Insurers face $2bn Cyclone Alfred bill

The insurance industry is bracing for a flood of claims, but industry watchers warn as many as one in four have no cover at all.

The insurance industry faces a $2bn bill from Cyclone Alfred, which is set to hit Brisbane and swathes of south-east Queensland and northern NSW, as one in four Australian don’t have cover.

Ratings agency S&P warns Cyclone Alfred may throw up $2bn in costs for the insurance sector. But UBS analysts say the potential damage bill was “manageable” for major insurers Suncorp and Insurance Australia Group.

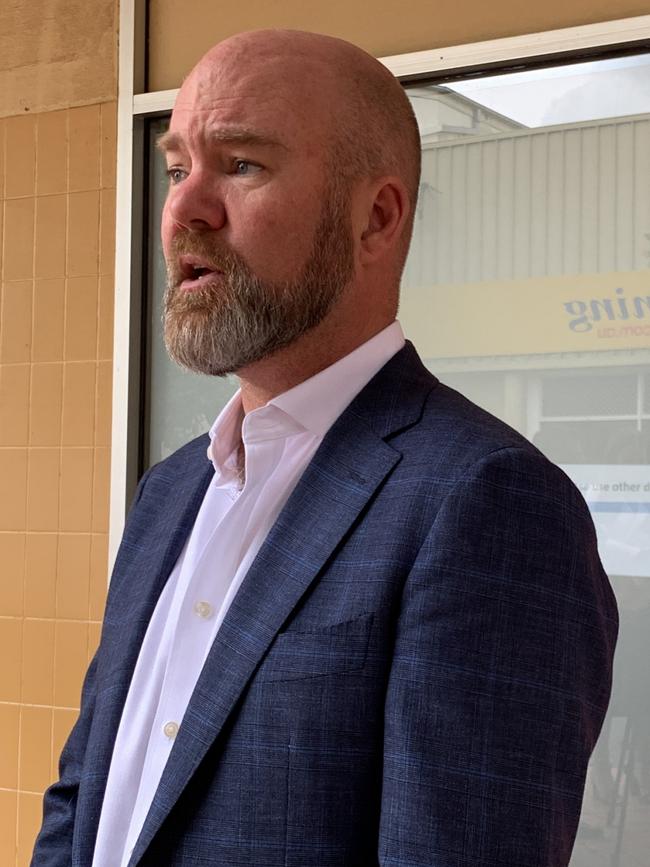

Insurance Council of Australia chief executive Andrew Hall said the looming cyclone set to slam into south-eastern Queensland was likely to be as costly as floods which inundated parts of Western Sydney in 2021 and 2022.

“This has been one of a couple of top end, worst case, scenarios the industry has been worried about for a number of years,” Mr Hall said.

“It's the combination of everything, very high population growth on the water's edge,” he said.

Forecasters expect the Cyclone Alfred’s winds to lash homes and damage roofs, while rain and rising storm surge are expected to inundate properties in high risk areas.

Mr Hall said the last round of floods to strike South East Queensland triggered 230,000 claims for damage, warning the added danger of cyclonic winds and weather “had the potential to exceed 2022 and become a very bad event”.

Insurers faced $4.3bn in claims from record-breaking floods in 2022.

While the 2011 Brisbane floods saw insurers face $2.3bn in losses.

Insurance Australia Group boss Nick Hawkins said it was hard to tell if Cyclone Alfred would rival the 1999 Sydney hailstorm as the most destructive natural catastrophe to hit Australia, noting the final damage toll was hard to tell.

But Mr Hawkins noted the category 2 cyclone was headed towards a heavily populated, built up part of the country.

“We’ve got a large cyclone heading into what looks like a large city and the amount of development that’s occurred (since Cyclone Zoe in 1974), it’s hard to predict,” Mr Hawkins said.

The insurance boss, who oversees major brands including NRMA, RACV, CGU, and WFI, said IAG had mobilised its national disaster response teams with staff on standby in New Zealand to deploy wherever they were needed.

Mr Hawkins said after the cyclone, Australia had to look at what had been built where and how homes had been built.

“We know we have built towns and communities in areas that are subject to these large perils,” he said.

“We know in the future we expect more events with greater severity.”

Many homes facing inundation or cyclonic winds only recently completed their rebuild after the devastating 2022 floods which hammered Brisbane and towns along the NSW-Queensland border.

“This is going to test the building standards of Southern Queensland and their capacity to withstand wind,” Mr Hawkins said.

“It’s going to have to be part of the consideration… we’re going to have to look at the impact of this and if they have to be strengthened.”

Recent research from the Actuaries Institute, which represents experts used by the insurance sector to determine risk, warned as many as 1 in 4 households in South East Queensland were facing unaffordable cover.

Actuaries Institute member and Finity consulting principal Sharanjit Paddam said the number of households facing unaffordable insurance nationally had lifted 50 per cent in three years, amid record price rises from the sector.

He said South East Queensland was among the worst affected areas in the country, noting homes in the area exposed to flood had received the heftiest price rises in recent years.

“This is an area with high flood risk where we think that there would be a high level of non-insurance or under insurance,” he said.

UBS analyst Kieren Chidgey said the recently implemented Cyclone Reinsurance Pool could limit losses to insurers, but said a critical element were floods that would follow the cyclone.

He noted the pool only picked up $91m of almost $410m in losses from Cyclone Jasper, which hit Far North Queensland in December 2023.

Mr Chidgey said Suncorp was likely to cop the biggest hit from the cyclone, with its biggest presence in the Sunshine State.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout