Macquarie to post soft first-quarter earnings, investors hopeful for recovery

Macquarie is likely to reveal much lower earnings in the first three months of this financial year than in last year’s bumper first quarter, but investors see things improving from then on.

Macquarie is likely to reveal much lower earnings in the first three months of this financial year than in last year’s bumper first quarter when it updates the market this week, but investors expect things will get better from then on.

Helped by “exceptionally strong” income from its commodities business, the so-called Millionaires Factory posted a record $5.2bn profit for the 2023 year in May. But weak commodity and capital markets, combined with its lower appetite for mortgages in recent months, is expected to result in a softer first quarter when it updates the market on Thursday.

“The update is going to probably be a bit weak,” Regal Funds Management portfolio manager Mark Nathan said. However, in the longer term, “the outlook still remains robust”, he said.

Macquarie’s outlook statements in May were less optimistic than what investors had hoped for, particularly for its asset management, local banking and global investment banking divisions, amid rapidly rising interest rates.

Investors will focus on whether it updates the near-term outlook for its divisions in the forthcoming update, expected before the annual general meeting in Sydney.

The asset management and investment banking giant is known to be modest in its guidance statements, but in previous years it has used the annual investor meeting to upgrade the year’s guidance. But given the expected softness of the first quarter, the AGM was unlikely to be a catalyst for an upgrade, investors and analysts said.

“Unless something is going materially differently, I doubt they’ll change their outlook statements this early,” Mr Nathan said. “With this global heatwave, it’ll be interesting to know if there has been any opportunity to make money through their energy trading business. But the market is not really factoring it.”

Macquarie’s commodities and global markets (CGM) unit has been a star performer in recent years, with extreme price turbulence in the oil and gas markets helping drive close to half the company’s revenues. Price volatility in energy prices is a signal of potential opportunities for Macquarie to trade and make money.

However, earnings in the unit for the three months to June are expected to be much lower given volatility in those commodities has been markedly lower in the northern hemisphere’s spring and summer months.

Macquarie’s share price has reflected the outlook uncertainty. Shares peaked at $210 in early 2022 and have been trading sideways in the $170 to $180 range since May, as “many investors are wondering what to do with Macquarie following its FY23 result,” Citi says.

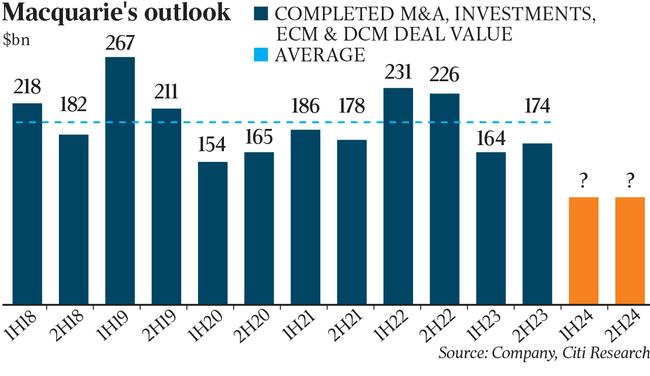

Deal-making activity, which remained persistently low in the first quarter, is also expected to have impacted Macquarie Capital, its investment banking division, and Macquarie Asset Management, leading to fewer deals, smaller gains on asset sales and potentially lower performance fees. “With these challenges arising, we see it as unlikely that they will be able to meet their 1Q23 profitability,” the analysts at Citi told clients in a note, forecasting earnings for the three months to June 15 to 25 per cent lower than last year’s at about $1bn.

“The challenge for investors is determining how long these low levels of volatility in CGM and weak transaction volumes will persist,” they said. “With the northern hemisphere winter months still ahead of us, it is far too early to be definitive either way.”

But green shoots for equity capital markets and M&A activity appear to be emerging, as expectations grow that interest rate rises might end soon.

“We believe Macquarie’s valuation has been impacted by concerns from some investors that rising rates would be an impediment to asset recycling gains, and performance fees/fund raising in Macquarie Infrastructure and Real Assets,” JPMorgan analyst Andrew Triggs said.

“Should global policy rates reach a peak in the near-term, we expect this could present a boost to sentiment on the stock.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout