Interest rate pain as CBA and ANZ lift

Commonwealth Bank and ANZ have followed Westpac in slugging borrowers with higher interest rates.

Commonwealth Bank and ANZ have followed Westpac in slugging borrowers with higher interest rates, despite having laid out concerns about heavily indebted borrowers, sparking expectations NAB is not far off from completing a set of rate hikes by the big four banks.

ANZ borrowers with variable home loans will face a 16-basis-point rate rise from late this month, while CBA, in an announcement made moments after ANZ’s, said it would be hitting borrowers with a 15-basis-point hike by early next month.

Both banks lifted rates more than Westpac’s 14-basis-point rise of last week, in the first round of increases by the big four without a change in the Reserve Bank’s official interest rate since late 2015.

Reserve Bank governor Philip Lowe this week urged customers to shop around if they were dissatisfied with their bank. However, the major lenders are all heading in the same direction, stoking the ire of politicians and threatening to push heavily indebted households further into mortgage stress.

The banks’ moves come despite the RBA having kept the official cash rate at a record low of 1.5 per cent since 2016, and it being expected to hold steady for some time. The central bank is increasingly concerned about rising interest rates amid stalled wages growth and growing household debt.

The big four banks control 75 per cent of the $1.7 trillion mortgage market and rate rises are expected to accelerate house-price falls and stifle retail spending.

This week’s official economic figures showed Australia’s household savings rate reached its lowest point — 1 per cent of income — since before the global financial crisis.

Labor’s financial services spokeswoman, Clare O’Neil, said the banks were taking advantage of the chaos in Canberra to sneak through rate hikes.

“Given the RBA earlier this week kept the official cash rate on hold, it’s disappointing to see these out-of-cycle rises,” she said.

A spokesman for NAB said it was “continuously” assessing its interest rates and always sought to balance customer and shareholder interests.

The corporate watchdog yesterday launched legal action alleging that NAB broke the law 77 times over a superannuation fee-for-no-service scandal that allegedly siphoned more than $100 million from 500,000 customers.

In the wake of the rate hikes, a borrower with a $500,000 mortgage will now be paying close to $600 extra a year in repayments. For property investors, or borrowers with interest-only loans, repayments have been rising far more quickly in recent years as rates have skyrocketed.

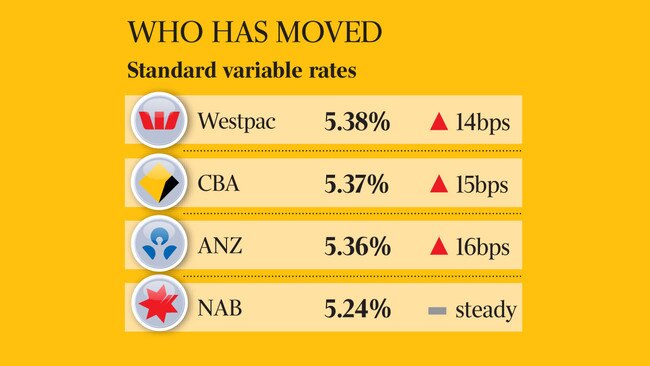

ANZ’s headline standard variable rate of 5.36 per cent and CBA’s 5.37 per cent still remain slightly below Westpac’s 5.38 per cent. National Australia Bank is currently offering 5.24 per cent. ANZ has carved out home loan customers in drought-declared regions, sparing 70,000 customers from a change in interest rates.

Although the major banks blamed sharply rising funding costs for the need to hike rates, analysts questioned why ANZ pushed through a larger rate hike as it is less reliant on wholesale funding than Westpac and CBA.

UBS analyst Jonathan Mott said: “This round of repricing is significant in that it passes through more than the additional wholesale funding costs to existing customers — especially at ANZ.”

ANZ Australia boss Fred Ohlsson said the decision was difficult given the bank knew the impact rising interest rates had on family budgets but claimed it was more expensive for the bank to fund its home loans on wholesale markets.

CBA retail bank boss Angus Sullivan said the bank had made the decision to hike rates after “careful consideration” and was “very conscious” of the impact that increasing interest rates would have on its customers.

Brisbane-based bank Suncorp issued its second out-of-cycle mortgage rate increase this year under the cover of Westpac’s rate hike, while Bendigo Bank subsidiary Adelaide Bank also rode under the cover of Westpac’s lead, pushing through a super-sized hike for interest-only loans.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout