Independent expert warns CBA not to repeat past mistakes

CBA has been warned by its independent expert to stay vigilant to ensure poor practices do not re-emerge.

Commonwealth Bank has been warned by its independent expert to stay vigilant to ensure the poor practices that led to last year’s intervention by the prudential regulator do not re-emerge.

In its first update on CBA’s approach to recommendations from APRA’s prudential inquiry, Promontory Australasia said the bank had shown a clear commitment to undertaking the necessary reforms.

“(But) as the program evolves and the focus turns from the design of milestones to implementation, CBA should recognise that project execution risks are likely to increase,” the Promontory report said.

“This will require ongoing close monitoring and the effective escalation of project risks to appropriate governance forums for discussion and resolution.”

The report said that the foundation of a successful risk remediation program was being laid, and that CBA was responding in a timely way to implementation risks.

Chief executive Matt Comyn said CBA had embarked on a significant program of change and was making progress.

While there was still a lot to do and the bank remained committed to implementing the plan in full and on time by the end of March 2021, Mr Comyn said CBA would ultimately be judged on the improvements made in customer and risk outcomes.

To ensure the bank kept its focus on making the required changes, all senior leaders of general manager-rank and above had 20-30 per cent of their performance benchmarks tied to successful delivery of the 2019 milestones in the remedial action plan.

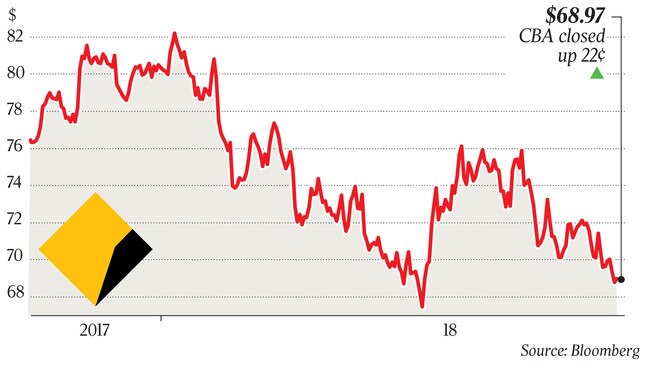

The Australian Prudential Regulation Authority handed down its damning review of CBA’s culture last May in the wake of a money-laundering scandal that led to a $700 million financial penalty.

The review by an independent panel found that the bank’s continued financial success had “dulled the senses” of the institution, which suffered from a “widespread sense of complacency, a reactive stance in dealing with risks, being insular and not learning from experience and mistakes”.

It also pointed to an “overly collegial and collaborative working environment”, which lessened the opportunity for constructive criticism.

The regulator forced CBA to carry an additional $1 billion in regulatory capital and enter into an enforceable undertaking to conduct remedial action and implement the report’s 35 recommendations.

CBA’s board was also criticised for a lack of rigour and urgency.

The panel said there was no evidence of the board reviewing systemic risks from customer complaints.

Prior to the appointment of Catherine Livingstone as chair last year, the board agenda was “relatively static”, and face-to-face meetings between former CEO Ian Narev and the former chair David Turner did not happen often enough.

The “strong confidence and trust” in senior management’s high IQ and their ability to take care of everything meant that the board did not challenge management strongly, or hold them to account over longer time frames.

“In this way, the encouragement to challenge at CBA has been more nominal than real,” the panel found.

CBA’s remedial action plan includes 153 milestones or actions to be undertaken.

The program of work is being managed by a central team in the bank — the BROP (better risk outcomes program) team, which comprises experienced executives drawn from across the organisation.

Work to address each recommendation is being performed under the oversight of an accountable executive under the new BEAR (Banking Executive Accountability Regime) framework.

The board and the executive leadership team were both participants in the formation of the remedial action plan, and are involved in overseeing its execution.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout