Insurers rate flood a catastrophe

Torrential rain and flooding in Townsville have led the insurance industry to declare 2019’s first catastrophe.

Torrential rain and flooding in Townsville have led the insurance industry to declare 2019’s first catastrophe, as damage is assessed and a run of claims is expected.

The Insurance Council of Australia enacted a catastrophe plan for policyholders in Townsville at the weekend with about 1900 claims already received by Saturday night, the industry body said.

So far, the ICA estimates insurance losses amount to $16.7 million but it expects “many more claims” as Townsville residents and those in surrounding areas examine the extent of their losses and contact insurers.

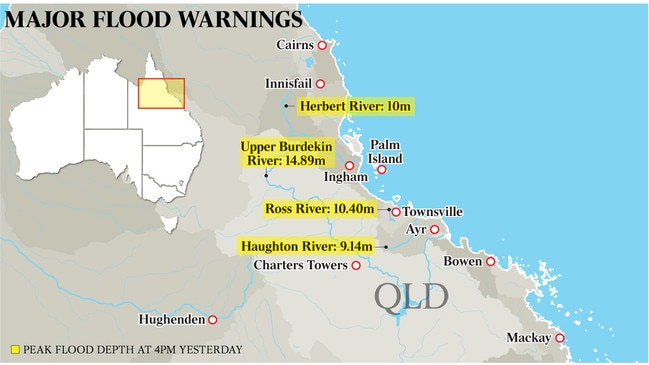

On Sunday, the weather bureau issued a spate of major and minor flood warnings for rivers in the area. In an earlier update, the bureau said a monsoon trough continued to influence weather across the Queensland tropics.

Queensland flood services manager Victoria Dodds said the Townsville area had already received “extraordinary rainfall” over the past week.

Listed insurers including Insurance Australia Group, Suncorp and QBE Insurance will be bracing for claims and analysts will be keeping a keen eye on the stocks in the lead-up to their profit results this month. Devastating bushfires are putting communities at risk in Tasmania, while hot conditions have other states on alert.

The federal government is also releasing the Hayne royal commission’s final report today, making it a busy start to 2019 for the insurance sector.

“The Queensland government and emergency services have informed the insurance council that dozens of homes and businesses may have been affected by the downpour and resulting inundation of the past few days,” ICA chief executive Rob Whelan said.

“Many other properties, as well as private and commercial vehicles, may also have been damaged.

“It is possible many more will be inundated in coming days, with some state government projections indicating thousands of homes could be affected. Therefore, the ICA has declared a catastrophe to help escalate the insurance industry’s response.”

In December, the ICA declared the mammoth hailstorm that battered NSW last year’s fifth catastrophe. It was the worst hailstorm to lash Sydney and the NSW central coast in almost 20 years, damaging cars and homes around the state.

The hailstorm followed other catastrophes last year including bushfires in NSW and Victoria, Cyclone Marcus, floods in Queensland and storm and flood damage around Hobart.

Declaring a catastrophe means policyholders in the area will be given priority by insurers and an industry taskforce established to address and identify any issues.

“The ICA has declared this catastrophe to help reduce the emotional and financial stress being experienced by families and businesses, and provide them with peace of mind that their insurer is there to help,” Mr Whelan said.

Flood insurance was controversial in Queensland following the 2010-11 flood crisis when more than one-quarter of insurance claims were rejected.

Although insurers such as Suncorp accepted almost every claim, the Commonwealth Bank’s CommInsure actually declined more claims than it approved. This was because CommInsure insured households only for “flash flood” and not “flood” caused by slowly rising rivers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout