IOOF pushes for court case to be held in June as APRA asks for more time

IOOF argues ‘reputation effects’ mean its court case should be heard in June, but regulators say they need more time.

Under-fire IOOF is pushing for its court stoush with the banking regulator to be heard in June, as its lawyers highlight “reputation effects” for those entangled in the action.

In a case management hearing in the Federal Court in Sydney on Thursday, lawyers debated the proposed timing for the case.

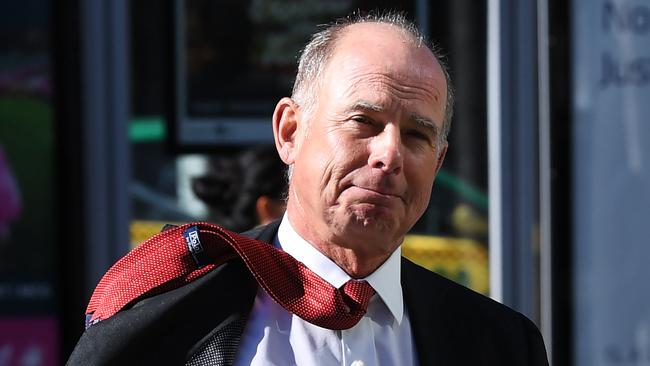

Earlier this month, APRA started the legal action alleging IOOF chief executive Chris Kelaher, chairman George Venardos, finance boss David Coulter, company secretary Andrew Vine and general counsel Gary Riordan were not fit and proper people to run a superannuation company.

APRA is seeking banning orders on the individuals and also wants to impose new licence conditions on the company.

In court, the parties agreed three weeks would be required for the hearing but the Australian Prudential Regulation Authority believes a June start could be too soon.

“APRA thinks June is a bit ambitious,” the regulator’s barrister Fiona Roughley said.

She told Justice Jayne Jagot that APRA first required a period of discovery to retrieve documents for its case, while it would also draw on files provided to the Hayne royal commission.

APRA’s legal action saw IOOF’s Mr Kelaher and Mr Venardos take annual leave and stand aside from their roles on December 10, while the matter is fought. Non-executive director Allan Griffiths was appointed acting chairman while wealth management boss Renato Mota became acting CEO.

Depending on whether the case is heard in June, and the time taken for a judgment, it looks as though Mr Kelaher will and Mr Venardos will spend the bulk of next year on the sidelines.

IOOF’s shares have tumbled 55 per cent this year with most of the losses occurring after the court action became public on December 7.

Lawyers for the individuals and IOOF argued for the court hearing to occur as soon as practicable. James Peters, QC, is representing Mr Coulter and other IOOF executives and said APRA needed to provide more detail around its allegations.

“When you (APRA) come back we’d like it to be confined and clear,” he said.

Judge Jagot said she would inform all parties of potential hearing dates in mid-January and pencilled in a directions hearing in March.

In an ASX statement earlier this month, IOOF said APRA’s allegations were “misconceived and will be vigorously defended”.

APRA argues IOOF has failed on many counts to meet deadlines the regulator set for it to improve systems and management of conflicts of interest. It issued a show cause notice relating to alleged breaches of the Superannuation Industry (Supervision) Act.

The legal fight also threatens to derail IOOF’s agreed purchase of ANZ Bank’s pensions and investments business, which needs to be signed off by trustees as being in member’s best interests.

ANZ’s finance chief Michelle Jablko this week told shareholders the bank hadn’t given up on the deal. “We are working through that,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout