Local M&A takeover activity plagued by funding uncertainty, but set for respectable 2022 finish

Most investment bankers and lawyers expect a steady flow of local mergers and acquisitions rather than a rush in the final months of 2022.

Most investment bankers and lawyers expect a steady flow of local mergers and acquisitions rather than a rush in the final months of 2022, given a slump in deal volumes this year.

Announced Australian mergers and acquisitions have tumbled 54.3 per cent this year to $US130.4bn ($194.5bn) as at September 16, albeit from a record high at the same time last year, Refinitiv data shows.

That reflects deal numbers dipping to 1325 transactions, from 1758 in the year earlier period. The data includes inbound, domestic and outbound transactions, where takeover offers have often been stymied by financial market volatility, higher funding costs and challenges securing debt and leveraged finance in overseas markets.

Takeover deals are typically taking longer to complete, are sometimes being repriced and – in the case of KKR’s joint $20bn bid for Ramsay Health Care – are being shelved.

Notable deals announced this year include ANZ’s $4.9bn tilt for Suncorp’s bank, BHP’s $8.3bn spurned bid for OZ Minerals and Uniti’s sealed $3.62bn takeover by a consortium led by Morrison & Co. Speculation has emerged, however, that BHP may raise its offer for OZ Minerals as early as this month. Announced domestic transactions are down 45.7 per cent, according to Refinitiv, and deal transaction volumes with any Australian involvement are up slightly compared to the $US129.3bn average year-to-date activity for the past five years.

Morgan Stanley Australia chief Richard Wagner said some of the M&A hesitation presently had to do with expectations that interest rate rises would continue for some time to curb inflation, and more broadly, sagging confidence levels.

“M&A is a leading indicator of confidence. If boards and management are confident about the future, the earnings of the target, the other macro factors that may influence the business, then they are confident and they do M&A.

“When people are less confident you find less M&A activity … at the moment we’ve got a lack of confidence in credit markets and we’ve also got a recalibration of what deals need to look like in order to get successfully syndicated,” he added.

“Domestic deals that are executed in Australian dollars are going to continue. But it’s highly unlikely, in the current market environment with the backdrop of uncertain funding markets, that we’ll see a flurry of multibillion-dollar M&A transactions.”

The Reserve Bank on Friday flagged it would do what was necessary to ensure high inflation did not become entrenched in the economy, stoking expectations there may be another 50 basis rate hike in October. The RBA has aggressively raised rates by 2.25 percentage points since May, taking the cash rate to 2.35 per cent.

“When there is more clarity on the economic outlook, we’d expect to see deal activity increase,” said Tim Freeman, head of the financial and strategic investors group at Goldman Sachs’ Australia and New Zealand.

“We’re generally seeing heightened diligence on company earnings and forecasts, and more robust modelling of different future cases. From a funding perspective, we’re seeing clients more often consider various interest rate and FX (foreign exchange) hedging solutions, including in a deal context.”

Mr Freeman does expect sharemarket volatility to result in more takeover approaches to listed companies. “That’s an opportunity, particularly for private equity buyers with committed capital,” he said. “Execution risk is meaningfully higher today compared to last year, but buyers and sellers are still finding ways to get deals done.”

Bankers will also closely watch completed deal volumes for 2022, given they translate into fees.

Corrs Chambers Westgarth partner Ricky Casali expects improved takeover activity in the final quarter of 2022, but volumes won’t shoot the lights out.

“Green shoots are emerging which point to a pick-up in activity for the remainder of the year,” he said. “However, I doubt that on 31 December we will look back on the year and say that M&A roared back to life in the fourth quarter.

“M&A in the technology sector is looking like the new frontier, particularly those offering difficult-to-substitute core software and systems.”

Mr Casali also noted it remained challenging for bidders to value targets because of lingering issues around the availability and costs of inputs, labour shortages and higher rates.

Globally, it has also been a slower year for announced M&A, with Refinitiv data showing a 32 per cent decline in volumes to $US2.6 trillion as at September 9, versus the same time last year.

Baker McKenzie partner Lawrence Mendes is, however, bullish over local fourth-quarter deal prospects.

He said that while Australia had experienced lower levels of 2022 activity, he was expecting a “very busy run” into December 31.

“(It has been) a tougher and more volatile market than in 2021 and so naturally there is a strong push in live processes to lock in transactions before the December/January break,” he added.

Private equity and venture capital firms are cashed-up locally with about $10bn to deploy, while globally Bain & Company puts the figure at a mammoth $US3.6 trillion.

Mr Casali noted while private equity was flush with capital, firms would still tread cautiously on deals.

“It is well understood that private equity funds have an abundance of capital, and my private equity clients are certainly busy evaluating many opportunities but, ultimately, are you going to get fired for not having done a deal in 2022? I don’t think so,” he said.

Baker McKenzie’s Mr Mendes said: “Private equity will continue to stress-test the target‘s business fundamentals through detailed due diligence and will walk away if they don’t get comfortable. If they do get comfortable with valuation and performance projections, they are in a position to do M&A deals.”

More broadly in deal making, Mr Mendes is seeing the most activity across healthcare, technology and real estate, excluding retail-exposed property assets.

“Outside of those sectors, we are also seeing a lot of activity around infrastructure assets and around businesses involved in energy transition and expect this to continue through 2023,” he said. “We are seeing reduced interest in businesses exposed to discretionary spending and in the venture/growth capital space.”

This year, bankers and lawyers have also had to contend with a dearth of initial public offerings.

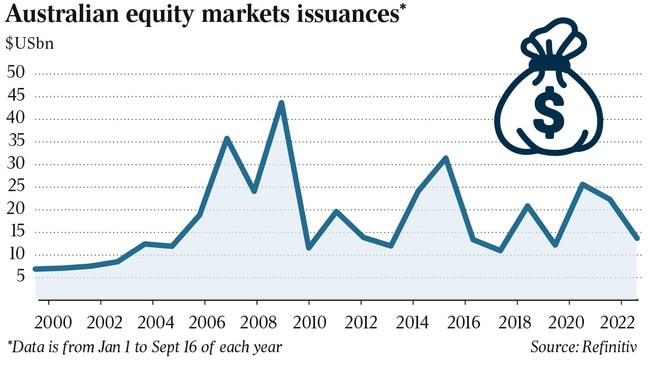

Equity capital markets activity – including secondary raisings and floats – has dropped 38.4 per cent so far in 2022, given choppy markets.

Capital raisings to pursue deals or shore up balance sheets have underpinned activity.

Mr Mendes characterised equity capital markets as “certainly difficult” in the present climate, but M&A funding in public markets remained robust.

“There is appetite from investors to fund the right deals through placements (such as on the back of Cleanaway’s acquisition of GRL, which was partly funded by a $350m placement),” he said. “We are expecting that these types of financings – for the right deals – will become more prominent as debt packages become more expensive and harder to underwrite.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout