Macquarie follows NAB, Westpac with bump in rates

Macquarie has hiked mortgage interest rates, piggybacking on repricing moves by major banks NAB and Westpac.

Macquarie has quietly hiked mortgage interest rates, becoming the most notable mid-tier lender to piggyback on repricing moves by major banks National Australia Bank and Westpac.

Macquarie, which has about $29 billion of mortgages, yesterday advised brokers that variable property investment loans would rise by 25 basis points, effective April 13 for existing customers and immediately for new borrowers.

Interest-only variable rates for owner-occupiers who settled on or before August 23, 2015, will rise by 5 basis points.

Rates for owners making principal and interest repayments — who are deemed more politically sensitive — were left unchanged at a sharp 3.89 per cent for borrowers with a loan-to-valuation ratio of below 80 per cent.

Also effective immediately, Macquarie tightened lending standards by reducing the maximum LVR for all interest-only loans to 80 per cent.

No reason for the changes was given and the bank declined to comment.

The move is, however, notable for making Macquarie the first of the second-tier lenders in the market to follow last week’s surprise rate hikes by NAB and Westpac.

While they typically follow the majors, Suncorp, Bendigo and Adelaide Bank, Bank of Queensland and ING Direct are yet to reprice their home loan books alongside NAB and Westpac.

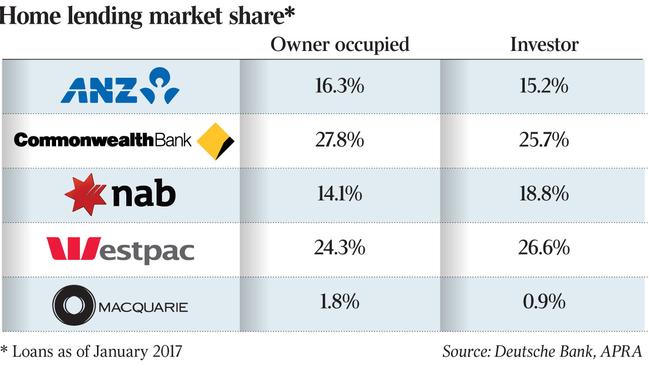

Commonwealth Bank, the nation’s biggest lender, and ANZ are also yet to follow their rivals, surprising analysts who widely expect them to also raise interest rates to boost margins.

NAB and Westpac blamed margin pressure from hot competition and elevated funding costs for hike rates. They also cited the need to stay below the Australian Prudential Regulation Authority’s 10 per cent annual growth cap on lending to property investors.

“With the other banks lacking the capacity to absorb much of NAB and Westpac’s lost business (without breaching their APRA investor cap) we expect them to follow the lead and reprice. This should take some heat out of the market,” UBS analysts told clients this week.

According to APRA’s most recent lending data, Macquarie has been standing back from the market in recent times after last year returning to about 2 per cent of the mortgage market.

Its three-month annualised move in its mortgage book was minus 1 per cent, well below the market’s overall growth of 6 per cent, according to Deutsche Bank analysis.

Macquarie’s investment lending book has also shrunk in the past year from $9.3 billion to $8.7bn.

However, Macquarie banking and financial services group chief Greg Ward told an investor briefing last month that the desire to lend to landlords or interest-only borrowers hadn’t waned and the “very competitive and dynamic” market was constantly changing.

Comparison website Finder.com.au this week claimed 11 lenders had raised rates this month across both variable and fixed home loans, despite the Reserve Bank’s cash rate holding steady this year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout