Insurance Council of Australia raises bushfires claims figure to $1.34bn

Insurance losses from Australia’s catastrophic fires have ballooned with 13,750 claims.

Insurance losses from catastrophic fires have hit $1.34bn, ranking the event as one of Australia’s most costliest natural disasters this century.

New figures, released by the Insurance Council of Australia show claims across the industry surging to 13,750.

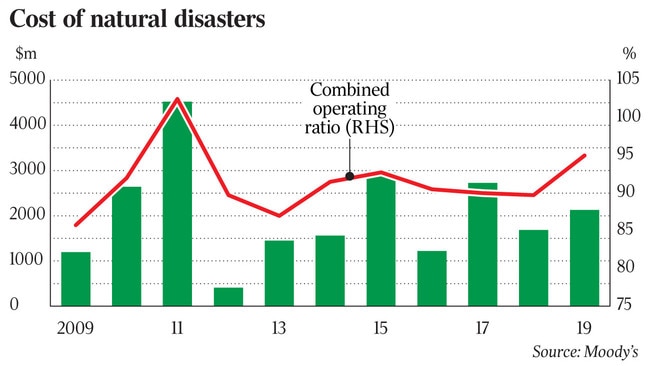

The figure, which has ballooned by $300m since January 10, ranks the bushfires just behind the 2009 Black Saturday bushfires where losses ran to $1.76bn and the Brisbane floods of 2011 ($1.53bn).

The insurance industry group is expecting the number of claims to escalate in the coming weeks.

“The ICA is anticipating a sharp increase in claims this week as household property assessments are undertaken and large commercial claims are lodged,” it said in a statement.

Suncorp has so far estimated its total bushfire claims costs so far at between $315m and $345m for the financial year to date.

Suncorp said it had a broad reinsurance program in place with “enhanced natural hazard protection” for the remainder of financial 2020.

IAG has outlined net natural peril claims costs of $400m, post its quota share arrangement, for the six months ended December 31, with bushfire events to contribute more than $160m.

Ratings agency Moody’s warned profits of insurers would be hit as payouts mounted over the coming months.

“The insured losses of these natural catastrophes will be negative for profits of the Australian property and casualty insurance industry,” Moody’s said.

However, it expected the losses to be “manageable” because of the industry’s strong underwriting performance.

“Nonetheless, these catastrophic events highlight that the property and casualty insurance industry is at the forefront of environmental risk,” Moody’s said. The ratings agency said Suncorp and IAG would have the highest levels of claims because of their large share in personal insurance.

As hundreds of insurance claims are made each day, Westpac economists expect the broader impact to the economy to exceed $5bn.

In a separate analysis UBS economists predict the bushfires could hit annual GDP growth by as much as 0.2 per cent.

UBS economist George Tharenou forecast the catastrophe will “drag” down December quarter and March quarter GDP by potentially a percentage point per quarter.

Goldman Sachs last week suggested the fires could shave 0.3 per cent off GDP growth in the six months to March, while Westpac has forecast a total hit to economic growth of between 0.2 per cent and 0.5 per cent.

The UBS analysts expect the disaster will make a February interest rate cut by the Reserve Bank of Australia “more likely”, due to a rise in headline inflation from higher food costs and rising insurance premiums.

UBS currently expects the Reserve Bank to cut rates by 25 basis points ahead of downgrading the economic outlook in its February Statement on Monetary Policy.

“While the direct impact of the bushfires has largely been outside capital cities and limited to rural/ regional areas, the indirect impact of smoke haze and on overall consumer confidence has been felt in the largest cities,” said UBS’s Mr Tharenou.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout