JP Morgan’s James Dimon raises spectre of zero rates

America’s biggest bank is starting to prepare for how to make money if interest rates in the US drop to zero.

The biggest bank in the US is starting to prepare for how to make money if interest rates in the US drop to zero.

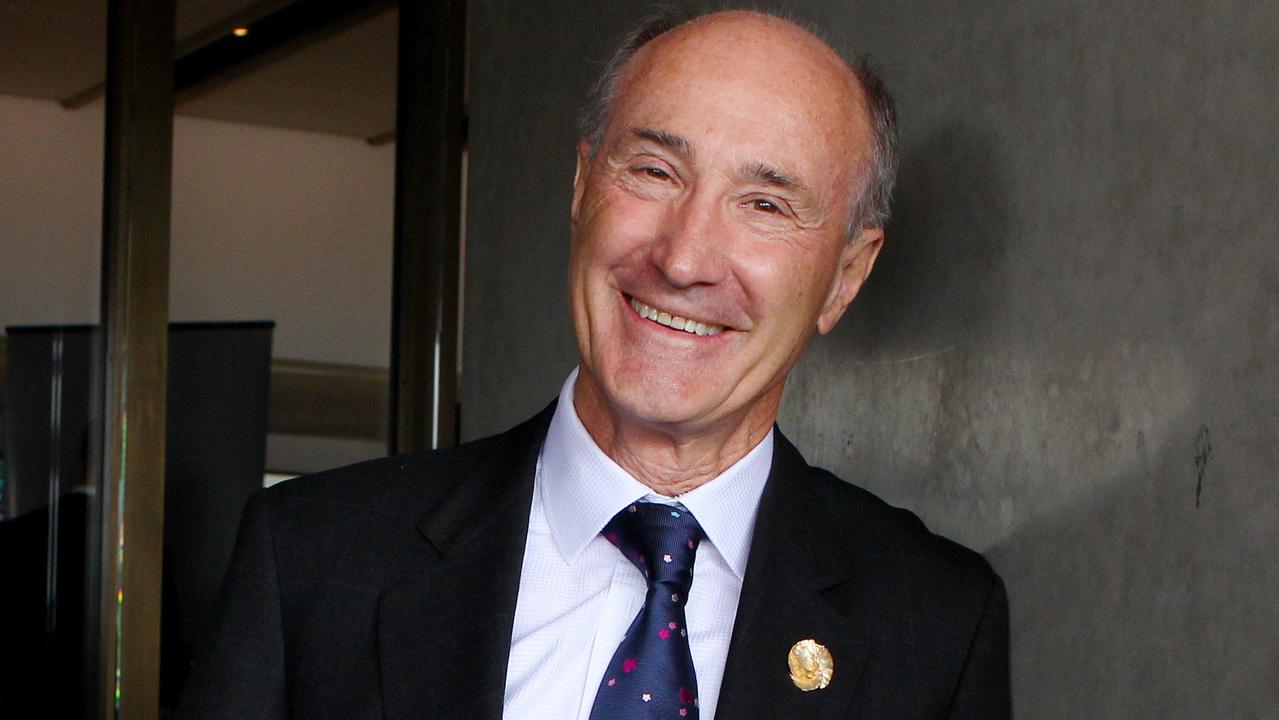

James Dimon, chief executive of JPMorgan Chase & Co, said at an industry conference the bank has begun discussing what fees and charges it could introduce if interest rates go to zero or lower.

While Mr Dimon stressed he wasn’t expecting zero rates at this point, the fact that he would entertain such a conversation is a sign of how sharply the environment has changed.

“I don’t think we’ll have zero rates in the United States,” Mr Dimon said.

“We were thinking about how to be prepared for it, just in the normal course of risk management.”

Possible responses to such a scenario include cost-cutting, as well as charging consumers account fees, Mr Dimon said.

A year ago, the Federal Reserve was still raising rates, and many bankers including Mr Dimon expected the rate increases to continue into this year.

Instead, the Federal Reserve lowered its key benchmark rate in July by a quarter point to a range of 2 per cent to 2.25 per cent, its first rate cut in more than a decade, and it is expected to cut another quarter point as soon as this month.

If the Fed were to go all the way to zero, or to negative rates as some European central banks have, it would likely be against a backdrop of a US recession or a worsening global economy. Yields in some countries including Germany, France and Holland have fallen below zero already.

Low interest rates squeeze margins banks make on loans. Hitting zero or negative rates raises complex questions about how to charge customers for loans and still make money. Banks would also have to grapple with whether to charge customers for their deposits without alienating them, a dynamic US consumers and businesses haven’t yet dealt with.

The change in tone about US interest rates has weighed on bank stocks this year, as the KBW Nasdaq Bank Index has underperformed the S&P 500.

Wells Fargo & Co, Citigroup and JPMorgan all told investors at this week’s Barclays financial services conference in New York that lending profitability in the second half of the year would likely be less than the banks had previously expected.

The bankers blamed falling interest rates along with a growing list of global concerns including Brexit and protests in Hong Kong, which they say are hampering business clients from making decisions. The trade war between China and the US remains the biggest impediment, the bankers said.

“People are a little less willing to make bets,” Bank of America’s chief operating officer Thomas Montag said. Some clients are changing supply chains, while others are holding off on drawing down on their revolving lines of credit, he said. “There’s enough uncertainty going on in the world that they’re going to wait.”

There were some brighter spots: Bank of America and JPMorgan were more upbeat on trading revenue. Lower interest rates have spurred increased mortgage origination. And generally the banks said US consumers remained strong.

Dow Jones, AP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout