament for its home-loan redraw fiasco.

Embattled ME Bank has apologised profusely to parliament for its home-loan redraw fiasco, saying it was right to protect customers from financial stress but fell short by not flagging the changes before they were made.

Appearing before the House economics committee, chief executive Jamie McPhee said the industry fund-owned bank believed that some customers were at risk of falling behind their repayment schedules once the loans were transferred to a new core banking system.

“But we got the timing and communications wrong,” Mr McPhee said. “We should have done better. We are deeply sorry that we upset our customers.”

Mr McPhee had a torrid time before Liberal and Labor members of the committee, conceding that the board, a board sub-committee chaired Christine Christian, the former chief executive of credit check agency Dun & Bradstreet, and management had all been involved in the process.

Pressed by Liberal MP and committee chairman Tim Wilson, he refused to accept there had been a “systemic failure”.

“I’d accept we got the communications wrong, but the intent of what we were trying to do was right,” Mr McPhee said.

ME, which is owned by 26 industry funds including 20.4 per cent holder AustralianSuper, was established in 1994, growing its customer base by 50 per cent over the last five years to 542,000.

Total assets weigh in at $30bn, with 99 per cent related to home loans. The bank, however, has never paid a dividend, choosing to reinvest any surpluses in growth.

Mr McPhee said last December, before COVID-19 struck, ME had seriously considered paying a dividend for the first time because it was generating enough organic capital and had a sufficient level of reserves above regulatory requirements.

Since the breakout of the pandemic, the dividend issue had become “more challenging”.

Asked by Labor MP Andrew Leigh why it had taken at least six years to transition the bank’s customers to the new platform, Mr McPhee said it was a “very intensive process”.

He also said the new platform operated differently to the legacy system, so there was less redraw capacity as loans matured.

While ME’s total redraw exposure fell 20 per cent from $1.8bn to $1.45bn as a result of the changes, Mr McPhee said the decision was not made for financial reasons or for liquidity or capital reasons. It did not contravene the National Credit Code or the Banking Code of Practice.

“ME is in a strong financial position and our liquidity and capital ratios are well above regulatory requirements,” he said. “I also note that other banks and financial institutions have also altered this particular feature in a similar way.

“Where we fell down was not communicating this change in advance. It won’t happen again.”

He rejected speculation the redraw adjustment was linked to the bank’s ownership by industry funds that were being drained of liquidity under the early access scheme. The bank had never lent money to its shareholders, he said. Since ME offered to reinstate customers to their original positions, 1795 customers, or 8 per cent of those affected, had taken up the option. The initiative had originally applied to 17 per cent of ME’s home loan customers.

Mr McPhee said “at no point” did ME ever “remove funds from customer accounts” or “transfer” any customer funds. “ME adjusted the redraw facility to ensure those customers couldn’t inadvertently withdraw funds above their original repayment schedule,” he said. “We believed this was in the interests of our customers.”