Macquarie chief backs loan brokers

Macquarie chief Shemara Wikramanayake has backed the role mortgage brokers play for borrowers.

Macquarie chief Shemara Wikramanayake has backed the role mortgage brokers play for borrowers, acknowledging that the Hayne royal commission would prompt smaller banks to rethink distribution and more closely assess what customers would pay for loans.

Commissioner Kenneth Hayne’s landmark final report last week recommended banning banks paying upfront and ongoing trail commissions to brokers and eventually moving to a customer-paid flat fee.

The finding has spurred outrage among mortgage brokers and some smaller lenders who see the change as having the potential to force many from the industry and make it harder for smaller banks to attract customers.

Ms Wikramanayake said Macquarie would be involved in any industry change and recognised the importance of the broker market for customers.

“They are valuable to the end customer,” she said of mortgage brokers, which account for 59 per cent of mortgages and up to 85 per cent of Macquarie’s home loans as it does not have branches.

“At the moment we are waiting to see what gets enacted … it is too early to tell.”

Ms Wikramanayake said much would depend on what borrowers wanted from their mortgage and what they were prepared to pay. Macquarie has about 2 per cent market share in mortgages.

The federal government last week said it intends to ban trail commissions, paid annually to brokers, with an option to ban upfront payments as well. Labor has said its intention is to adopt Mr Hayne’s recommendations.

Ms Wikramanayake labelled the Hayne royal commission a “rigorous process” that contained learnings for the financial services industry.

“At the moment we are all ears and open … about what we can learn from it,” she said. “We are thinking about how we can best service people as it evolves.”

Her comments come as Macquarie used an operational briefing yesterday to reiterate guidance for annual profit to print up to 15 per cent higher.

That points to the asset manager and investment bank, led by Ms Wikramanayake since December, handing down a $3 billion-plus record annual profit in 2019, as it also celebrates its 50-year anniversary.

The briefing showed Macquarie has record levels of dry powder to invest across its funds at $24.3bn as at December 31. That comes after it raised capital for several large global funds, including to target investments in the US and Europe.

“We continue to see investment opportunities … at this point in the cycle that [risk management] discipline is important,” Ms Wikramanayake said.

However, analysts questioned how Macquarie would deploy the large capital pool, and whether it would become more difficult if asset prices and interest rates resumed an upward trajectory.

Macquarie has been linked to a number of high-profile asset sales offshore, including a bid to buy a 49.9 per cent stake in Toulouse airport in France.

Various Macquarie executives used yesterday’s briefing to suggest the company had acquisition opportunities across a range of markets and growth levers spanning its divisions, despite slowing global growth and the risk of further trade ructions between the US and China.

That includes targeting a bigger slice of the $50 trillion US asset management market, where Macquarie accounts for only 0.5 per cent.

Cadence Capital managing director Karl Siegling said Macquarie’s December-quarter update showed the bank had “done very well” over a volatile period for financial markets.

“There are a lot of strings to their bow,” he said, noting that he believed Macquarie was on track to become a Fortune 500 company given two-thirds of its income was generated outside Australia. “They are on their way and it is going to happen globally,” Mr Siegling said.

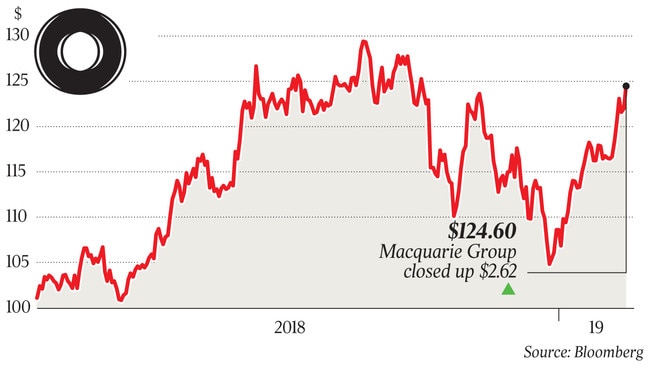

Investors were buoyed by the operational briefing, sending Macquarie’s shares 2.2 per cent higher to $124.60.

Macquarie said trading conditions were satisfactory and asset divestments were significant in the December quarter. The profit contribution from its asset management, corporate and asset finance and banking and financial services divisions was “slightly up” in the December quarter compared to a year earlier.

Total assets under management dipped 2 per cent to $532.1bn, however, weighed on by financial market movements.

Macquarie’s business units that are leveraged to financial markets — Macquarie Capital and Commodities and Global Markets — had a combined profit contribution “significantly up” in the December quarter.

“Commentary appeared to be mostly positive, noting strong fundraising in MIRA and strength in North American power and gas. However, market movements impacted AUM and funds on platform, and MQG removed its expectation for an improved result in cash equities from its outlook,” analysts at JPMorgan said.

On Bloomberg estimates, analysts are expecting Macquarie to report an annual profit of $3.01bn.

In November, Macquarie flagged a second earnings guidance upgrade for 2019, buoyed by asset sales including gains on the divestment of Quadrant Energy. It has since made a string of other divestments including its holding in online property exchange firm PEXA.

Profit result for the 12 months to March 31, 2018 came in $2.56bn. Macquarie’s group capital surplus over regulatory requirements was $4bn as at December 31.

Ms Wikramanayake took the helm from Nicholas Moore on December 1 and Macquarie rules off its financial year on March 31.

Total staff numbers edged up to 15,110 in the December quarter, with 56 per cent based outside Australia.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout