Insurers may face higher reinsurance bills from floods

Investors are bracing for rising flood damage costs to hit major ASX-listed insurers despite assurances from companies their exposure to flooding in Queensland and NSW will be limited.

Investors are bracing for rising flood damage costs to hit major ASX-listed insurers despite assurances from companies their exposure to flooding in Queensland and NSW will be limited.

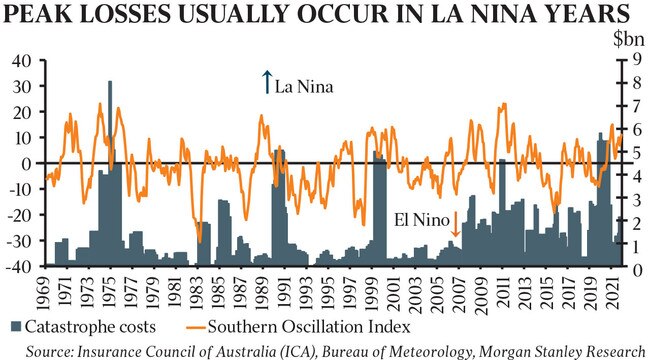

Morgan Stanley equity analyst Andrei Stadnik told clients on Wednesday that while the losses from the NSW and Queensland floods were “manageable for now”, “risks remain on event duration, reinsurance reinstatement and July renewals”.

Suncorp and Insurance Australia Group have both told investors their catastrophe aggregate cover limits would kick in as flood claims mount.

Suncorp’s net exposure is limited to $75m, while IAG said it expected claims not to top its limit of $95m. QBE has a maximum event retention of $175m for a natural catastrophe in Australia.

These limits apply to catastrophic events, passing on costs above the cap to reinsurers.

However, Morgan Stanley’s Mr Stadnik said if the flooding persisted, damages could run over the seven-day limit often used by reinsurers for a single event.

This may trigger a further catastrophic event and see listed insurers wear more costs arising from the damaging weather.

Mr Stadnik warned reinsurers may need to buy more reinsurance to replenish coverage if losses from the flood top $500m.

“In recent years, reinstatement costs have been $30-60m, but in (the 2011 financial year) they were (more than) $230m for (Suncorp),” he wrote, adding reinsurers were piling on price rises.

Suncorp’s reinsurance cover is up for renewal in June.

“These losses likely set back Australian insurers in their negotiations,” Mr Stadnik said.

The Insurance Council of Australia reported 48,220 claims relating to the floods as of Wednesday. Queensland customers account for 37,807 claims, with 10,413 coming from NSW.

ICA data shows 84 per cent of claims were for property damage, with the remainder for motor vehicle damage.

ICA chief executive Andrew Hall said the lift in claims showed the need for governments “to do more to protect homes, businesses, and communities from the impacts of extreme weather”.

“With appropriate mitigation infrastructure and household-level programs, property can be better protected and premiums can decrease, but this can only be achieved if governments act with urgency,” he said.

Suncorp chief executive Steve Johnston said it had received “an extraordinary number of claims,” topping 13,000 by early Wednesday. In its recent results Suncorp noted premiums on policies were up almost 7 per cent.

Mr Johnston said without work done to minimise damage from extreme weather events price rises may continue.

“The inevitability is that we are going to be repairing homes that we repaired three or four times. And that’s what we saw in 2011,” he said. “What this really brings to bear is the need to build it back better. We need to take account of the water that we’ve seen, where that water has flowed, and work with our customers and the industry more broadly to build homes that are more resilient.”

While rains have lashed Queensland and northern NSW, the latest forecasts from the Bureau of Meteorology suggest southern NSW is next to be hit. Data shows several dams around NSW are full or over capacity.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout