One of his fund’s biggest exposures is to Netflix, the streaming company behind global hit Squid Game. Even the promise of a new series of the wildly popular South Korean drama couldn’t match the momentum of the market with Netflix’s shares sliding by 20 per cent on Friday night.

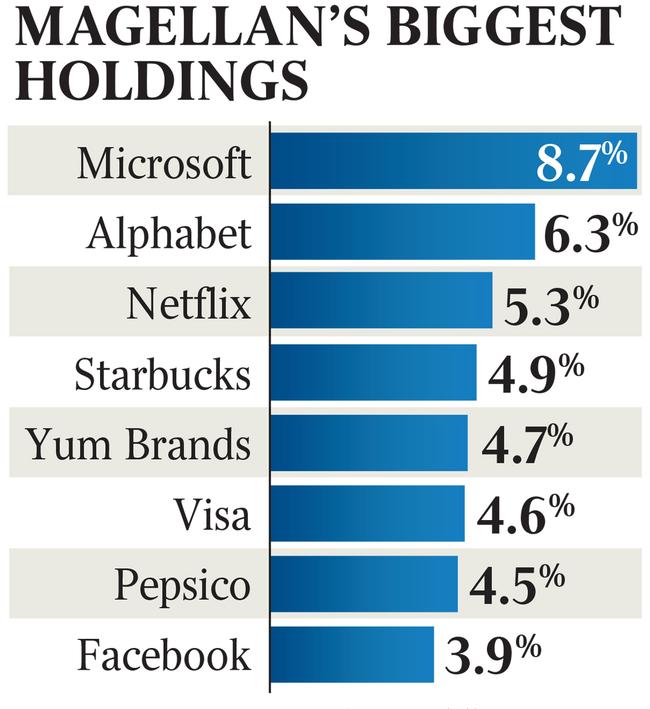

The Nasdaq Composite has now fallen into correction territory this month and that has big implications for local stock pickers with a global focus, including Douglass. His other major exposures – Microsoft and Google – have both moved into correction this month, down 11.6 per cent and 10.3 per cent respectively.

This will impact Magellan’s Global Fund, which although posting a positive December quarter return, continues to underperform on a quarterly, six-monthly and annual basis.

Investors are bracing for another wild week across highly-priced tech stocks with the US Federal Reserve’s powerful open market committee meeting on Wednesday. While US rates are expected to rise, potentially from March, this month’s meeting is expected to set the stage for the hike. At the same time it could outline how the Fed intends to finish up its massive bond buying program to help tame inflation.

The inflation breakout is sucking everything into it with cryptocurrencies also taking a pounding. The price of bitcoin over the weekend has fallen below $US35,000, marking the lowest level since July last year. Bitcoin has fallen nearly 50 per cent from its November record of $US69,000.

The tech-heavy Nasdaq is down 13 per cent so far this calendar year, pushing deeper into correction territory. Wall Street’s S&P 500 is down 8.3 per cent, while Australia’s benchmark S&P/ASX 200 is down 5.5 per cent. Shares in Magellan Financial touched a 5½-year low of $19.23 and are down nearly 10 per cent this year.

Futures are pointing to the Australian market to be down 0.7 per cent on Monday morning in the wake of the Wall Street jitters.

But tech stocks are in focus given they remain highly vulnerable to rising interest rates, particularly companies that are not delivering yet on earnings. Tech stocks have already been punished with a prospect of a US interest rate rise all but locked in. The question is how much more punishment is left.

Netflix, which represents a little over 5 per cent of Magellan’s holding in its global fund, took the biggest beating after its earnings outlook disappointed on Friday. The shares dived more than 20 per cent as it warned of growing pains during its earnings update.

The streaming company is targeting 2.5 million new subscribers this quarter, down from 8.3 million in the December quarter. The question for Netflix is how much global competition from the likes of Amazon has eaten into sales, at the same time as whether the phenomenal growth seen through Covid has brought forward growth that would have occurred over the medium term.

“It’s tough to say exactly why our (subscriber) acquisition hasn’t recovered to pre-Covid levels. It’s probably a bit of just overall Covid overhang that’s still happening after two years of a global pandemic that we’re still unfortunately not fully out of,” Netflix’s chief financial officer Spencer Neumann told investors on Friday.

Magellan’s moves

Pressure is building on Douglass to turn his ship around after last month losing a $23bn mandate from foundation investor, London-based St James’s Place, and seeing a drift of other fund outflows.

This has been compounded by persistent underperformance of Magellan’s global fund as well as a personal crisis with the separation from his wife in recent months.

In a video investor update posted Thursday night – before the Netflix crash – Douglass noted he was at his Southern Highlands farm with his wife and family while Omicron was keeping everyone away from the office.

He said he expected the Omicron wave, while big in terms of case numbers, to pass quickly. Disruption linked to Omicron was likely to impact global growth during the first quarter, but growth was expected to recover quickly after that.

More broadly he said if inflation didn’t roll over by the middle of the year and Omicron in southeast Asia was complicating things, “we could have a rude shock for markets if central banks are forced to tighten monetary policy to effectively stamp out inflation”.

Douglass said there had been a massive run up in valuation of some assets around the world that was “not underpinned by reality”.

But if inflation pressures required a “material increase” in interest rates this could trigger share price falls in some technology names of as much as 50 per cent.

“I don’t think the bubble has yet burst,” he said.

“The market feels like 1999 in many respects. We’ve got many companies without any earnings with very high valuations. Of course some of these companies are fabulous companies, but there are others who may not survive.

“If we got to a situation where we had a material increase in interest rates it could be devastating for some of these companies that are unhinged from economic reality and it could have wider implications for the market.”

Douglass also noted his fund has been trimming its holding in Facebook owner Meta in a “meaningful” way.

At the same time his fund has maintained its position in Google-owner Alphabet.

Douglass said the medium-term outlook for Facebook has deteriorated, particularly as it was facing more competition for younger users from other social media platforms including TikTok and Snap. He also questioned the massive investment spending, adding that there was no guarantee it would be a winner to the eventual shift to the metaverse.

“I’m not convinced that meta platforms/Facebook is going to be the winner in virtual reality. “Rather this technological shift to augmented reality and virtual reality complements a search business such as Google’s owner Alphabet.

“You have to keep adapting to the reality you see in the medium term ahead of you,” he said of the Facebook repositioning.

Beyond Magellan, one of the key “tech mood” stocks to watch is US-listed ARK Innovation Fund run by high-profile manager Cathie Wood, which invests in mostly tech stocks that match the theme of “disruptive innovation”.

Wood shot to local fame after naming Tesla as her top stock pick for 2019, during the Australian Sohn Hearts & Minds conference.

With holdings including Tesla, Zoom, Roku, Coinbase and now Afterpay-owner Block, ARK is seen as a bellwether for the Covid tech boom. The ETF is off 43 per cent since November and more than 54 per cent from its record high last February.

There’s been little summer respite for Hamish Douglass as his $95bn fund manager Magellan Financial is being swept up in a tech shock.