IOOF lifts as it builds confidence

Acting IOOF chief Renato Mota plans to return capital to investors should its ANZ pensions deal fall over.

Acting IOOF chief Renato Mota plans to return capital to investors should its ANZ Bank pensions deal fall over, as he expressed confidence the under-fire wealth group could navigate “tough times” in the advice sector.

Mr Mota, who is standing in while CEO Chris Kelaher and four others defend legal action by the prudential regulator, has concerns around how consumers perceive advice and its overall affordability.

But he thinks the industry will recover as it restores trust and demand for advice grows alongside superannuation balances.

“The next couple of years will be tough,” Mr Mota told The Australian yesterday, referring to public trust in the sector post the Hayne royal commission, increased education standards and greater compliance.

“But we have strong conviction … this organisation has a long track record and history.

“We have an issue around affordability of advice … you can use technology to help facilitate that and make it more efficient.”

However, IOOF would not bring forward the implementation of Hayne recommendations such as giving customers an annual advice opt-in decision, rather than doing that every two years.

His comments come as investors backed IOOF’s interim profit result, despite the numbers missing expectations, and it declaring a lower dividend.

IOOF’s statutory profit — which included lumpy items — jumped to $135.4 million for the six months ended December 31, compared to $45.2m in the year earlier period. Underlying profit from continuing operations edged up 5 per cent to $99.9m.

A fully franked dividend of 25.5c a share was declared, down from 27c a share a year earlier.

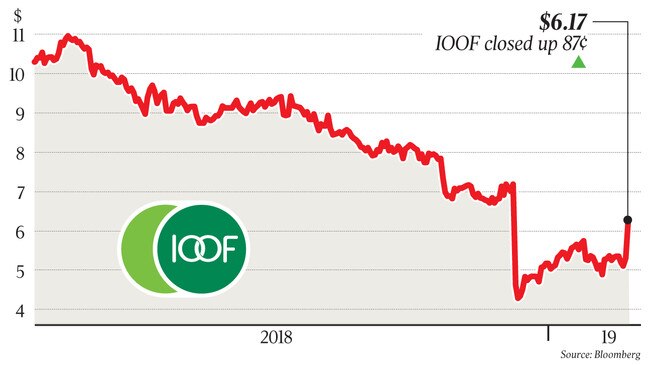

IOOF’s shares surged 16.4 per cent to $6.17, their highest level since the Australian Prudential Regulation Authority started legal action and imposed a string of licence conditions on the group in early December. The rally was the biggest one-day rise in more than a decade.

“They did show there has been a change in the tone at the top,” said Matthew Davison, a senior analyst at fund manager Martin Currie, of the IOOF results.

Macquarie analysts said while the result came in below expectations, IOOF was taking important steps to “rebuild confidence”.

IOOF said it was making progress on key APRA licence conditions and had implemented seven items.

Short positions in IOOF suggested an accelerated squeeze also contributed to the strong share price rally. Short positions in the stock were at record levels late last year and last week were hovering at about 9 per cent.

There were moving pieces in IOOF’s statutory result including a profit on the sale of a corporate trust unit, recovery of legal costs and a prior period impairment of Perennial.

IOOF warned it would incur $20m-$30m in compliance and regulatory costs, starting immediately and into fiscal 2020.

Mr Kelaher and chairman George Venardos are on leave while they and three other executives fight the APRA action, which alleges they are not fit to run a superannuation company.

IOOF estimates that insurance will cover about 85 per cent of defence costs.

The court fight threw into doubt IOOF’s agreed acquisition of ANZ Bank’s pensions and investments business, which needs to be signed off by a trustee board.

Mr Mota said IOOF continued to work on the deal and he expected clarity within the current half year. “Our primary focus is assisting ANZ on reaching a positive conclusion,” he said, adding IOOF’s fallback capital management plan was “progressed enough” to be able to enact quickly if required. IOOF completed the purchase of ANZ’s planner groups last year.

IOOF’s revenue climbed 22 per cent, net platform inflows amounted to $688m, while funds under management and advice rose to $137.8 billion.

But the results showed pressure on operating margins and net outflows of $176m from financial advice, amid more competitive pricing by rivals.

IOOF kept its estimate for remediation of deceased estates at $5m-$10m.

It outlined a $3m hit from ending super exit fees but has not detailed the dent it expects from having to consolidate its 40,000 low-balance accounts.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout