IOOF execs fight for survival

Pressure on beleaguered wealth group IOOF will intensify this week as investors demand answers.

Pressure on beleaguered wealth group IOOF will intensify this week as investors demand answers about its fractured compliance practices, and some call for an overhaul of the board and management after landmark legal action by the prudential regulator.

The IOOF board was bunkered down over the weekend amid further talks over whether those targeted in the action would stand aside while the matter was fought or, instead, recuse themselves from certain discussions.

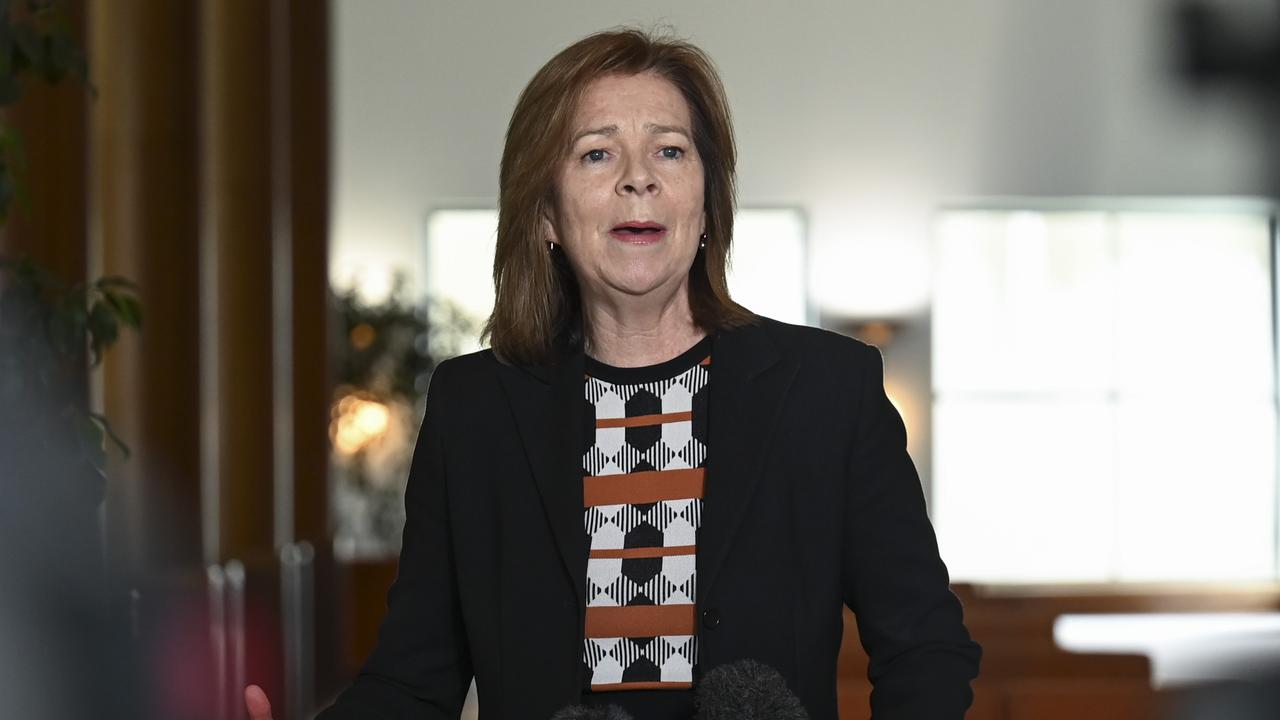

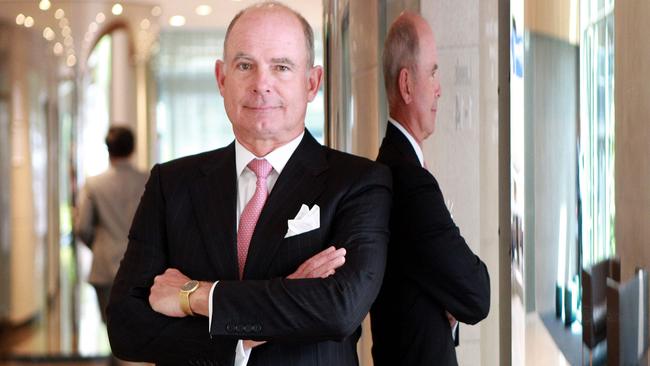

The Australian Prudential Regulation Authority came out swinging on Friday in a Federal Court action alleging IOOF chief executive Chris Kelaher, chairman George Venardos, finance boss David Coulter, company secretary Andrew Vine and general counsel Gary Riordan were not fit and proper people to run a superannuation company.

APRA also wants to impose sweeping new licence conditions on the company.

“Shareholders have been badly treated,” said Australian Shareholders’ Association chairman Ian Curry, who represents about 60,000 smaller investors in IOOF. “They have to give shareholders a better picture of how well they have been doing their job, if they can demonstrate that.”

IOOF was pummelled on Friday, with the stock down almost 36 per cent and $900 million erased from its market value. Mr Curry stopped short, though, of joining fund manager Martin Currie in calling for IOOF’s non-executive directors to make substantive changes to the board and management. He said those in charge had to spearhead the initial response to APRA rather than being “cleared out”.

“That might be an ideal, but in practice they (those named by APRA in the action) have to provide a response,” Mr Curry said.

In a letter to IOOF, APRA has given the company 14 days to explain why it should not be hit by new licence conditions, citing a review from professional services giant EY that found 10 breaches or potential breaches of prudential standards and the Superannuation Industry (Supervision) Act.

Nikko Asset Management’s head of Australian equities, Brad Potter, declined to comment on IOOF when contacted on Sunday. Nikko and Martin Currie both hold about 7.5 per cent of IOOF respectively, according to Bloomberg. Reece Birtles, chief investment officer of Martin Currie, on Friday said it was “disappointing IOOF have been unable to manage relations with a key regulator that has led APRA to take action against executives and directors”.

“The materiality of the underlying transgressions remains unclear, but clearly APRA’s view of IOOF’s acceptance and responsiveness has reached the point where the IOOF board needs to make material change to the board and management and comply with APRA’s managed action plan,” Mr Birtles said.

APRA argues that IOOF has failed on many counts to meet deadlines the regulator set for it to improve its systems and management of conflicts of interest.

The Federal Court statement outlines concerns with IOOF’s conflicted structure, where companies were both trustees of super funds that were responsible for looking after the interests of members and, at the same time, earned revenue by running investment funds.

The legal action has suggested that IOOF’s deal to buy ANZ’s pension and investments business will likely be abandoned.

Sources said ANZ was yet to start re-engaging with any underbidders on the pensions and investments division, as the bank focused on the separation and completion of its life insurance divestment to Swiss giant Zurich.

Analysts at Morgan Stanley, led by Daniel Toohey, have highlighted several concerns following the APRA action against IOOF, including the increased likelihood the deal with ANZ would fail and further challenges with the viability of the vertically integrated model. IOOF representatives, including Mr Kelaher, would not comment yesterday.